|

SOUTHEAST SNAPSHOT, JANUARY 2010

Washington, D.C., Office Market

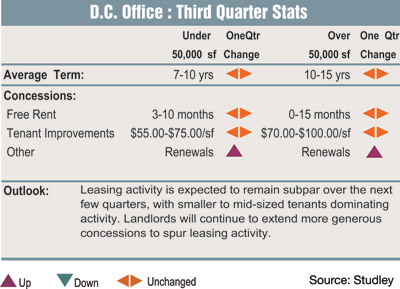

To take measure of the recession’s effect on office transactions in the Washington market, simply watch the city’s tenant base. In a town where the market-wide vacancy rate is 10.8 percent, lessees are being very careful about any real estate moves they make. Tenants who are active are obtaining short-term deals, hoping a brighter day is in the immediate future.

“Getting decisions made takes considerably more time than in years past,” says Wendy Feldman Block of Studley’s Washington office. “Although some people feel that tenants are showing less hesitancy recently than they were 6 months ago, it’s very painful getting decisions made.”

Hesitancy among landlords also is contributing to the city’s transactional slump. These owners are in financial trouble, but tenants are requiring massive tenant improvement packages and free rent before leases are signed. This culture leaves landlords in a bind; they want to get space leased up, but they also have to make money. If tenants were more prevalent, finding other interested parties wouldn’t be a problem, but the tenant pool has become smaller and smaller.

“There are too few tenants for too much space — particularly for those who have requirements that are under 50,000 square feet,” she says.

Another casualty of the recession is the brokerage firm. More established brokers who have built up strong business relationships have been able to hold onto their jobs, but commercial real estate rookies, Feldman Block says, have ended up leaving the real estate business.

“We’re seeing some correction in the rampant growth that we had seen within the brokerage firms, both on the landlord and the tenant side,” she says. “There’s definitely been some reduction within the ranks.”

There are, however, a few new developments in the area. Recent projects include:

• City Center D.C.: This 2.5-million-square-foot mixed-use development is located on the former convention center site. The project calls for more than 1 million square feet of office space.

• Square 54: Boston Properties is constructing 455,800 square feet of office space on the former George Washington University hospital site. Located at 2200 Pennsylvania Ave., the office space is part of an 850,000-square-foot mixed-use project.

• PNC Place: Developed by a joint venture of PNC Bank and Vorando/Charles E. Smith, the bank’s 350,000-square-foot property is being built to LEED Platinum certification.

One major player has been pursuing office space. At what seems, relatively, like a tenacious rate, the Government Services Administration is looking for new offices to house increasing numbers of government workers.

“They’ve done more large transactions than most anybody,” she says. “2009 was the year of big GSA deals. 2010, at least for part of it, is anticipated to continue [that trend].”

Washington office brokers are hoping more tenants follow the GSA’s lead and sign leases for existing office space. Increased activity will decrease the city’s vacancy rate because no new development is planned, and there is a high burden to getting any future developments off the ground.

“It will take a sizeable pre-lease commitment to get a new building built, and it will require larger tenants,” she says. “The lack of funding available to start new projects, we see that continuing for the foreseeable future.”

— Jon Ross

©2010 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|