|

FEATURE ARTICLE, FEBRUARY 2007

SOUTHEAST COMMERCIAL LENDING REPORT

A lender’s perspective of the money markets for some major property types in the Southeast.

OFFICE MARKET

Atlanta and several surrounding Southeastern cities have recently been referred to as development havens. The brisk pace of office development in Atlanta includes 3 million square feet of space delivered last year and 4 million square feet under construction. In a recent inventory conducted by Capmark Finance Inc., office and mixed-use projects under construction in the city’s downtown and midtown, totaled an astounding $4 billion. Additionally, the sale market has had another record-setting year with $3.6 billion in volume. Class A properties are in the $350 to $380 per square foot range, which is remarkable considering that vacancy in most markets is hovering around 15 percent. Buyers are looking at vacant space as an opportunity to increase their yields as rents improve.

In financing office buildings as well as other property types, borrowers have come to expect lenders to be “one stop” shops with the ability to layer or structure debt to meet their leverage or pricing needs.

There are three main types of structured finance: lower-leverage fixed-rate loans, high-leverage bridge loans and the wide world of derivatives.

In today’s office market, lower-leverage fixed-rate loans are an instrument of extreme market efficiency due in large part to a very low default rate. Spreads over a treasury index are tight at 90 to 120 basis points (BPs) with little preference in regards to location, sponsorship or property type, as long as there is a debt-service coverage ratio (DSCR) of 1.20 and a loan-to-value (LTV) below 80 percent. The fun really begins with pricing of loans below 70 percent LTV and more than 1.30 DSCR. Good collateral with acceptable sponsorship will command up to full-term interest-only loans with no funded replacement reserves for tenant improvements or leasing commissions, early repayment at par or a fixed rate and other concessions. A spread in the low 90 BPs range over treasuries is ideal for borrowers. How is this possible? Although lenders will tell you competition has driven profits down, real estate increasingly is seen as a relatively safe asset class with low delinquency and default rates.

High-leverage bridge loans typically are floating-rate loans indexed over the 30-day LIBOR. With today’s LIBOR rate at approximately 75 BPs higher than 10-year treasuries, the flexibility of bridge loans for financing the purchase of under performing or value-added office properties is a saving grace. Due to its short term, bridge loans typically are funded from the lender’s balance sheet or a commercial real estate collateralized debt obligation pool (CDO), an actively managed revolving pool of debt assets. A mixture of CMBS, unsecured REIT debt, whole loans, B-notes and mezzanine debt goes into these often billion dollar plus pools. A CDO functions as a debt mutual fund, allowing investors matched-term funding at a relatively low cost. The benefit to the office buyer is that this instrument offers high-leverage finance at increasingly low pricing with prepayment at minimal fees. Loan pricing spreads have tightened as they follow the CMBS market into the 150 BPs to 250 BPs range. It is important to note that with the right business plan and known sponsorship, bridge loans are underwritten as an “exit” or up to the point in which the property stabilizes. Therefore, leasing commissions, capital improvements and/or debt-service reserves can be structured into the loan amount.

Derivatives are used to bridge the gap between fixed- and floating-rate financing, especially on development projects. With increases of more than 20 percent in office construction costs in the last year due to hurricanes and material shortages, every dollar counts. Derivatives are another name for swaps. The swap market is the result of floating-rate investors trading with fixed-rate investors for liquidity, borrowing cost, inflation expectations or other reasons.

In today’s market, timing, the structure and type of hedge, duration and bid/negotiation all go into tailoring a swap structure that will save rather than cost borrowers money no matter which way the market moves.

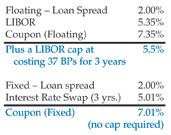

Office developers are looking at the following scenario:

Borrowers can save 34 BPs on rate plus the 37 BPs one-time charge for the LIBOR cap. However, a swap transaction is complicated and has a structure loaded with options. Borrowers who seek out a professional advisor or strategist to receive the maximum benefit from this type of structured finance.

The knowledge and evaluation skills present in an increasingly sophisticated finance market have resulted in more complex financing structures. The growing use of these structures has contributed significant liquidity to the market and helped drive both the office acquisition and development business in the Southeast and throughout the country.

John M. Beam, Jr., is senior vice president – branch manager with the Atlanta office of Capmark Finances.

MULTIFAMILY MARKET

What is happening in the multifamily financial market? In a word, plenty.

While reflecting on 2006 and making plans for 2007, swirling commercial currents make the multifamily market future difficult to predict with any confidence.

