|

CITY HIGHLIGHT, FEBRUARY 2007

RICHMOND CITY HIGHLIGHTS

Steven Brincefield, Evan Magrill, Connie Jordan Nielsen

Richmond Multifamily Market

The Richmond multifamily leasing market closed with a strong showing last year. The sale of properties and conversion to condominium units defined most multifamily activity. Although some new development of multifamily units was completed in 2006, new construction was much below the pace of previous years. Now, low interest rates are continuing to push renters into buyers, although the rental market flourished, ending with a strong fourth quarter.

Between October 2005 and December 2006, 16 multifamily properties, representing 3,744 units, were sold. The total sales volume was more than $265 million. Of the multifamily units sold, 566 units were converted to condominiums. The most notable conversion was Locke Lane Apartments, originally constructed in 1935 and consisting of 118 units. The property is located in a fashionable high income area of the West End and represented an ideal condominium conversion opportunity. The property was purchased by Robinson Development for $94,915 per unit. Unit sales range from $165,000 to $500,000. Other multifamily properties that were not sold but converted by their owners to condominiums totaled 602 units last year.

The largest single sale totaled 818 units for nearly $59 million, which involved three properties that were constructed in the mid 1980’s. The properties were purchased by CORE Realty Partners, representing a TIC 1031 Exchange. The largest dollar-per-unit sale was Henrico Doctors Hospital’s $128,205-per-unit purchase of 156 units in the 544-unit Honey Tree Apartments. The hospital will demolish the units to expand it’s current campus. The balance of the property, 388 units, was sold to a Washington D.C.-based company, in a deal negotiated by Cushman & Wakefield, for a reported $88,402 per unit. That buyer intends to spend approximately $5 million renovating the property, which was built in 1980.

Area wide, the Richmond multifamily leasing market surged last year as expected. With very little new development taking place (less than 800 units) existing properties were able to reduce vacancy by 11 percent to an overall average vacancy rate of 5.1 percent. Rents experienced modest increases with few concessions needed. Average square foot rents moved upward approximately 3 percent to approximately $0.84 per square foot, resulting in an average monthly rent of $763 for a two-bedroom unit.

Chesterfield County and the West End of Henrico County account for the majority of new multifamily product that is under 10 years old. These two areas are also the most active in terms of lease activity and have the highest rental rates. Average rents in these two areas are the mid-$800 range and vacancy experience is below 4 percent.

The city of Richmond, located in the center of the market, continues to enjoy a steady pace of multifamily renovation projects. For example, Forest City Residential is in the second phase of the River Lofts at Tobacco Row and the Lucky Strike building in Shockoe Bottom. Renovation movement outward to the fringes of the downtown market includes by Aneka Guna, LLC’s 119-unit Southern Stove building and River City Real Estate’s 95-unit Parachute Factory. Leasing in the downtown area is strong with average rents more than $1.03 per square foot and vacancy rates of near 4 percent

The future of the Richmond multifamily area looks positive as a result of continued economic growth. Expect multifamily occupancy to increase steadily in this. Rent levels will also increase as demand is expected to accelerate absorption of existing units.

— Steven B. Brincefield, CPM, is senior vice president with Richmond, Virginia-based Thalhimer/Cushman & Wakefield Alliance.

Richmond Industrial Market

Higher ceiling heights of 32 feet are the latest trend in Richmond area warehouses as the industrial market takes advantage of a healthy national economy and looks for creative ways to store more goods in each building. The most recent Consumer Price Index (CPI) supports the positive outlook, showing a continued decrease overall of 0.2 percent in the price of fuel, food and cost of labor, according to the U.S. Department of Labor. The Hollingsworth Companies’ SouthPoint Business Park off of Interstate 295 in Prince George County, south of the city, will consist 130,000 square feet with the revised higher ceilings when complete.

There is 60,000 square feet of new flex construction going on at Windsor Business Park in the northeast quadrant near the Parham and I-95 exit by Boston-based General Investment and Development Co. The first tenant is expected to be Simplex Grinnell, which will occupy 18,000 square feet. One exit north, at the Atlee/Elmont exit off of I-95, Curbell Plastics will be the lead tenant at Crescent Business Center, occupying 16,000 square feet when the hybrid flex/bulk distribution building is completed. The size of the building, 57,000 square feet, is in line with other standard flex projects, but Crescent Business Center will include the 24-foot-high ceilings, which is much higher than the standard 16- to 18-foot-high ceilings that are found in most flex buildings.

Most of the industrial development in the Richmond area is taking place in areas with excellent interstate access such as the Enterchange at Northlake Building B, which is being developed by Devon USA, and is located within 1.5 miles of the Lewistown Road exit off of I-95. Creative Office Environments is also building in the Enterchange at Northlake and will use the new 81,000 square feet as its showroom and headquarters when it is complete. It will be relocating from the Laburnum/Route 360 submarket.

