|

SOUTHEAST SNAPSHOT, FEBRUARY 2010

Jacksonville Office Market

In an economy that has left large amounts of vacant office space throughout the Southeast, brokers in Jacksonville are having a tough time making small users happy. The bigger companies — those looking for chucks of space spanning between 60,000 square feet to 90,000 square feet — have found a foothold in Jacksonville, but closing deals involving local and regional tenants that require less space is harder.

“There’s a few companies from out of town looking for large chunks of space, and there’s already been a few deals done this year,” says Victor Hughes, managing director of Parkway Realty Services in Jacksonville. “At the smaller deals, there’s not as much velocity.”

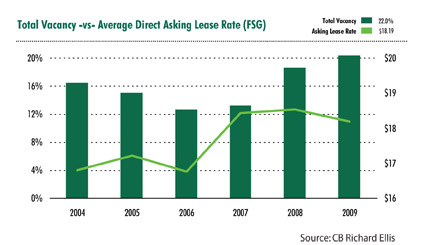

Jacksonville has the space to spare because of the large campuses formerly occupied by Blue Cross/Blue Shield, Merrill Lynch and Bank of America. According to CB Richard Ellis, vacancy during the fourth quarter stood at 22 percent, 3.4 percentage points more than the vacancy total during the fourth quarter of 2008. Hughes says companies looking for space are attracted by Florida’s lack of sales tax and Jacksonville’s good infrastructure. Despite the 8- to 10-point drop in the office vacancy rate Jacksonville has experienced due to the recession, Hughes is hopeful that the city’s history as a financial and healthcare hotspot will help the office sector pull through any hardships.

“Even though we’ve had a tough time, we’ll continue to come back with those sectors,” he says.

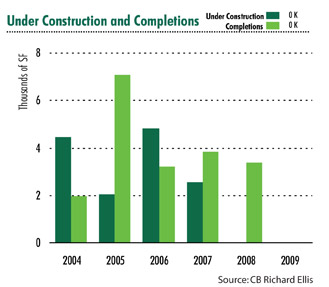

Before companies start expanding, however, the unemployment rate and the city’s general financial outlook has to improve. Hughes characterizes the current corporate marketplace in Jacksonville as “real choppy” and notes that some firms are still shedding workers. On the bright side, developers have stopped pursuing office projects in the area. When firms stop firing employees and tenants large and small once again start to gobble up vacant offices, Jacksonville’s lack of current development will work to their favor. Burning through vacancy might take a while, however; CB Richard Ellis puts the amount of sublease space on the market at 186,576 square feet.

“There’s nothing that’s really going to move the needle one way or the other — maybe a small development, but not much else. We’re just backfilling vacancies,” he says. “All we need is the economy to continue to improve a little bit and businesses starting to hire a little bit and some of this vacancy will burn off.”

— Jon Ross

©2010 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|