|

CITY HIGHLIGHT, FEBRUARY 2005

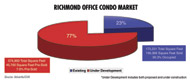

RICHMOND EXPERIENCES OFFICE CONDO

CRAZE

Like many other southeastern cities, Richmond, Virginia’s

office market is seeing an increase in the commercial condominium

sector. There are 19 condominium projects either completed

or coming on line in the next year in Richmond. The retail

sector saw a large number of new retailers enter the market

in 2003 with the opening of two malls; even so, it is expected

that existing retailers will continue to add new units and

that new retailers will continue to enter the market. In the

industrial market, last year positive but relatively slow

for Richmond.

Office

The

biggest story in the Richmond office market, as in many others,

is the commercial condominium craze. The combination of low

interest rates and investors seeking to diversify their holdings

has made office condos a win-win option for business owners

and developers alike. Currently, there are 19 condominium

projects either completed or coming on line in the next year.

The traditional medical user is being joined by more mainstream

businesses such as accountants, day care centers and law firms. The

biggest story in the Richmond office market, as in many others,

is the commercial condominium craze. The combination of low

interest rates and investors seeking to diversify their holdings

has made office condos a win-win option for business owners

and developers alike. Currently, there are 19 condominium

projects either completed or coming on line in the next year.

The traditional medical user is being joined by more mainstream

businesses such as accountants, day care centers and law firms.

One of the most significant recent events is the completion

of Route 288, which now has Richmond commuters traveling between

the West End (Henrico) and South Side (Chesterfield) in a

toll-free 20 minutes versus a 50-minute commute previously.

As expected, land prices along this corridor have shot up

dramatically.

In the central business district, landlords that had the foresight

to buy or stay on Broad Street are beginning to see the rewards

of their vision as the Community Development Association marches

forward with its plans for new office, retail, hotel, parking

and performing arts complexes in the area. “In the next

few years, downtown will become a convention, theatre and

entertainment district with ample parking, additional luxury

hotels and other amenities,” says former mayor Rudy McCollum.

Complementing the city’s $55 million investment in the

historic canal area is Daniel Corporation’s Riverside

of the James, the largest mixed-use development on the riverfront

with 230,000 square feet of office space, 122 apartments,

70,000 square feet of entertainment/retail space and an 800-car

parking deck on the 4.2-acre site. Still almost a year away

from projected completion, Riverside is already 74 percent

leased. Further down the river, another large mixed-use development,

Rockett’s Landing, has been approved, and will unfold

over the next 10 years.

Looking forward, expect a climate of moderate growth, particularly

from mid-size companies as they commit to more expansion than

in the past several years. Consequently, Class A suburban

space occupancy should experience a slight increase, but Class

B will remain flat and compete with high vacancy rates and

concessions. As interest rates and the price of construction

materials rise, demand for office condos may decrease from

its current accelerated pace.

— Jimmy Appich, director - commercial properties,

Advantis Real Estate Services Company/GVA

Retail

|

|

The 40,000-square-foot Promenade

specialty center opened

with rents near $40 per square foot.

|

|

At of the end of the third quarter of 2004, retail space in the

Richmond metropolitan statistical area totaled approximately

33 million square feet, with a vacancy rate of approximately

8 percent. Even with an unusually large influx of space and

new retailers in 2003 with the addition of two large malls,

it is expected that existing retailers will continue to add

new units and that new retailers will continue to enter the

market. This is based on the Richmond area’s strong retail

track record and the final completion of the Route 288/295 outer

loop.

|

|

Stony Point Fashion Park is

one of two malls that opened in Richmond, Virginia,

in September of 2003.

|

|

In north Richmond, The Home Depot signed a lease near Simon

Property Group’s Virginia Center Commons Mall in a power

center on Sliding Hill Road. In the west, Forest City Enterprises’

new Short Pump Town Center dominates the landscape. The Cheesecake

Factory opened in the area formerly designated for Lord &

Taylor, with Orvis and Saxon Shoes slated to open this year.

Across Broad Street, two 40,000-square-foot specialty centers

opened with rents near $40 per square foot. Circuit City added

a store adjacent to the mall and PetsMart is under construction.

Along Hull Street Road in southwest Richmond, expansions are

planned for Commonwealth Center and Village at Swift Creek.

Retail growth is expected to continue along this already heavily

traveled corridor. In south Richmond, Kohl’s is under

construction in Chester and Best Buy has a new store in Colonial

Heights. In the northeast, the retail focus is along Route

360. Cousins Properties is building a Target- and PetsMart-

anchored center and further east on Route 360 a new Lowe’s

is planned. Development also continues in some of Richmond’s

more mature markets, notably at the intersection of Forest

Hill and Chippenham, where Target, Office Depot and Ukrop’s

will be opening this year.

|

|

The Shops at Stratford Hills

is a Target/Ukrop’s-anchored center

under construction at Forest Hill and Chippenham.

|

|

The introduction of the two malls in 2003 also had negative

effects. Regency Square, just 4 miles from the new Stony Point

Fashion Park, experienced a decrease in sales and tenant turnover.

