|

CITY HIGHLIGHT, APRIL 2007

GREENVILLE–SPARTANBURG CITY HIGHLIGHTS

P. Randall Bentley, Brian Reed

Greenville–Spartanburg Industrial Market

The Greenville/Spartanburg industrial market finished last year with stable vacancies as well as strong absorption, construction, and rental rates. Changes in the industrial market are impacted by declines in the textile industry and expansions in the automobile manufacturing industry. According to the CoStar Industrial Report, the Greenville/Spartanburg industrial market ended the fourth quarter of last year with a vacancy rate of 13.2 percent. Flex projects reported a vacancy rate of 20.7 percent and warehouse projects had a 12.8 percent vacancy rate.

The Greenville/Spartanburg industrial market is relatively one of the largest in the country; therefore national trends are likely to have a local impact. Average industrial rental rates decreased at the end the fourth quarter to $3.06 per square foot signifying a decrease of 0.3 percent from the end of the third quarter of 2006. The overall Greenville/Spartanburg market had a net absorption of negative 460,731 square feet in the fourth quarter of 2006, which included direct and sublease space. CoStar reported the Greenville/Spartanburg market’s total industrial inventory to be approximately 139.5 million square feet in 3,070 buildings. The flex sector comprised 7.7 million square feet in 489 projects and the warehouse sector consisted of 131.7 million square feet in 2,581 buildings.

New construction activity in the industrial property market continues to grow at a steady rate. Distribution and warehouse projects exceeding 1 million square feet are expected to be complete this year according to area developers. An overwhelming percentage of these projects are being built on a speculative basis. Most developers are reporting a mild increase in prospect activity beginning this year although interest levels have been increasing steadily throughout 2006. Interest seems to lie mainly in a wide diversification of uses and distribution. Problematic are the increases in construction costs during the past year and higher land costs; however, consistent growth of new businesses in the market have created a higher demand for industrial buildings. The steady influx of new businesses to this market area seem to be attracted by not only a lower cost of living, but the quality of life that the Upstate South Carolina offers.

The Clemson University International Center for Automotive Research (ICAR) is a recent development to hit the Greenville area. The first phase will add more than 1 million square feet to the market. The 400-acre research park has impacted the market by adding substantial amounts of office space that attracts tenants and tenants new to the market will increase net absorption. The emergence of ICAR will create high demand for industrial space across the region for many years to come.

The most active developers in the area continue to be Liberty Property Trust, Johnson Development, and The Whirmire Company, LLC.

Liberty Property Trust continues to be a major provider of quality projects with the completion of a 96,000-square-foot multi-tenant industrial building in the Brookfield Business Park in the fourth quarter of last year. Bob Shaw of Liberty Property Trust reports that this project is currently 21 percent leased. In addition, Liberty recently completed the acquisition of a 51-acre tract on Highway 101 near BMW, which will be named Caliber Ridge Industrial Park. The excellent location and quality of this planned project ensures a successful occupancy provided market trends and growth remain favorable. The project will supply the Greenville/Spartanburg industrial market with a total of 750,000 square feet of new space during the next few years. According to Shaw, the first building consisting of 126,000 square feet of multi-tenant office warehouse space began construction last month.

Garrett Scott reported that current Johnson Development projects include a 100,000-square-foot single tenant industrial building at Fairforest Business Park and a 340,000-square-foot industrial building located at Interstate 26 and John Dodd Road.

The Whitmire Company has two projects under construction in The Matrix, a business and technology park, located near the Southern Connector in Greenville County. According to Charlie Whitmire, these new projects include a 185,000-square-foot single-tenant industrial building and a 70,000-square-foot flex multi-tenant building which offers units ranging from 7500 square feet to 70,000 square feet.

Friddle Properties recently purchased approximately 20 acres on Pelham Road less than half a mile from the Interstate 85 and Pelham Road interchange. Currently a 108,800-square-foot multi-tenant office warehouse building, with 12,800 square feet is pre-leased, is under construction. The building is scheduled for comlpletion in third quarter 2007.

