|

CITY HIGHLIGHT, APRIL 2009

GREENVILLE CITY HIGHLIGHTS

William D. Crawford and Richard Barrett

Greenville Multifamily Market

Multifamily developers were focused on the Upstate region in 2008 — an area composed of Greenville, Spartanburg and Anderson — bringing 2,304 rental units online. Greenville is considered the hub of the Upstate area; it has the highest population of the three major cities and has been referred to as the economic engine of South Carolina. Once known as the textile capital of the world, Greenville has transformed itself into a more diverse and international community. Many companies in Greenville are widely recognized as strong competitors in the global marketplace. The most significant factor in the city’s transition is the automobile industry. Greenville now plays host to BMW, Michelin and the Clemson University-International Center for Automobile Research.

While every sector of commercial real estate in the Upstate area of South Carolina is expected to suffer through the next year or two, the apartment sector is best positioned to weather the storm because the fundamentals are in place to survive a moderate recession. One factor is the 15.4 percent growth in population seen from 2000 to 2008. Another reason is the predicted 1,756 jobs that will be created from last year’s announced capital investments. In just the first 2 months of 2009, redi-Group North America and Samsung Networks America have announced creating another 1,250 potential jobs. Greenville-Spartanburg is also on the short list for Carbon Motors Corporation’s $350 million plant, a facility that would employ another 1,100 to 1,300 people.

The other side to these new developments is the job loss in existing industries. As of December 2008, 17,168 people in Greenville County were unemployed; this number will likely rise in the short term. The job market is a key driver of the rental market.

Greenville has been experiencing severe downward pressure on rents and occupancy rates. Special offers are being made to attract new tenants as well as retain existing ones. Reports of rent reductions in the last half of 2008 range from $25 to $125 per unit. Occupancy rates had been trending downward during the last quarter of 2008, falling below 90 percent. However, that trend has been slightly reversed in the first quarter of 2009, and occupancy rate are back to 91 percent. If employment losses continue, occupancy rates will decline, but for the moment, rental rates and occupancy rates are level.

Other factors in operation include the trend of renters doubling up to save on housing costs, people going home to live with mom and dad and the overall state of the single-family housing market. Many renters have been enticed to leave apartments to purchase single-family homes in a very affordable market. Some of these purchases are now contributing to the current economic disaster, and foreclosed owners are returning to apartments. A competing factor is the very low interest rates available to home buyers. There also is the shadow market stock of single-family houses and condos being converted to rental units. Greenville is fortunate that new home construction fell 49 percent in 2008 as a result of national builders exiting the market. Sales prices have held up until recently, whereas the national market is seemingly at the bottom.

The above factors are largely out of the control of apartment firms. Development of new product, however, is not. In Greenville, developers brought 506 units online in 2007. More than 1,780 units were completed in 2008. These included Diversified Realty Ventures’ 216-unit Preserve at West View in Greer; Rohman Development’s 305-unit Millennium off Fairforest Way; Wood Partners’ 256-unit Alta Brook Wood on Brookwood Point Place; and Rohman Development’s 223-unit Garden District in Simpsonville. Spartanburg had 164 units added with the Mayfair Lofts project, another 27 units at James Anderson, and 10 units to Country Garden Estates. Anderson had 216 units of Ashton Park completed, 56 units at Park on Market and 48 units in the Kingston complex.

Currently there are 2,811 units under construction or proposed for 2009 and beyond. These include 340 units on W. Georgia Road in Simpsonville by Land Development Holdings; 1,125 possible units at The Point by Flournoy Development; 220 units on Locust Hill Road in Greer by Martin Henry Associates; 252 units on Reid School Road in Greer by Lightning Developers; and approximately 350 units to be built in the Verdae complex. The Appalachian Council of Governments reported an absorption rate of 548 units in 2007, indicating potential problems from new construction should development of many of these projects move forward. Construction starts are declining rapidly, however, as the lending environment is impacting further development. When new construction lenders can be found, they are seeking more than 35 percent equity positions from developers. Some developers can find these funds, but development proformas require solid and improving markets to ensure required rates of return.

Sales of existing apartments have been slow and are currently at a standstill. In 2008, the 152-unit Bridle Ridge, built in 1998, traded for $58,875 per unit. Caledon Court, which has 350 units, sold for $80,714 per unit. Grand Eagle’s 160 units, which were built in 1967, sold for $49,594 per unit. The 196-unit Vining’s at Duncan Chapel sold for $84,310 per unit. Declining income from rent reductions and decreased occupancy have impacted NOI, forcing cap rates up and values down. Until diminished cash flows or other market forces come into play to force action, owners are reluctant to market their properties. At some point, the length and severity of the current recession will begin to force sales.

