|

FEATURE ARTICLE, DECEMBER 2004

2005 Outlook

NASHVILLE, TENNESSEE

Industrial Market

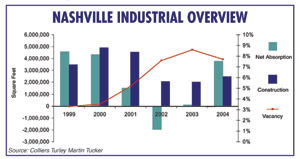

The economy is improving and national and regional economic

indicators continue to point to an expansion. Corporations

have increased productivity and cut costs by eliminating excess

capacity during the recent economic downturn, and they are

finally into an expansionary mode. Interest continues in single-tenant

facilities in the 22,000- to 30,000-square-foot range, and

build-to-suit facilities will still be needed to meet market-specific

needs. We look for sustained periods of growth and project

absorption in the 2.5 million-square-foot range for 2005.

Multifamily Market

In response to an improving economy and apartment market coupled

with low interest rates, Nashville is witnessing a significant

increase in apartment construction. There are currently more

than 3,000 units under construction as compared to less than

500 units completed in 2003. Murfreesboro leads the pack with

almost 1,400 units currently under construction.

Not unlike many other cities, Nashville is experiencing a

downtown revitalization and a return to urban living. Currently

there are approximately 1,500 units downtown, but there are

more than 700 more units either under construction or planned,

most of which are for-sale product.

Retail Market

The Nashville MSA will continue its retail growth in the outlying

submarkets of Murfreesboro/Rutherford County, Hendersonville/Gallatin,

Cool Springs and Mt. Juliet/Wilson County. The immediate Nashville

area’s most desired locations are constrained for expansion

by lack of available land, and growth in these areas will

be dependent upon developers choosing to level older centers

and start fresh. Such is the case in Green Hills with H.G.

Hill Company demolishing its former location and additional

shop space to construct a new 162,000-square-foot mixed-use

venue. Shopping centers remain the choice product for the

investment market.

Investment

The recovery in the corporate economy and the increasing likelihood

of higher interest rates should help close the gap between

the real estate capital markets and physical space market

fundamentals. Vacancy rates should fall as tenant demand recovers

and new supply remains modest, while rising interest rates

and an improving outlook for other asset classes diminish

the appeal of real estate yields. For investors, events signal

a shift in investment strategy from the credit-driven investing

that has dominated the market in recent years to strategies

that focus on the opportunities created by the recovery in

demand and, eventually, rents.

Office Market

Look for steady, albeit incremental, growth in 2005. Expectations

for the office market include a reduction in the market-wide

vacancy rate to 13.5 percent and net positive absorption of

approximately 1 million square feet. Sublease space will remain

steady in the slower growth submarkets, but will not be an

impediment to speculative construction. New multi-tenant facility

construction, a topic of conversation, speculation and contention

for the CBD, will come to fruition. However, the most likely

areas for speculative construction remain the Brentwood/Cool

Springs area.

— Whitfield Hamilton, managing principal, Colliers

Turley Martin Tucker, Nashville Regional Office

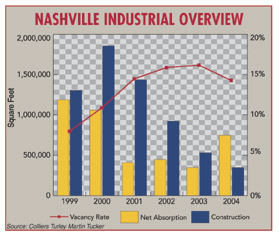

| In 2005 we will see an increase in rental

rates and less concessions for tenants, which is caused

by the lower vacancy rates in the suburban markets. Continued

job growth, which will in turn create expansion among

existing businesses, will help span new business and help

absorb some of the shadow space still on the market.

Leasing has improved previously from the past 2 years.

While absorption numbers are on track with previous averages,

they have been boosted by approximately four large users

in the Airport North, Brentwood and MetroCenter submarkets.

As of third quarter 2004, office absorption is 450,453

square feet.

The vacancy declined in Brentwood, Cool Springs and MetroCenter

throughout 2004. Brentwood and Cool Springs will continue

this throughout 2005 due to the quality of developments

and workplace environments and price of competitive lease

rates in these two areas. With the lack of space in the

Brentwood and Cool Springs areas, new development should

start by the end of 2005.

The recent completion of the Roundabout Plaza has relocated

several large tenants away from the CBD. The Summit on

West End, which will be a multi-use building of approximately

900,000 square feet, will have an impact on the market

as well. Two new proposed skyscrapers in the CBD could

negatively affect the strength of the downtown market:

the SunTrust Tower (350,000 square feet of Class A office

space) and the Signature Tower (325,000 square feet of

Class A office space).

— Grubb & Ellis|Centennial

|

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|