|

SOUTHEAST SNAPSHOT, AUGUST 2004

Raleigh/Durham Office Market

|

|

Gary Lyons, CCIM

Senior Advisor

Sperry Van Ness/AIM Realty Advisors

|

|

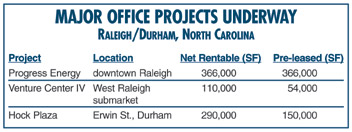

Office development in Raleigh/ Durham, North Carolina, is

beginning to pick up as office absorption improves. “However,

as a result of the tremendous run-up in vacancies that began

in 2001, office development is still far below the past 10-year

average,” notes Gary Lyons, senior advisor with Sperry

Van Ness/AIM Realty Advisors. As of the end of 2003, the area

only had three major office projects underway: Progress Energy,

Venture Center IV and Hock Plaza (please see chart at right

for more information).

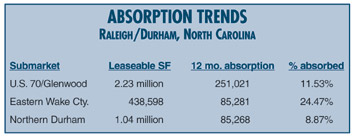

From an absorption perspective, there are three submarkets

that have rebounded — U.S. 70/Glenwood, Eastern Wake

County and northern Durham. In the past 12 months we have

seen the following changes in the U.S. 70/Glenwood, Eastern

Wake County and Northern Durham submarkets (please see chart

at right for more information).

In contrast, over the past 12 months, Cary gave back 117,680

square feet (2.61 percent), the Research Triangle Park (RTP)/Interstate

40 corridor gave back 611,507 square feet (6.88 percent) and

central Durham gave back 82,487 square feet (5.58 percent).

“The Progress Energy building, which is under construction

in downtown Raleigh, is part of a much larger redevelopment

of significant portions of our central business district,”

says Lyons. “We are seeing a revitalization of the downtown

core with the redevelopment of the old Belk building and discussion

regarding the construction of a new five-star hotel and convention

center.”

There is no single concentrated area of office development.

“Because of the excess supply that has accumulated over

the past 3 years, we are seeing very little speculative construction,”

Lyons comments.

Most of the construction is build-to-suit-related activity

as a result of successful pre-leasing. The Raleigh CBD is

active as are portions of the I-40/Highway 55 corridor near

RTP in Durham as well as near Duke University in Durham (additional

medical space). In general, the projects are much smaller

than they were in the late 1990s when many large Class A office

buildings were put up.

Class A rents range from $16.50 to $23.50 per square foot;

however, the vast majority are between $18 and $20 per square

foot.

At the end of 2003, Class A vacancies ranged from a low

of 6.3 percent in downtown Raleigh to a high of 24.7 percent

in Cary. The RTP/I-40 corridor, which had been one of the

strongest markets in the ’90s, was a close second in

vacancy at 23.4 percent. Most submarkets, however, were between

10 and 16 percent.

“The Interstate 540 corridor around Glenwood Avenue near

the Raleigh-Durham International Airport (RDU) should be a

very good one for office development,” says Lyons. “I

can envision significant office space beginning to develop

around the Briar Creek planned-unit development (PUD) near

RDU and RTP, as well as Wakefield in north Raleigh near Wake

Forest. Both of these PUDs have been highly successful in

terms of roof top additions and retail development. The CBD

should continue to experience steady development since it

is the tightest submarket.”

The RDU office market was hit harder during the recent recession

than at any time during the past 20 years. Many factors came

into play, but the single biggest impact came from the implosion

of the high-tech sector. Raleigh/Durham shed tens of thousands

of jobs at AT&T, Nortel, IBM, Lucent, Alcatel and even

Cisco. In fact, Cisco has five or six large office buildings

sitting vacant, just waiting for an upturn in the company’s

hiring.

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|