|

SOUTHEAST SNAPSHOT, JANUARY 2010

Atlanta Multifamily Market

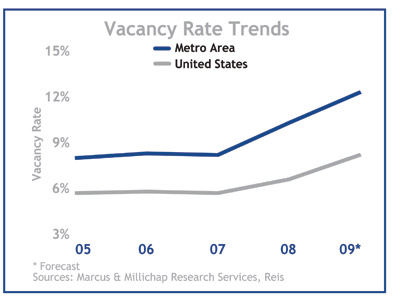

The Atlanta multifamily market has experienced a 200-point jump in its vacancy rate when compared to the fourth quarter of last year. The market-wide total rate is sitting at 12. 5 percent, and the rate for Class B and Class C properties is a few percentage points higher. These numbers are, of course, a function of the recession and the overall lack of job stability in the city. When the jobs return, says Andrew Mays of Marcus & Millichap’s Atlanta office, the vacancy rate will start to recede.

“Unemployment is the main deterrent to multifamily growth,” he says. “It’s such a function of the job market right now, and until we work our way through this, it’s going to take a little while to get that number back in check. Ideally, Atlanta performs much better around the high single digits.”

Increased transactions from high net-worth buyers from South Florida, the Northeast and Chicago, along with the occasional foreign spender, has helped prevent a complete shutdown of the market. Mays says the number of transactions, and interest from international investors, will increase once lenders release more distressed assets onto the market.

“Moving forward, It’s not going to be ‘06 or ‘07 by any stretch, but it will be significantly better than this year,” Mays says. “There’s a ton of capital sitting on the sidelines waiting to jump in.”

Developers in the coming years will start pursuing work more actively. Lending will free up eventually, and demand for new apartment spaces and condominium projects will increase. Mays says he thinks developers in the future will be more conservative about building rampant projects without an adequate amount of demand. Speculative buildings will take a lot to get off the ground because memories of a crippling recession will change the way developments are built.

“It’s definitely going to hold people in check as far as the developing boom that we lived through in the last several years,” Mays says. “That, obviously, is going to take its toll, and that will put some fear into people.” But real estate is cyclical, and unspoken real estate rules prevalent in recessionary times are likely to be broken once money starts flowing. As Mays says, “It’s amazing that once things start going again, people have a short-term memory.”

— Jon Ross

©2010 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|