|

CITY HIGHLIGHT, DECEMBER 2004

JACKSONVILLE ATTRACTS NEW BUSINESSES

Jacksonville, Florida’s metropolitan statistical area,

which includes Duval, St. Johns, Clay and Nassau counties,

has a population of more than 1.2 million. Expansion Management

Magazine has consistently ranked Jacksonville in the top 10

of its survey of “Hottest Cities” in America for

business relocation or expansion. Jacksonville ranked Number

1 on this list in 1999, 2002 and 2003.

Office

The city of Jacksonville has taken a proactive role in the

city’s overall growth and development by establishing

economic incentive programs to help support multiple commercial

and residential projects. Attracting more people to live downtown

is a major goal for civic leaders. Developers are currently

preparing for several new residential projects in the downtown

area, providing a key component in the renewed strength of

downtown as a place to live and work.

Jacksonville is continuing to grow in every direction, offering

many opportunities for investors. The prime growth area for

office construction is still along Southside’s Butler

Boulevard corridor, extending southward toward St. Johns County.

However, other adequate development sites exist elsewhere

in Jacksonville.

Jacksonville is becoming a major city on everyone’s map.

It has multiple assets and is diverse in many aspects of its

economic, social and geographical environment. There are many

concrete reasons that Jacksonville continues to rank highly

for businesses to relocate or expand.

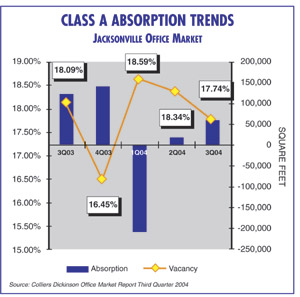

Jacksonville’s office market has fared better in many

respects over most regional and comparable markets. Nevertheless,

the turnaround from the downturn has been slow. Speculative

construction has been at a low level and it is projected to

remain so until occupancy increases in the Class A office

market. At present, there remain few build-to-suit projects

under construction. Most build-to-suit projects in Jacksonville

are tenant-driven, multi-tenant buildings, resulting in additional

user space coming on line upon completion of these projects.

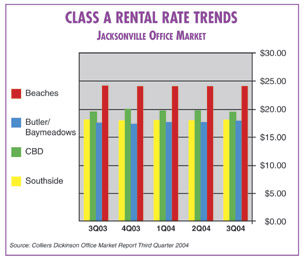

Of Jacksonville’s 34.5 million square feet of office

space, roughly 10 million square feet is owner occupied, leaving

24.5 million square feet of rentable building area. The average

asking rent in Jacksonville for Class A office space is $19.83

per square foot, while Class B and C is quoted at $15.49 per

square foot. The bulk of deals occurring in the market is

relatively small, in the 2,000- to 10,000-square-foot range,

but bigger deals are also appearing.

Consensus has it that the Jacksonville office market has stabilized.

Minimal new hire or little corporate expansion will likely

continue for the next 6 to 9 months before the beginning of

an upward trend. It is still considered a tenant’s market;

however, landlords are beginning to limit rent concessions

while attempting to improve their income stream. Any significant

increase in rents is not expected until next year. Absorption

will eventually improve with a stronger job market.

— Louis Galant, director of research, and Jenna

Kirk, assistant director of research, Colliers Dickinson

Retail

The population of Jacksonville metro has experienced 9 percent

growth since 2000, now approaching 1.2 million. The retail

prognosis is promising, with another 10 percent increase forecast

by 2009 to 1.3 million residents — nearly one-third of

whom will be in the prime 25 to 44 age bracket.

The Baymeadows/Avenues submarket has performed exceptionally

well during the first half of 2004, with the strongest rent

rates ($21.42) and second-highest occupancies (97.3 percent).

The market overall posted average rents of $14.99 per square

foot with occupancy of 93.24 percent. Baymeadows/Avenues is

bolstered by the super-regional Avenues Mall, which underwent

major renovations in preparation for Super Bowl XXXIX. New

to the submarket is The Sembler Company’s 109,000-square-foot

Southside Shoppes, featuring Best Buy and Sports Authority,

among other retailers, and the first phase of the Shoppes

at Bartram Park, anchored by Publix.

West Beaches continues strong occupancy (98.8 percent), sparked

largely by limited inventory of 1.2 million square feet. However,

new development is on the horizon with Wal-Mart Supercenter

and SuperTarget coming to the area. Significant new development

also is planned for the Regency submarket at the Gate Petroleum

Company’s Kendall Town Center, complete with multifamily,

retail, offices and hotels. Phase I, anchored by a 208,000-square-foot

Wal-Mart Supercenter opening this spring, is slated to be

built out in 6 to 8 years.

