|

SOUTHEAST SNAPSHOT, FEBRUARY 2009

Columbia Multifamily Market

The 2009 outlook for the Columbia multifamily market started looking grim early in 2008. Although 2,064 new units entered the market last year, construction suffered as demand slowed. The economic downturn reared its ugly head, and the commercial real estate market in Columbia started heading south.

“In the 6 months prior to October, construction starts slowed dramatically to just under 250 units. In comparison, the three time periods prior to that had starts over 1,000 units,” says Jenny Shelden, a multifamily analyst with Charlotte, N.C.-based Real Data.

As with almost every other city in the Southeast, unemployment is a huge trend affecting the multifamily market. “Demand is expected to remain weak as the overall economy weakens and more job losses occur. As more people have difficulty selling their homes, a shadow market will continue to occur, where there are single-family homes competing with apartments for renters,” she says.

Even with the current state of things, there are people still doing deals. Apartments transactions were still moving entering the last quarter of 2008. New construction, while not as healthy as it once was, is limping along slowly. More than 1,000 units are currently under construction, and 3,600 units have been proposed for development. In the Central submarket, more than 500 units are under construction, including Holder Properties’ 400-unit Assembly Station, which is slated for delivery this summer. The firm is also working on Adesso, which will feature 110 condominiums at the intersection of Main and Bloom streets in downtown Columbia. The property will also feature 8,500 square feet of retail space. Two new projects have been proposed in the Lexington submarket totaling more than 600 units, and more than 700 units are on tap for the Northwest submarket.

Even with all this activity on paper, development is as healthy as it seems. “During the next year, it is expected that new supply will slow enough that demand will match or exceed supply in 2009,” Shelden says, making for a slow year in a once stable market.

— Jon Ross

Northeast Submarket Leads the Way

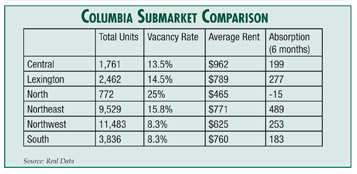

The numbers for Columbia’s Northeast submarket might not look that impressive. Vacancy stands at 15.8 percent, and average rents hover around $770. But during the past 5 years, 2,877 units have been built in the submarket, according to Jenny Shelden of Real Data. “In that time period, there were more than 1,600 proposed, 620 under construction and 420 completed in the Northeast submarket,” she says.

These proposed units are housed in five developments in the submarket. Greenway Development has plans to build the 162-unit Brookside Crossing, and Estates is looking forward to the 200-unit Estates at Roper Pond. Rounding out the development schedule are the 240-unit Greenhill Parish Crossing, the 756-unit Killian Lakes and 275 proposed units at Killians Crossing. Properties under construction include Meridian Housing’s 216-unit Meridian at Heron Lake and Kahn Development’s 160-unit Residence at Sandhill.

Taking into account the current development climate, these numbers qualify the Northeast submarket for hot spot status. |

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|