Kroger, however, opened near Regency and Wal-Mart announced

plans to open in a former Kmart in nearby Parham Plaza. Willow

Lawn, closer to the city, lost Dillard’s when it opened

in the two new malls, and a de-malling and renovation is planned.

At Chesterfield Towne Center in south Richmond, one of Dillard’s

two boxes will be demolished to allow for a mini lifestyle

center. Chesterfield County purchased the 50-acre Cloverleaf

Mall at Chippenham and Midlothian Turnpike with hopes to revitalize

this struggling but high profile property.

The new Route 288/295 beltway promises to keep the spotlight

on the high growth corridors along West Broad Street to the

Goochland County line; along Hull Street Road; and along the

new interchanges of Route 288. Expect major retail announcements

next year for the Watkins Tract at 288/Midlothian Turnpike

and for CenterPointe at 288/Powhite Parkway.

— Kent Cardwell, Divaris Real Estate, Inc.

Industrial

|

|

Devon USA recently delivered

building E at the Enterchange at Walthall project

in Richmond, Virginia.

|

|

2004 was a positive but relatively slow year for the Richmond

industrial market. Activity in the market is typically measured

by looking at the net absorption for the year. Net absorption

is the net change in occupied space over a given period of

time. The total absorption for the year was positive 308,038

square feet, which surpassed the net absorption for 2003,

which we called a flat year, by nearly 130,000 square feet.

Despite the increased absorption for the year the vacancy

rate increased slightly from 14.69 percent in 2003 to 14.78

percent for 2004. This is due to the development of new speculative

building in the market, which increased the amount of available

space.

Leasing Activity

Tenants moving out or announcing move-outs of large blocks

of space include the IRS, which will vacate 230,000 square

feet in 2005 from its facility near the Fairgrounds Distribution

Center; The Wella Corporation, which, due to its sale to Proctor

& Gamble, will vacate approximately 600,000 square feet

in the east end of Henrico; Mazda, which vacated 317,000 square

feet that it leased near the RIC airport; and Hewlett Packard,

which announced that it would close two facilities of 158,400

and 146,000 square feet that it leases in the RiversBend Industrial

Park near I-295 and Route 10.

Tenants moving into large blocks of space in 2004 included

Ryder Logistics leasing 130,000 and 60,000 square feet on

Tranport Street in the city of Richmond; BWI of Virginia leasing

76,000 square feet on Transport Street; Ferguson Enterprises

leasing 45,000 square feet in the Brittons Hill Distribution

Building; Central Virginia Health Network leasing 55,000 square

feet in the Brittons Hill Distribution Building; Cebco leasing

103,000 square feet on Carolina Avenue; Uquality Automotive

Parts leasing 43,000 square feet at 4215 Eubank Rd.; and Southwest

Plastics Binding Corporation leasing 25,000 square feet in

the Highwoods Distribution Center.

Sales Activity

With interest rates relatively low, there were a number of

significant sales of vacant buildings. The 98,000-square-foot

former Ben Hogan facility, which had been on the market for

3 years, sold to ColorTree Inc. of Virginia for $3.85 million.

Woodworth Virginia purchased the 55,000-square-foot modern

manufacturing facility from Interflex for $2.7 million.

New Construction

The Richmond industrial market grew slightly with the delivery

of one speculative building. Devon USA, a developer of warehouse,

distribution and light manufacturing facilities in the Mid-Atlantic

area, delivered building E at the Enterchange at Walthall

project. Building E is 262,000 square feet and is a state-of-the-art,

Class A distribution facility that features insulated pre-cast

concrete panels, ESFR (early suppression fast response) “wet”

sprinkler systems, 32-foot clear ceiling heights, numerous

dock doors, and abundant automobile and trailer parking. This

is the fifth building developed to date at the Walthall project

and brings the park to more than 1.4 million square feet of

space. Enterchange at Walthall is located in a green field

Enterprise Zone that provides numerous tax benefits and incentives

to tenants. In addition, this same developer has two other

buildings that are under construction and will be delivered

early this year. These two buildings are being developed at

Enterchange at Northlake in Hanover County, Virginia, and

will contain 508,186 square feet of space. This is extremely

significant as no other developer is currently constructing

speculative warehouse buildings in this market, and Devon’s

two projects will effectively bookend the Richmond area with

two Class A warehouse parks.

Outlook

The fourth quarter absorption made up nearly 75 percent of

all of the recorded absorption for 2004. This indicates that

after a long lull, the market is showing significant signs

of increased activity. Expect 2005 to be more active than

2004 with more leasing activity than Richmond has seen in

several years. With nearly 15 percent of the market vacant

and landlords ready to agree to reasonable terms, the Richmond

industrial market is in a great position to welcome new tenants

and the growth of existing tenants.

— Evan Magrill, CCIM, SIOR, senior vice president,

Thalhimer/Cushman & Wakefield

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|