Biagi Brothers Inc., recently signed a lease to become the largest tenant in Building D at the Fairgrounds Center on the north side of Richmond, utilizing 81,000 square feet, or half of the available space. Biagi chose this building because of its need for rail access to bring in the beer that it distributes.

Overall, vacancy rates in the Richmond market have risen slightly from a third quarter low of 6.5 percent to an overall vacancy rate of 7.6 percent at the end of last year. Increases were spread evenly across town with the downtown showing an increase in the overall vacancy rate from 2.3 to 3.2 percent from the third to fourth quarter of last year. The southeast quadrant jumped from 6.2 to 8.1 percent in the same time period and the southwest showed a similar trend going from 8.5 to 9.2 percent. The northeast industrial overall vacancy rate went up from 7.5 to 9.8 percent while the northwest showed a more modest increase going from 5.9 to 6.3 percent from third to fourth quarter.

The Airport Industrial submarket is the area to watch in the upcoming year as the availability of land and vacant buildings with easy access to interstate highways will give businesses looking at the Richmond area the immediate opportunity to find a building or site that will allow them to grow and expand.

— Evan Magrill is a senior vice president with Richmond, Virginia-based Thalhimer, a member of the Cushman & Wakefield Alliance.

Richmond Retail Market

The Richmond retail market continues to reflect the high standard of living with easy access to amenities that area residents have come to expect as the gold standard in the southern capital. Lifestyle projects and off-shoot convenience centers feeding off of their bigger neighbors dominate the trends in retail at the start of this year.

A successful example is the Short Pump Town Center, located along West Broad Street in the northwest quadrant, which has already resulted in several nearby off-shoots. For example, the mixed-use West Broad Village, located across West Broad Street at Interstate 64 just east of the Town Center, will have 494,400 square feet of retail space that will showcase the hotly anticipated Whole Foods Market. Also, there will be an adjacent 90,000-square-foot Short Pump Station, anchored by Petco. And Town Center West, located just west of the outdoor mall, will offer a new Hilton Hotel and Ethan Allen showroom. The Corner at Short Pump is anticipated to be delivered in 2008 offering a location immediately adjacent to the Town Center.

|

White Oak Village is the first major retail project along the eastern I-64 corridor in Richmond. National retailers are focusing on East Richmond locations.

|

|

Forest City is trying to duplicate its Short Pump Town Center success by delivering the long-awaited retail footprint in East Richmond. The more than 900,000-square-foot White Oak Village is the first major retail concern along the eastern I-64 corridor and is already inspiring a spike in new rooftops. National retailers are finally focusing on East Richmond locations and will be watching the success of the White Oak project with anticipation for further developments. The overall vacancy rate in the southeast quadrant at of the end of last year was 4.1 percent with rental rates of $8.35 per square foot. In the Northeast submarket, the overall vacancy rate was 6.9 percent with a rental rate of $11.83 per square foot.

The completion of Route 288 in the southwest quadrant, and the spiked increase of cars, has led to multiple new projects along the Midlothian corridor, including Watkins Centre Corporate Park which incorporates the 1 million-square-foot Westchester Commons retail center and 3.2 million square feet of proposed office space. Also, there are additional retail projects underway helping the southwest quadrant grow toward becoming the same powerhouse as the northwest quadrant of Richmond.

The majority of development continues to take place in the Short Pump area due to the success of the Town Center, good traffic counts and better-than-average household incomes, which were measured at $122,000 in 2005. The overall vacancy rate in the northwest submarket for the last quarter of 2006 was 3.8 percent with a rental rate of $17.28. This is compared to the southwest quadrant with an overall vacancy rate of 7.9 percent and a rental rate of $11.34. The downtown retail market, which has also seen some activity, has an overall vacancy rate of 4.4 percent and an average rental rate of $13.64.

Marchetti Properties continues their Richmond development successes with Staples Mill Square in the West End, anchored by a new Target store, and Stonehenge Village, which is located across Midlothian Turnpike from the newly enlarged Wal-Mart SuperCenter. Rebkee, another local developer, has multiple projects around town, including the Shoppes at Westchester, which is part of the 650-acre Watkins Centre Corporate Park. Another Wal-Mart is expected at Hancock Village along Hull Street as well as new Best Buy stores in the Commonwealth Centre and at Bell Creek Commons in Mechanicsville.

— Connie Jordan Nielsen is first vice president with Richmond, Virginia-based Thalhimer.

