|

CITY HIGHLIGHT, JULY 2005

BALTIMORE DEVELOPMENT IN FULL SWING

|

The three-story retail component of Lockwood Place in Baltimore City now is attracting big boxes that previously passed on the downtown area; this trend is taking place in retail developments all over the city as the market is improving rapidly. In addition, two large leases have been executed within the office component of the project.

|

|

Across the board, Baltimore’s real estate development is growing. Office rental and vacancy rates are stabilizing, retail development is flourishing and demand for industrial projects continues to increase speculative development. Overall, the city is seeing a surge of positive factors beginning to affect its various markets.

Office

Our recent survey of the Class A market in Baltimore’s central business district included 30 buildings totaling more than 8 million square feet. Direct vacancies of approximately 1.1 million square feet combined with subleases nearing 200,000 square feet of space have effected a vacancy rate of 17 percent, representing a 2 percent increase in occupancy since this time last year.

Most, if not all, buildings are still offering incentives such as lease buyouts, free rent (1 month for each year) or broker incentives of up to 1.5 percent per square foot. Overall, this allows for lower rents and stronger rent rolls.

Currently, the most visible projects include:

• Lockwood Place at 500 Pratt Street: Two large leases totaling approximately 120,000 square feet successfully have been negotiated at Trammell Crow Company’s 12-story, 271,000-square-foot office tower. Both tenants will relocate from existing buildings in the CBD and will have little effect on net absorption.

• 750 E. Pratt Street: Constellation/ Whiting Turner is constructing a 338,000-square-foot office/retail complex, which has Constellation Energy occupying approximately 67,000 square feet as its lead tenant. Additionally, the building is in negotiations with at least one tenant — currently in the CBD — to relocate approximately 70,000 square feet. Word is that this project was able to negotiate rates starting in the high $20s per square foot.

• Developer Ed Hale is well underway with Canton Crossing Tower, located at 1501 S. Clinton Street. This 510,000-square-foot mixed-use project pushes the eastern boundary of new development; it offers approximately 230,000 square feet of office product.

Although the 1980s vintage office product still struggles to find an identity and finds itself often in a bidding war, rental rates have remained fairly stable over the last 24 months. Previously, we saw a rate reduction of approximately 10 percent. The recent decline in vacancy may signal the resurgence of activity we have anticipated for the last 18 months.

Hopefully, as the newer product tightens and activity maintains current levels, we will see a continuation of stabilization in the rates; however, it is much too early for any talk of increase in the rates. Keeping with the current trend, rising rates may be a talking point for next year’s piece.

— Vince Brocato, senior sales and leasing associate, Manekin, LLC

Retail

En fuego! This stolen catch phrase from ESPN’s Stuart Scott best illustrates the retail climate in the Baltimore market. Historically viewed as the no-growth stepchild of Washington, D.C., Baltimore has emerged from the shadows into the forefront of national retailers’ expansion programs. As in other mature markets, scarcity of raw land and restrictive zoning compel both retailers and developers to be more creative in their respective approaches.

Over the past three decades, the common sentiment among retailers was to avoid “desolate” downtown; however, this attitude is deteriorating rapidly. The Streetscape Initiative, enhancing a shopper-friendly atmosphere with larger sidewalks and attractive storefronts, is underway with more than $10 million invested by quasi-public partnerships. A surge of residential development, both renovations of early 20th century row homes as well as new construction such as the Ritz Carlton Condominiums, is piquing the interest of merchants. Trendy Los Angeles-based American Apparel will open in Federal Hill this summer; Starbucks is opening its first drive-thru at Can Company, a Struever Bros. Eccles & Rouse development; Ruth’s Chris Steak House is opening its second downtown restaurant; and The Capital Grille has executed a lease at David S. Brown’s Lockwood Place. In addition, the joint venture between Finmarc Management and Kodiak Properties at Port Covington is attracting big box hard and soft goods retailers that previously passed on downtown Baltimore. This, too, is the case at the abovementioned Lockwood Place, a three-story retail project located across the street from the National Aquarium.

Although retailers have a healthy appetite for more stores in suburban Baltimore, limited retail zoned land has resulted in ingenuity, experimentation and compromise by all. On Reisterstown Road, Target purchased a motel, razed the existing structure and erected a parking deck in order to provide its customers adequate parking while maintaining its prototypical store size. As an alternative to primary retail roads, retailers such as Outback Steakhouse and Bone Fish Grill have opened restaurants on secondary, “connector” streets such as Owings Mills Boulevard.

The relentless demand for quality small shop space continues as new concepts enter the market and robust expansion strategies of existing retailers progress. Rental rates in the affluent suburb of Towson have increased by more than 50 percent with vacancy holding steadily under 2 percent over the past 5 years. Anthropologie made its Baltimore debut at Towson Town Mall this past winter and Pei Wei Asian Diner will open its first East Coast restaurant at the redevelopment of 6300 York Road.

One cannot converse about retail in the 21st century without the word lifestyle. Well, lifestyle has arrived in Baltimore. Quarry Lake at Greenspring is currently under construction on a 242-acre property with 107,000 square feet of retail, 287,500 square feet of first-class office, 510 multifamily and 83 single-family residences, all surrounding a 40-acre lake. Greenberg Commercial’s Hunt Valley Towne Centre, a redevelopment of an obsolete mall, has attracted tenants such as Coldwater Creek and Ann Taylor Loft as well as Baltimore’s first Wegmans Food Market scheduled to open in October.

