|

SOUTHEAST SNAPSHOT, AUGUST 2004

Greenville/Spartanburg Multifamily

Market

The apartment market in the Greenville, South Carolina, metropolitan

statistical area (MSA) — also known as the Upstate —

is poised for improvement, according to Charles Dalton, president

of Real Data, a real estate research firm based in Charlotte,

North Carolina. A number of major economic announcements have

been made in the last year. Development activity is moderate,

demand is improving and rising mortgage rates should mitigate

competition from homeownership.

BMW Manufacturing has unveiled plans for a $17 million development

and testing facility at its Greer, South Carolina, campus

in addition to its already announced research center at Clemson’s

Automotive Research Park in Greenville. Greer’s proximity

to BMW’s facilities and its relatively low vacancy rate

have sparked several potential apartment development projects.

Rogers Harmon Development/ Trinity Group, STM Acquisitions

and Benchmark Development Group are proposing a total of 466

new apartment units in Greer.

Apartment supply in the Anderson, South Carolina, submarket

has grown by more than 20 percent in the past 2 years, pushing

vacancy rates above 14 percent. Two significant economic announcements

should help fuel demand for this new supply. Walgreens will

build a $150 million distribution center in Anderson; the

center will employ 450 people. Reliable Automatic Sprinkler

Company is planning a 350-employee manufacturing plant in

Pickens Industrial Park in Pickens County.

The west Spartanburg submarket, like Anderson, has seen its

apartment supply increase by nearly 20 percent in the last

year. Consequently, occupancy rates in west Spartanburg have

fallen to 83 percent even though demand has been positive.

In Greenville, the northeast submarket is faring the best

with occupancies approaching 90 percent.

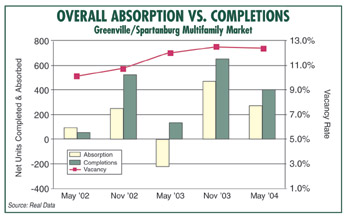

Although apartment vacancy rates for the Greenville MSA remain

high at 12.4 percent, according to the June 2004 Apartment

Index published by Real Data, demand in the past 12 months

reached its highest level in 5 years. Dalton notes, “Demand

for multifamily living in the Upstate has suffered in recent

years as a result of lost manufacturing jobs and competition

from single-family homes. With mortgage rates likely to rise

and limited new apartment development, occupancy rates should

slowly improve.”

Currently, there are only two new apartment communities under

construction, which should enable demand to outpace new supply

in the near term. Rock Creek is under construction in Greenville

and Haven at Boiling Springs is expected to open in Spartanburg

this fall. Johnson Development is building Haven at Boiling

Springs and PRS Companies is constructing Rock Creek.

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|