The Greenville lifestyle is no longer a secret. Companies seeking to relocate have discovered a dynamic downtown offering a myriad of new restaurants, hotels, shopping and entertainment, with growth in the suburbs to satisfy most shopping needs. City government and private enterprise have combined to create a community downtown that has become the model for, and the envy of, other cities, especially with the improvements along the Reedy River.

If developers stay on the sidelines, the underlying fundamentals for apartments in the Greenville market should allow for a reasonable recovery. 2009 will undoubtedly be a rocky ride, but despite short-term setbacks, economic and demographic trends support a positive long-term outlook for Greenville apartments beyond 2009. The current game, however, is active management for the control of expenses and rent stabilization and turnaround.

— William D. Crawford is the owner of Greenville-based Crawford Associates.

Greenville Industrial Market

Industrial properties in the Upstate region of South Carolina continued to perform at a steady if unspectacular rate through 2008, and this trend is expected to continue through 2009. The market will continue to see good activity on the leasing side of the business. This activity, while driven by the confusion of the credit market, has still reflected the desirability of the area as a place for new businesses and the continued growth of key industries.

The current expansion of BMW’s facilities has heightened the likelihood of both secondary and tertiary suppliers opening or expanding locally in anticipation of the plant’s growth. This is further intensified as the International Center for Automotive Research complex continues to grow. The recent opening of the Carroll A. Campbell Jr. Graduate Engineering Center will further improve local research and development capabilities. This strategic investment was cited as one of the reasons the Upstate area was chosen for a multi million-dollar titanium manufacturing facility. Equally impressive has been the announcement that Fitesa, a Brazilian manufacturing company, also plans to establish a presence in the region.

Another source of growth has been from foreign-owned corporations that view this as a good time to expand in the United States. South Carolina’s centralized location in relation to the growing Southeastern seaports, such as Charleston and Savannah, Georgia, makes the region favorable for distribution centers or strategic call facilities. Samsung recently announced it would open a call center in Greenville County, and a distribution center for Adidas is in the final phase of construction in Spartanburg County. Additional distribution centers in Anderson County are coming online because Interstate 85 bisects the county and will provide tenants with easy access to the Charlotte, North Carolina, and Atlanta metro markets.

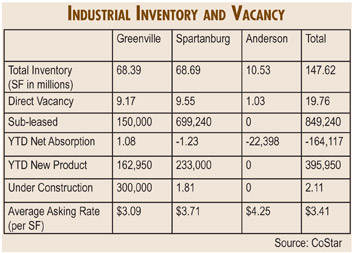

The availability rate for industrial/warehouse space as of December 31, 2008, was 14 percent. While this is a challenging number on its surface, net absorption for the full year was modestly negative at 164,117 square feet. With the exception of an extremely poor third quarter at –618,945 square feet, there was positive absorption in the other three quarters of last year. Fourth quarter absorption stands at 39,719 square feet. Considering the severity of the fourth quarter nationally, this has to be viewed as a positive indicator. This positive read is further confirmed by a rising average asking rate. Year end was at $3.41 per square foot, which represented a 1.9 percent increase in quoted rental rates from the first quarter of 2008.

The portions of the market that will remain the most active will be space that is less than 50,000 square feet in size, and there will be a particular vibrancy in the category of 10,000 square feet to 20,000 square feet. This will allow a company to establish a presence in the market and then to plan for future expansion as market conditions improve.

|

The 128,000-square-foot Kemet Electronics Building was sold in September.

|

|

Major transactions in 2008 include the sale of the 128,000-square-foot Kemet Electronics Corporation building, located at 1224 Old Stage Rd., to MBVB LLC in September. Major lease signings occurring in the Greenville market for 2008 included the 625,000-square-foot lease signed by Louis Dreyfus Company at Donaldson Distribution Center in the Greenville market; the 187,000-square-foot deal by Southern Cotton on Rutherford Road in the Greenville market; and the 160,000-square-foot lease signed by UTI Integrated Logistics at 2819 Wade Hampton Blvd., Building 2. O. Gas Turbine Efficiency leased 49,225 square feet at 240 E. Parkway; Iron Mountain leased 45,000 square feet at 125 Caliber Ridge Dr.; and Earth Protection Service signed a lease for 15,000 square feet at 109 Twenty Nine Court in Anderson.

— Richard Barrett is a broker with Greenville-based Bentley Commercial.

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|