As of October 2004, the Jacksonville retail market had sparked

more investor interest than all of last year. Seven strip

center transactions took place through June 2004, compared

with just one during the first 6 months of 2003. Additionally,

the retail market this year is expected to nearly double its

total volume from 2003.

Overall, the Jacksonville retail market is in good shape.

More than 75 percent of the market has occupancies in excess

of 93 percent, and residents can expect more than 3 million

square feet of new retail space over the next 3 years, involving

such major names as Wal-Mart, SuperTarget, Lowes, Best Buy

and Cost Plus World Market.

— John Crossman, senior vice president, director

of retail investment services, Trammell Crow Company

Multifamily

Multifamily trends in the greater Jacksonville area include

an increase in apartment/condominium conversion projects such

as River Reach Apartments on San Jose Boulevard, which AIMCO

is selling to an unnamed developer. As of July 2004, occupancy

was at approximately 92 percent, which is strong overall,

although an almost 2 percent decrease from last year.

Demand for housing in Southpoint on Jacksonville’s Southside,

home to the majority of new development in North Florida,

has increased to the extent that two new developments are

on line from two different developers. Pulte Homes is bringing

forth Ironwood, a 570-unit project on Gate Parkway West, and

Summit Contractors started construction in late June on a

350-unit, 14-building apartment complex on the same road,

which is located just off J. Turner Butler Boulevard, a major

beaches artery.

While the majority of the multifamily development is on the

Southside of Jacksonville, following the growth of office

developments such as Southpoint Business Park and Deerwood

Center, the Better Jacksonville Plan — a $2.2 billion

comprehensive growth management strategy for infrastructure,

roads and other targeted areas of concern — has had the

effect of rejuvenating many other areas of the city such as

east and west Jacksonville, which could reap investment rewards

in the future due to overbuilding on the southside and the

lack of incentive dollars in that area. A prime example of

these “niche” plays is an Atlanta developer bringing

forward a $32 million, 400-unit apartment complex in the Regency

area of greater Arlington in northeast Jacksonville.

Jacksonville is seen nationwide as stable, but very much on

the radar screen of many national companies, as demonstrated

by more than 100 purchases of multifamily properties in 2001

and 2002. With interest rates at the lowest in recent memory

and the city hosting the Super Bowl in just a few months,

look for Jacksonville to continue to compete for a greater

share of the “Sunbelt” investment dollars pouring

into the Southeast.

— Sidney Jones, CCIM, vice president and multifamily

specialist,

Coldwell Banker Commercial-Nicholson Williams Realty

Industrial

Through three quarters of 2004, Jacksonville’s industrial

market has outperformed North Florida’s two other major

areas — Orlando and Tampa. Adjusting for market size,

Jacksonville clearly emerges as the leader among positive

absorption, declining vacancy rates and increasing rent rates.

Warehouse/distribution activity continues to be healthy, posting

12 months of positive absorption buoyed by the outstanding

performance of the Southside and West Side submarkets, where

more than 168,000 and 298,000 square feet, respectively, was

absorbed. Key recent transactions include Kraft Foods North

America Inc., which leased 183,500 square feet in West Side

Industrial Park #4 as a Maxwell House Coffee distribution

center. Transamerica Auto Parts leased 81,000 square feet

in Tradeport Distribution Center VIII, bringing building occupancy

to 73 percent; Decker Inc. leased 11801 Grand Central Pkwy.,

a 168,210-square-foot distribution building with 4,000 square

feet of office space; and 8691 Western Way, a 53,300-square-foot

warehouse built in 1975, sold for $2.4 million in July.

No major lease-only projects are planned in 2005, and only

one (Beachwood Commerce Center — delivery in early 2005)

currently is under construction. Time will tell what impact

emerging warehouse condo construction may have on future development

of (and occupancy of existing) lease-only, multi-tenant properties

in Jacksonville. By year’s end, there will be some 74,000

square feet of industrial condo space available in the Southside

submarket, while another 57,000+ square feet is about to be

completed in West Side.

The overall asking rent for warehouse/distribution space is

nearing $4 per square foot, up $0.60 from a year ago. Rents

are up in every industrial submarket, with average rents ranging

from a low of $2.95 per square foot in Clay County to $5.49

in Butler/ Baymeadows. Direct vacancy has reached its lowest

level in 2.5 years, finishing the third quarter at 16.6 percent.

As previously noted, it remains to be seen how the delivery

of warehouse condos will impact that in the long run. However,

with new construction of lease-only multi-tenant buildings

at a virtual standstill, the upward pattern that began during

the previous four quarters should continue into the near future.

— Brad Chrischilles, senior vice president –

brokerage and Jacksonville director, Trammell Crow Company

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|