|

COVER STORY, JANUARY 2010

FANNIE AND FREDDIE’S NEW LOOK?

Government lenders are poised for a transformation.

Jon Ross

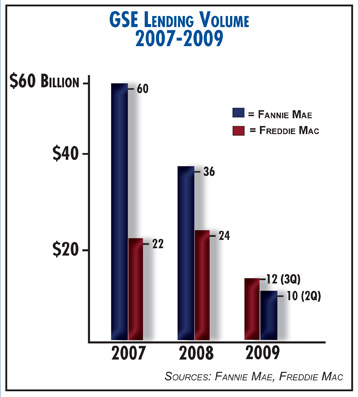

In the multifamily real estate lending environment, Fannie Mae and Freddie Mac shoulder a large burden. Life insurance companies handle close to 20 percent of the money market for apartment complexes and condos, but Fannie and Freddie — two governmental institutions — take the rest of the responsibility.

The balance of power, and the fact that there are only a limited number of lenders in the market, is fundamentally flawed and unsustainable, says Kieran Quinn, vice chairman of Walker & Dunlop. Quinn served as a director of the Mortgage Bankers Association (MBA) until last year, and chaired the organization in 2008. From his position, he’s helped the MBA draft a proposal to reformulate the two government-controlled lenders.

“What we really want is privately chartered companies,” he says.

The MBA proposal goes into detail about the goals Fannie and Freddie should adopt heading into the future. The onus shouldn’t be on two government entities; Quinn would ultimately like to see a handful of private lenders that would focus on the multifamily and single-family markets. “We would like Fannie and Freddie to securitize the overwhelming majority of loans that they’re involved in,” he says. “We also want these mortgage companies to raise capital and have it so that is the first line of defense to any defaults on these securities.” Strong regulation also is part of this process. Quinn envisions guidelines for what kind of loans these new companies can make. He also wants them to stay away from the affordable housing market. “When they try to serve too many masters is when they get into trouble,” he says.

If so many drastic, fundamental changes need to be made to these two companies, why not scrap them and start fresh? Quinn has heard this argument before. He believes Freddie Mac and Fannie Mae finance as many loans as they do for a reason: both entities are very, very good at it. With that in mind, Quinn wants to use as much existing structure as possible when retooling the two organizations. “They have great infrastructure, they have great people, they have great resources, they know how to price these securities, they know how to underwrite these loans,” he says. “We’d like to take advantage of that, that’s why we don’t want to see them taken over by [the U.S. Department of Housing and Development]; we don’t want to see them merge.”

The next step, which is an ongoing process, is lobbying senators, congressmen and employees at the Department of the Treasury and the Federal Deposit Insurance Corporation to try to make this proposal a reality. There are similar ideas floating out there by different organizations — the Center for American Progress wants to create commercial mortage issuers from the two companies, Quinn says, but the two proposals are basically the same; Credit Suisse also has issued a report that mirrors the MBA proposal in some ways. The governmental powers-that-be simply need to sort through all the recommendations before making a final decision.

The federal administration has set a deadline for a new structure. Recommendations will be made in the 2011 U.S. budget, which will be released in February or March of this year. Quinn thinks this timeline is a bit optimistic, when he looks at the government’s docket for the past year and 2010. Healthcare took up most of the previous 6 months, and congress still needs to concentrate on job growth promotion and debt recovery. “People would like to see it reconciled, but we just have too many issues,” Quinn said. “More importantly, the housing recovery won’t be done until we’re into this point in 2010 maybe early 2011.”

Whenever all the various issues are reconciled, Quinn will be there, proposal in hand, lobbying for a better multifamily lending market.

©2010 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|