|

COVER STORY, DECEMBER 2010

2011: THE RESEARCH SAYS...

Stabilization, shocking sales prices and slow growth are possible next year.

Jaime Lackey

As we move toward a new year and we see encouraging signs of an improving economy, we are optimistic that 2011 will bring recovery to the commercial real estate industry. To get a look at expectations for next year, Southeast Real Estate Business talked with Ross Moore, executive vice president of research with Colliers International; Lanie Rea, director of research operations with Jones Lang LaSalle Americas; and Josh Gelormini, director of capital markets research with Jones Lang LaSalle Americas.

SREB: What are your predictions for the multifamily sector? Industrial? Retail? Office?

Moore: Multifamily is the clear winner. I also think industrial will do well in 2011. Industrial is so closely tied to the global economy, which is on track to do well next year. Exports and global trade are already up. The latest International Monetary Fund (IMF) numbers show the global economy will grow 4.8 percent in 2010 and will only moderate marginally in 2011, with growth still coming in comfortably above 4.0 percent — and, more importantly, back to levels experienced prior to the global financial crisis. With the world economy on track to post robust growth, global trade is expected to surge higher, increasing the demand for warehouse space across any market that is part of the global supply chain.

Rea: All commercial sectors will remain in recovery during 2011. Growth in and around major transportation hubs like airports and seaports will help primary industrial markets shrink vacancy levels, while smaller, non-hub markets may experience flat dynamics in the next 12 months. A comparatively strong winter could boost momentum in the retail market for 2011.

The office sector’s recovery will be influenced largely by job growth, as many Southeastern markets have seen vacant space climb significantly in recent years and will need organic job growth in order to fill the glut of empty space. Cities like Atlanta and Charlotte — where in-town markets delivered several million square feet of empty space in recent months — could see elevated vacancies well into 2011 and potentially beyond. Some suburban areas, smaller urban metros and niche markets, like Birmingham and Nashville, may experience slow growth during the next year as local office-using firms target these areas for growth and expansion.

SREB: What are your predictions for job growth in the Southeast?

Rea: Job growth throughout the Southeast will undoubtedly be slow in the coming year. Metros like Savannah, which will see growth come from its port expansion, could see above-average growth rates. New start-up companies in business-friendly environments will help to drive growth during 2011. Industries such as the health services and education sectors, along with government expansions, will continue to exhibit growth and should help to drive future employment especially in smaller metros and rural areas. Unemployment figures are expected to remain elevated through mid-2011, but by year-end should be trending downward in most metro areas.

Moore: Washington and Baltimore are producing jobs, and there is no indication either will throttle back anytime soon. In fact, in terms of job growth, the September data shows that Washington is the Number 3 major market in the U.S. (after Austin and Charleston, South Carolina) and Baltimore is Number 4 of the 53 major metros that Colliers International tracks.

SREB: Distressed properties have not hit the market in the numbers that many expected. How will this affect the market in 2011?

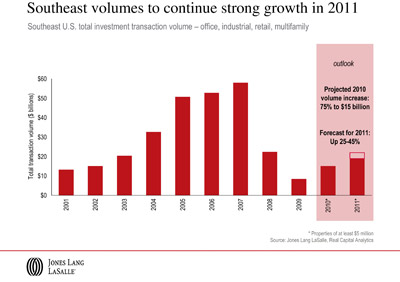

Gelormini: Investment activity across the Southeast has been dormant. With relatively few distressed or foreclosure opportunities available, investors may focus their attention on trophy assets (well-established, well-located buildings with stable occupancy) or properties in the middle market (Class A-/B+ properties). The gap between buyer and seller expectations remains wide in some primary and most secondary markets. And with recent declines in property values across all asset classes, most current owners are still reluctant to sell. Over the next 12 months, many markets can expect to see an increase in capital markets activity, but volume levels will not return to those seen in 2006-2007 in the near future.

Moore: A year ago, people were predicting at least 50 percent of 2010 commercial real estate sales would be distressed assets. In reality, there has been sufficient liquidity in the market so that we’ve had very few distressed sales — less than 15 percent of total sales. Underwater loans are getting worked out. I don’t see anything to suggest “pretend and extend” is going away immediately. Low interest rates have also played a role in the low volume of distressed property sales. A good many “distressed” properties are at floating rates, and they have the cash flow to service the debt.

As values for quality properties bounce back, “pretend and extend” will begin to wane. In the meantime, we will likely see another wave of distressed property sales in 2011. A wave — not a tsunami. Investors can buy properties for 60 to 80 cents on the dollar — not 10, 20 or 30 cents on the dollar.

SREB: What are your predictions for foreign investment?

Moore: Although there is a huge appetite for U.S. real estate, little more than 10 percent of the total investment in any given month is from foreign sources. (This is up from a couple of years ago when foreign investment accounted for 6 to 7 percent of purchases.) There just isn’t a lot of product to buy, and foreign investors are frustrated. Essentially, they are priced out of the market. Big funds want big core buildings, and these assets are not trading at prices they are willing to pay. The Number 1 source of foreign investment is Canada. We’ve seen some Canadian and Latin American money come mostly into Florida.

Gelormini: During 2011, it is likely that many institutional investors, including foreign entities, will push more into secondary markets, as they will need to expand their horizons from the singular focus on gateway markets’ core trophy assets in order to meet target returns. They will also need to increase their tolerance for risk, and major Southeastern markets stand to benefit from the trend of increased investor interest and transaction activity.

SREB: Overall, what do you expect for 2011?

Rea: The next year should be one of stabilization in most secondary and tertiary markets, and one of slow growth in primary markets.

Office and retail growth will come with the return of consumer confidence and a reversal in employment trends. The multifamily sector will continue to be a bright spot for investors, and demand for this product type will strengthen in the coming months as companies resume hiring and the population in Southeastern markets continues to grow. By 2012, recovery efforts will be in full swing in the vast majority of markets throughout the Southeast.

Moore: The next 12 months will certainly be better than the last 12 months. We will see some shockingly high prices paid for some assets due in large part to the low interest rates. To clarify, I think people outside the real estate industry will be shocked at the prices paid for buildings that cannot be filled while we are not creating a substantial number of jobs.

However, real estate will continue to be a preferred investment. Money is earning less than 1 percent interest whereas real estate is providing 5 percent returns. Why wouldn’t people buy something with greater return and where they can add value?

©2010 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|