|

CITY HIGHLIGHT, DECEMBER 2004

LEXINGTON TO BE STABLE IN 2005

Paul Ray Smith, Bruce Isaac, Jim Kemper and Chad Voelkert

For 2005, the Lexington, Kentucky, market will be stable with

selective growth in certain categories. There will be only

a few new office projects in the suburbs and none in the central

business district. No significant speculative construction

of industrial or flex space is anticipated. The retail market

continues to benefit from the regional retail trade area that

Lexington serves, specifically the Nicholasville Road corridor

and Hamburg Pavilion. The lack of retail zoned land continues

to provide challenges in creating opportunities to expand

the retail market. Investment sales were strong in 2004 and

this strength is anticipated to continue in 2005, as buyers

continue to take advantage of favorable interest rates and

sellers of attractive cap rates.

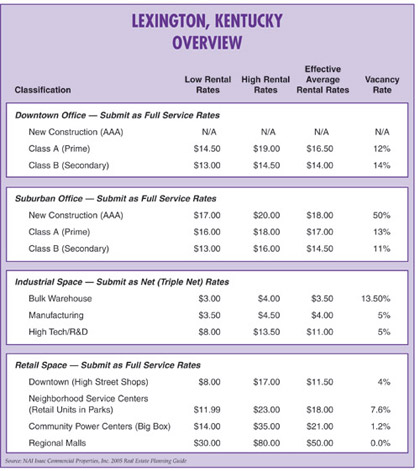

Office

Office condominiums and approximately 15,000- to 25,000-square-foot

low-rise office buildings are the most common projects occurring

within the Lexington suburban office market. These projects

are occurring in South Lexington due to the majority of zoned

and developed professional office lots becoming available

in the Beaumont, Wellington and Hamburg developments.

Existing suburban office developments are projected to experience

increased competition in 2005, mainly due to the new space

coming on line. Sublease space will also impact the market

as a vacant 160,000-square-foot building plus other sublease

space competes for tenants in the market. Occupancy levels

are projected to trend lower with downward pressure on rental

rates. The present suburban office market is estimated to

have 293,812 square feet of vacant space and a vacancy rate

of 13.56 percent.

While Lexington’s central business district has no new

office projects planned, it is seeing increased interest by

developers in building residential units. The University of

Kentucky and the city of Lexington have agreed to work closer

together to bring campus activities to the CBD. The present

CBD office market is estimated to have 268,244 square feet

of vacant space and a vacancy rate of 12.72 percent.

Converted industrial space to office space is not a factor

in our market at this time.

Industrial

Lexington’s industrial market primarily consists of distribution

and light industrial space, but Lexington and the University

of Kentucky have focused in recent years on attracting high-tech

and R&D companies. In 2004, the industrial market remained

stable with slow absorption of existing facilities and sites

in industrial parks. Lexington’s proximity to Interstate

75/64, its overall low cost of doing business, low electric

power costs and continued strength of Toyota Manufacturing

make it an attractive place for companies to do business.

Amazon expanded their presence in Lexington by leasing an

additional 384,000 square feet and Clark Material Handling

Company (the inventor of the fork lift) purchased a ±

100,000-square-foot facility in West Lexington for its headquarters.

Lexington reports ±1.1 million square feet of vacant

industrial space with a vacancy rate estimated to be 14.38

percent

Retail

The most active areas for retail for 2005 will continue to

be the Hamburg area and Nicholasville Road.

In the Nicholasville Road corridor, Brannon Crossing and Commerce

Center are still proceeding with pre-leasing activity. At

Regency Centre, located inside New Circle Road, the landlord

is building a 12,000-square-foot, speculative retail building

and has created a new outparcel. In addition, Fayette Mall

has recently announced a 140,000-square-foot expansion with

Dick’s Sporting Goods leasing 80,000 square feet for

a two-level store. There are also several available freestanding

restaurant/retail sites in the corridor, which is not typical;

however, absorption of these sites is expected in 2005.

In the Hamburg area, Circuit City and Bed Bath & Beyond

are now open at Sir Barton Place, and Off Broadway Shoe Warehouse

and a Bonefish Grill-anchored small shop building are now

under construction. Gordon Food Service, Starbucks Coffee

and Chipotle Grill have also opened locations across Man O’

War Boulevard.

Lexington neighborhood centers continue to enjoy high occupancy

rates and have seen rental rates increase slightly from 1

year ago.

With a total gross leasable area of ± 9 million square

feet, the present retail vacancy rate is estimated to be 7.08

percent with ± 654,464 square feet of available retail

space in Lexington.

Multifamily

The multifamily market has continued to be stable throughout

Lexington. Although mortgage rates have seen record lows and

home ownership is at an all-time high, landlords have continued

to enjoy a relatively low percentage of vacancy. After a lack

of new construction last year, this year three large projects

near the University of Kentucky and Hamburg are breaking ground,

which will add 1,452 units to the marketplace. With state-of-the-art

exercise facilities, conference rooms and theatres, these

new complexes include amenities that have not typically been

seen in apartment complexes in central Kentucky.

The following executives from NAI ISAAC Commercial Properties

contributed to this article: Paul Ray Smith, executive vice

president; Bruce Isaac, SIOR, CCIM, senior vice president;

Jim Kemper, vice president; and Chad Voelkert, associate.

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|