The single biggest factor affecting rental properties is the pause in the condominium market. The rapid sale of new condominium offerings has halted and has been replaced with extreme caution on the buyer side as investors have fled the market.

In some regions, the condominium market has negatively affected operating results at existing rental properties. Ft. Myers, Florida, by way of example, has experienced five failed condominium or condo-conversion properties. The owners have decided to rent these properties and are giving significant incentives to potential renters. In order to compete, the rental properties have to meet the market on concession to keep existing tenants and compete for new tenants. This trend from conversion sale property to rental property is just one of many factors changing the face of the market in the Southeast.

Additionally, in Ft. Myers, many of the buyers of successful condominium deals are investors with no plans to occupy the units. They are trying to minimize the negative cash flow by renting the units. The Internet provides a good marketing outlet for condominiums as most new renters shop there first.

In addition, the purchase price of existing rental properties has gone down. At the end of 2005, a condominium converter placed a three-property portfolio in southwest Florida under contract at $140 million. Currently, the market dynamic has changed and the same property is at the $110 million level — a 21 percent drop in value. The proposed buyer plans to hold the property as a rental for the short time, perhaps 2 to 3 years, and then convert the property when the condominium market rebounds.

The second biggest factor in Florida and other coastal markets is the availability and cost of insurance. Horror stories abound that cite 1-year premium increases from 200 to 400 percent. Worse are those cases in which insurance has been impossible for the owner to secure. In addition, many owners are resisting lender requirements for insurance, claiming that the cost of insurance is not a sound economic decision. The dual impact of rising premiums and rising deductibles has created a self-insurance reality, with the exception of total, catastrophic loss.

Lenders and borrowers alike are wrestling with solutions to this impasse. Most are centered on the common approach for earthquake insurance of maximum probable loss. This approach should be effective over time, but is now just in the beginning stages of development. All parties will have to come to the table with reasonable risk management attitudes.

Another factor affecting Southeastern commercial real estate is the excess capital supply in the market for commercial real estate transactions, especially the favored multifamily category. With new CMBS transactions approaching $300 billion in 2006, the old rule of thumb for lenders and borrowers is out the window.

Today we see loan requests for maximum leverage on multifamily acquisitions of 90 to 95 percent. Some borrowers have been successful in investing little to none of their own capital by getting credit for bringing a deal to the table.

Spreads on the first mortgage loan of up to 80 percent of cost are at a spread over treasuries of less than 100. The second mortgage or mezzanine loan for between 80 and 90 percent is 10 to 12 percent. Above 90 percent, capital sources are pricing their capital at 15 to 18 percent.

More significant is the fact that many lenders are underwriting loan amounts to ADS coverage of 1.0 time. Several recent financings have been done with ADS coverage of less than 1.0 times. These loans are structured with interest reserve holdbacks and underwrite immediate increase in net income. There is no room for a hiccup in occupancy or decreasing income on this type of transaction.

Real cap rates today on quality multifamily properties have risen to 5.5 to 6 percent on in-place net income. Real interest rates on “A” loans are in the 5.5 percent range with loan constants at approximately 6.5 percent. This obviously means you cannot get positive leverage on an acquisition unless you are confident in increasing net income in the short term through increasing rents and other income, combined with reducing operating expenses. The aggressive lenders in the market have solved this by offering 10-year, interest-only loans.

Until recently, occupancy and rents have increased, creating a positive environment for owners — the fourth factor affecting the multifamily market. In 2007, it is unclear if this trend will continue or if more markets will soften due to owners dumping failed condo projects into the rental market.

The factors identified above are making affordable housing a bigger issue than ever before. Many markets have 25 to 40 percent of their residents unable to afford decent housing due to affordability. Lower income residents are clamoring for solutions as their housing prospects are diminished. This is not a new issue, but a magnified issue. There is no question political leaders will be forced to bring the markets’ participants to the table with significant incentives for solutions.

The immediate future will be choppy for the multifamily market in 2007 and 2008, especially for markets with significant numbers of condominium units under construction. In Miami, for example, there are more than 22,000 units under construction for delivery in 2007 and 2008. The number of units under construction approximately equals the total number of condominium units absorbed over the past 10 years. The dynamics of the Miami market as a diverse, world showcase is unique, making a confident prediction tough.

This year should prove to be another exciting and challenging year with good opportunities for multifamily professionals who stay in touch with the rapidly changing marketplace. The fundamentals are solid and there continues to be excess capital for both equity and mortgage investments in good multifamily properties and markets.

Larry Silvester is managing director and Paul Ahmed is a director with the Weston, Florida, office of Collateral Real Estate Capital, LLC.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|