Together with the Orioles, Baltimore retail is in full swing and we are optimistic this is just the beginning.

— Geoffrey Laurence Mackler, H&R Retail, Inc.

Industrial

The second half of 2005 should result in steady leasing activity of the industrial market in greater Baltimore (Baltimore City and five surrounding counties). Direct vacancy dropped from 10.58 percent (fourth quarter 2004) to 10.33 percent (first quarter 2005). Vacancy with sublet decreased from 11.53 percent (fourth quarter 2004) to 11.18 percent (first quarter 2005). While average asking rental rates increased for flex product ($10.04 per square foot), bulk warehouse product decreased slightly to $4.58 per square foot. The overall direct vacancy rate for the industrial market was down in the first quarter; however, most significant was the overall flex market, where direct vacancy was reduced by almost 1 percentage point.

Industrial construction continues to increase; at the start of 2005, there was 2.6 million square feet underway in the greater Baltimore region. Along Interstate 95 in the Baltimore-Washington Corridor, the majority of the new construction is being built because of its proximity to the Port of Baltimore and BWI Airport. Baltimore Crossroads @ 95 is a 1,000-acre development in northeastern Baltimore County expected to generate at least 10,000 new jobs upon completion. Somerset Construction Company of Bethesda and its partner, MIE Properties Inc., will build up to 2.5 million square feet of office space, while First Industrial Realty Trust will build 2.5 million square feet of manufacturing and industrial complexes. Construction is expected to begin in late 2005 once the extension of Route 43 is complete. The developers expect to attract pharmaceutical, biotechnology and technology companies to this space.

Increased demand in the Baltimore-Washington Corridor submarket continues to fuel speculative construction. A prime example of this is the Patapsco Valley Business Park, where Lincoln Property Group is planning to construct bulk warehouse product; Merritt will build flex space and Liberty Property Trust and Seefried Properties have plans for a mix of office/warehouse and bulk space. However, due to the high cost of land in the Baltimore-Washington Corridor, some institutional developers are choosing to move north to Harford County. Traditionally this area was a build-to-suit submarket, but the affordable land has made it much more attractive to developers.

Noteworthy projects include

• Preston Partners and Urdang’s redevelopment the 800,000-square-foot former GE Appliance Distribution Center at 4608 Appliance Drive in Harford County.

• Preston Partners currently has two warehouse buildings under construction totaling 585,403 square feet, with another 500,000 square feet planned in the new Preston Gateway Corporate Park on Dorsey Road in Anne Arundel County.

• 621,000 square feet at 7001 Quad Avenue in Baltimore County transferred ownership from Trammel Crow Company to RREEF.

— Daniel Hudak, senior vice president/principal – industrial services group; Toby Mink, sales & leasing associate – industrial services group; and Bradley Cole, vice president – industrial services group, MacKenzie Cushman & Wakefield Alliance

Office Investments

|

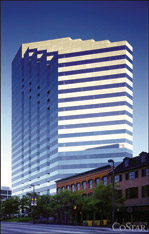

Behringer Harvard recently acquired 250 W. Pratt Street in Baltimore.

Source: CoStar Group, Inc.

|

|

The mantra of buy low, sell high in Baltimore means buy high, sell higher. Case in point: The PHH Headquarter’s sale at the Highlands Corporate Campus. Located in Sparks, Maryland, this 220,000-square-foot office building sold for $42 million in March of 2004 and again in October for $44.3 million. The cap rate for the sales are reported to be in the mid- to high 7 percent range. Baltimore’s recent home run CBD sale was Boston Properties’ conveyance of 100 E. Pratt Street to Atlanta-based Wells Real Estate Investment Trust for a reported $207.5 million ($316 per square foot) in May. This comes shortly after Dallas-based Behringer Harvard’s purchase of 250 W. Pratt Street for $51.8 million ($140.85 per square foot) in December 2004 and Norfolk-based Harbor Group International’s purchase of The Mercantile Bank Building for $51.25 million ($126.85 per square foot). Prior to the Wells purchase, Baltimore’s high bar was Amstar’s sale of 300 E. Lombard for $40 million ($172 per square foot). In Baltimore, quality income streams coupled with a quality asset result in record or eye-catching prices.

|

In May, Boston Properties sold 100 E. Pratt Street in Baltimore’s CBD to Wells Real Estate Investment Trust for $207.5 million. Source: CoStar Group, Inc.

|

|

The institutional investment scene is not alone. For opportunistic purchases, consider the November 2004 sale of 4 Park Center Court in Owings Mills for $3.55 million. Vacant, in a soft leasing market and at more than $136 per square foot, many contend that low interest rates or 1031 exchanges continue to drive prices. I agree, and also would note Baltimore’s burgeoning condo market. Now converted, 4 Park Center Court condo units mostly are sold at $200 per square foot to small business owners staking their piece of the pie. Further solidifying the condo craze is Greenebaum and Rose Associates’ mixed-use community called Maple Lawn. In this 600-acre live/work/play community, one office building out of many is slated to be a condominium with an asking price of $250 to $275 per square foot.

— Alan Grace, principal, MDRE Equities LLC in Baltimore |

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|