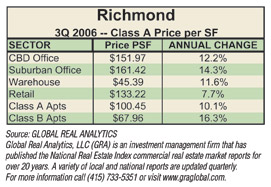

Richmond Office Market

The Richmond economy finished last year on a high note with rosy expectations for this year, encouraging several national corporations to look for larger spaces in the Richmond suburban office market. A trend toward the northwest quadrant with higher-end rooftops, particularly the Innsbrook submarket, left large vacancies in second generation buildings in the southwest quadrant, particularly along the Midlothian corridor. MeadWestvaco moved out of its 108,000-square-foot space in Boulders and into 210,000 square feet on West Broad Street across from Innsbrook Corporate Center. Meanwhile, LandAmerica moved from its 127,000-square-foot space at Gateway I and into a 297,000-square-foot space at Innsbrook. Both of the new locations were properties vacated by Capital One, which is forgoing leasing properties to ownership in West Creek in Goochland County, just west of its old location. The Capital One moves accounted for the up tick in overall vacancy in the Innsbrook market during the third quarter, with a rate of 15.6 percent, which fell back in line by the end of last year with a rate of 10.8 percent. The Midlothian Corridor saw a reverse with a third quarter overall vacancy rate of 11.1 percent, which rose to 20.1 percent by the close of last year. Philip Morris, a long-time giant in the southwest quadrant, also vacated a building at Gateway II and headed for the Innsbrook area. Overall, office vacancy rates for the Richmond suburban market remained relatively unchanged, rising slightly at the end of the year from 8.5 percent in the third quarter to 9 percent at the end of last year.

The inventory of large-block suburban office space has diminished overall in the Richmond office market from 1.7 million square feet in 34 buildings 1 year ago to only 1.3 million square feet in 24 buildings today, with very few remaining sites still available for new construction. Developers who already control sites are now patiently waiting for build-to-suit opportunities or strategically constructing office buildings as the market demands.

One example is Reynolds Crossing, a mixed-use development, located in the northwest quadrant at West Broad Street and Glenside Drive near Interstate 64. It is being built as a joint venture between Reynolds and developer, Ryan Lingerfelt. Original plans called for a 70,000-square-foot spec building, but interest from several businesses, both medical and office, are leading to negotiations that may increase the size of this building substantially.

The new Stony Point Office Park Building IV, being developed by Highwoods Properties across from the Stony Point Fashion Park mall in the southwest quadrant, is following the hot trend as almost all of its 92,000 square feet of office space was snapped up before the spec building was completed. Only 15,000 square feet is still available.

Active developers in the area include: Lingerfelt, who is also developing the Westerre Condominiums at Cox and West Broad streets in the Innsbrook suburbs; Liberty Property Trust, which developed Westerre III; Highwoods Properties, which is developing North Shore Commons B; and Brandywine Realty Trust, which developed 75,000 square feet of Class A office space at Paragon III. Highwoods and Liberty also recently renovated separate second generation buildings to Class A properties in Innsbrook. The Far West End, in particular the Innsbrook submarket, is expected to continue to lead the market well into this year.º

— Mark Douglas is a senior vice president with Richmond, Virginia-based Thalhimer, a member of the Cushman & Wakefield Alliance.

Notable Richmond Industrial Projects & Transactions

With 8 percent vacancy rates for industrial and flex properties in Richmond, institutional and private equity money has stepped up the pace with industrial and flex acquisitions in metro Richmond. The AMF 200,000-square-foot sale of 8080 AMF Drive to an investment group was one of the largest freestanding industrial sales at $21 per square foot. HBO has been named as an interim tenant. First Potomac REIT continued its expansion into the Richmond area with its purchase of more than 1 million square feet of investment properties in Rivers Bend, Northridge and the Chesterfield Business Park Complex. The industrial and flex properties were purchased from Liberty Property Trust and a private investor for $63 per square foot (industrial) and $75 per square foot (flex). Meanwhile, Fawn Inc., and 881 Ind. LLC purchased a large portfolio in the airport area that consists of more than 300,000 square feet for an average price of $58 per square foot.

As for industrial land, a development group headed by Graham & Company purchased 48 acres at Airport Distribution Center on South Laburnum Avenue. The land already has pad-ready sites and the development group will be delivering the first new speculative shell building in more than 7 years in the airport area with a divisible 115,000-square-foot warehouse. A scheduled completion date for this fall is set.

Earl Thompson has assembled several hundred acres off Technology Boulevard in Richmond’s east end near the Interstate 295 Beltway and has plans for an industrial park. USPS is possibly seeking a 50- to 60-acre site at this location to build its own 600,000-square-foot distribution center.

Devon continues its expansion via delivery of a new sub-dividable 136,000-square-foot distribution facility at Northlake. Devon has had some recent success in obtaining substantive leasing at its Enterchange locations both north and south along I-95.

— Dick Porter is president of Richmond-based Porter Realty. |

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|