On a submarket level, there are several areas to watch for future growth. Among those areas is Greer, home to a large portion of the region’s new construction. Another submarket with indications of a promising industrial market is Spartanburg West, having more than 26 million square feet of industrial space. Half of the submarket is warehouse space that experienced a 9 percent drop in the vacancy rate during the past 3 years. The growth in the Highway 101 corridor is another market hot spot, which will be spurred to new growth levels by Liberty Property Trust’s new project.

P. Randall Bentley, SIOR, CCIM, is a principal with Greenville, South Carolina-based Bentley Commercial, LLC/CORFAC International.

Greenville–Spartanburg Office Market

The Greenville-Spartanburg region is host to two competitive hubs of office development, focused in the two largest cities in the South Carolina Upstate: Greenville and Spartanburg. Despite being separated by 25 miles, the two downtown cores are influenced by the same trends.

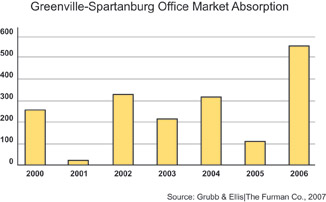

The local market is on the cusp of an expansion cycle. From the beginning of 2004 to the middle of 2006, the Greenville-Spartanburg office market struggled to absorb 400,000 square feet of office space. In the second half of 2006, tenants gobbled more than 500,000 square feet of space.

This shot in the arm was delivered by growth in the automotive and engineering fields. The Fluor Corporation’s expansion at Patewood Plaza accounted for more than 160,000 square feet of absorption while Timken’s occupation of the newest building at Clemson University’s International Center for Automotive Research (CU-ICAR) absorbed another 117,000 square feet. While Class A space in the CBD was already in scant supply, these two deals in the suburbs have diminished the supply of Class A space in the suburbs. Simply put, there is a shortage of high-end space throughout the market.

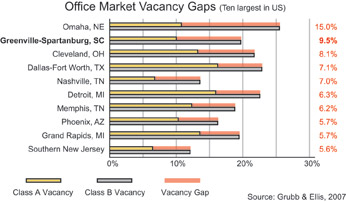

Unfortunately for Class B property owners, the same cannot be said for less competitive spaces. There is a natural tendency for Class A properties to enjoy lower vacancy rates than Class B properties, but the gap in Greenville-Spartanburg is among the largest in the country. Vacancy rates for Class A properties stand at 9.7 percent while similar rates for Class B vacancy are 19.9 percent. A major cause for the disparity is the proliferation of office condos. The Greenville-Spartanburg market has more than 900,000 square feet of office condos with a vacancy rate of more than 40 percent, which are competing directly against Class B properties. Given the current rate of absorption, this will impact the market for the next 5 years.

In spite of this, the market appears on the verge of an expansion cycle. During the past 2 years, asking rates for Class A space in the CBD have risen about $1 per square foot to just under $20 per square foot. This trend is expected to continue as there is little speculative space under construction, further tightening the market for the product.

In January, Johnson Development delivered the Carolina First building in downtown Spartanburg and 65,000 square feet of occupied office space. Other major projects scheduled for completion in 2007 are the second phase of Riverplace (50,000 square feet), the third building at CU-ICAR (75,000 square feet), and the seventh building at Independence Pointe (80,000 square feet); only the latter of which is expected to bring with it a considerable amount of speculative office space available to any interested tenant.

For 2008 and beyond, large projects appear on the horizon, which will help meet the burgeoning demand for Class A office space. Johnson Development is planning a new building in downtown Spartanburg and Hughes Development is planning the third phase of Riverplace in downtown Greenville; both of which could bring a substantial amount of high-end office space to the market.

— Brian Reed is the research manager in the Client Services department of Greenville, South Carolina-based Grubb & Ellis|The Furman Company.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|