|

SOUTHEAST SNAPSHOT, FEBRUARY 2009

Birmingham Office Market

In another case of how the economy negatively affects one area while not disrupting another, the Birmingham office market is benefiting from high occupancy rates in the neighborhood of 93 percent while other office markets struggle.

“The office market is very stable in Birmingham,” says Charles Simpson of Birmingham-based Brookmont Realty Group. “The good news is that while the larger tier-one cities’ rates are decreasing, our rates are rising because we have very little supply in our market.” He goes on to say the market currently benefits landlords, with rent increases of 2.5 to 3 percent per year.

But in the current economy, brokers in struggling office markets must be wondering how Birmingham has come out ahead of comparable office arenas. The answer is simple: put off development until it’s absolutely necessary. When the market needs more space, build spec properties, but only at a size that the market can bear.

“We’ve always had a very measured development cycle,” says Bo Grishman, Simpson’s colleague at Brookmont. “We don’t start speculative projects until we’re bursting at the seams. You’ll have a year that will look like an anomaly because you’ll have a lot of delivery all at the same time. It’s not like Nashville or Atlanta or even Charlotte where there’s been an influx of users from the outside. We’re generally very organic.”

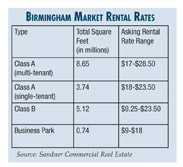

Joe Sandner, IV, of Birmingham-based Sandner Commercial Real Estate has another explanation. “It’s important to note that 2007 was a banner year of activity with approximately 900,000 square feet of positive absorption. So, 2007 was an explosion and 2008 was very quiet,” he says. “The Birmingham occupancy rate stays at a relatively healthy level because most of the office developers are conservative and require 40 to 50 percent pre-leasing. Therefore, Birmingham typically avoids the boom/bust cycle.”

|

When it delivers this fall, The Summit will bring 75,000 square feet of office space to Birmingham. Future tenants will benefit from a beavy of nearby retail options.

|

|

Sandner says only two significant office developments are underway for 2009. One property is anchored by ServisFirst Bank (see sidebar). The other property, The Summit mixed-use development located in the 280 submarket, will open this fall. The project will offer 75,000 square feet of office space along with a variety of retail options.

The recession has laid waist to a number of banks, forcing closures across the country. Birmingham, however, had already experienced its fair share of bank losses and has already seen benefits from the hardship. “The consolidation spawned a handful of start-up banks,” Sandner says. “These banks have largely been unaffected by the subprime mess, since their loan portfolio is new and they have money to lend.” Birmingham may also benefit from Wells Fargo’s acquisition of Wachovia. “Due to Wachovia’s significant existing physical assets, Birmingham could be a great regional headquarters for Wells Fargo,” Sandner says.

Safe development practices have isolated the Birmingham market from a high vacancy rate, but as with any commercial real estate type anywhere across the country, the recession is still very real. Simpson says that three or four spec buildings have been put on hold because of the economy. An excess of sublease space is another negative affect of the economy. “With the tight economy right now, there’s an influx of sublease space that has come onto the market,” Simpson says. “You’ve got companies that are being more cautious; companies that have laid off people that are trying to sublease excess space. You’ve got some companies that have downsized; you’ve got some companies that have closed their offices.”

As long as Birmingham developers maintain the status quo, however, the office market should ride its way through the recession with few economic bruises.

— Jon Ross

Midtown Weathers Economic Pinch

Charles Simpson of Brookmont Realty Group compares the Birmingham Midtown submarket to some of Atlanta’s highly visible office markets.

“It would be the equivalent of Midtown and Buckhead combined in Atlanta,” he says. “You’re convenient to downtown, but you’re also convenient to the perimeter. It’s where most of the CEOs live.” But unlike the Atlanta markets, vacancy rates in Birmingham’s Midtown area are stable. With a third quarter 2008 occupancy of 93 percent, it’s hard to find space for tenants to occupy. And that’s a good thing. “If you’re a tenant at 20,000 feet for example, you’ll have a hard time finding space. You might have two options,” he says. “We’re blessed by the fact that we’re not a development city where we don’t have a lot of spec inventory.”

In June, the market will free up a little with the addition of a 50,000-square-foot building to serve as ServisFirst Bank’s headquarters. The company will occupy most of the property’s first floor. The three-story building still has 12,700 square feet available, a number that the developers would like to see shrink before construction wraps up.

Joe Sandner, IV, of Sandner Commercial Real Estate points out, however, that that demand for office space in the Midtown market will remain high even after this new development. “Despite the economic woes, there is still demand for space in the Midtown market, where Class A occupancy rates have dropped from 99 percent to 98 percent during the year,” he says. The Midtown submarket’s high absorption rates mean Birmingham is well positioned to weather the economic storm. |

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|