|

CITY HIGHLIGHT, JUNE 2007

CHARLOTTE CITY HIGHLIGHTS

N.J. Godbold, Engle Addington and David A. Dorsch

Charlotte Industrial Market

Dynamic growth in population and jobs continues to drive demand for industrial space in the Charlotte region. The 13-county Charlotte MSA grew almost 20 percent from 2000 to 2006 and is projected to grow by an impressive 50 percent in the next 10 years.

Increasing demand for industrial space is evidenced by the absorption of more than 4.8 million square feet during the past 4 quarters in Charlotte’s nine-county industrial market. On the supply side, more than 1.7 million square feet of new product was delivered in the past year, including about 530,000 square feet during the first quarter. There remains an ample supply of quality space for growth and new market entries, with a vacancy rate of about 11.4 percent at the end of the first quarter of 2007.

Recent deliveries include:

Northpark XVIII in north Mecklenburg County – a 110,400-square-foot facility with a 24-foot clear height developed by Childress Klein was completed in the first quarter and remains vacant, with quoted rents at $4.25 per square foot.

Shopton Ridge in southwest Charlotte – two buildings, totaling 272,000 square feet with 30’ clear heights. These buildings were completed by American Asset Corporation last August and remain vacant in search of rents from $3.75 to $4 per square foot. Merriman Schmitt Architects, Inc., was the architect. The developer also developed a 102,000-square-foot flex building with 18-foot clear heights at the same location and has attained 100 percent occupancy since completion in January with rents of $7 to $8 per square foot.

Versus Partners will deliver Gateway Distribution Center Building #1 within weeks of this writing. The 168,000-square-foot – 30-foot clear height building was designed by RBA Group of Charlotte and is quoted at $3.85 per square foot. Leasing agent Lawrence Shaw of Clarus Properties, Inc., reports “spotty” activity and no signed leases to date. Building #2, planned for 130,000 square feet will start once leasing picks up on Building #1.

Also nearing completion is the 180,000-square-foot Building 1 of Perimeter West near Charlotte Douglas International Airport. This 30-foot clear building is being developed by Lord Baltimore Properties. Their park will accommodate 442,000 square feet of industrial space. Rental rates are quoted at $3.95 per square foot.

Industrial firms locating in the Charlotte market will enjoy improving infrastructure, including progress toward completion of the 63-mile I-485 loop with a new interchange providing direct airport access. Improvements continue at Charlotte Douglas International Airport. Construction began in March on a third parallel runway and planning is moving forward on an airport-owned intermodal facility that will lie adjacent to the new runway. Funding for the intermodal facility is still in progress but basic groundwork is being accomplished during new runway construction. A new interchange will provide direct airport access from I-485.

Charlotte offers ample industrial space and existing industrial parks are able to accommodate continued growth in supply. Rental rates remain attractive in comparison to primary markets across the nation. As the Charlotte market continues to grow, however, the availability of industrial land is dwindling. In Mecklenburg County, hub of the Charlotte region, land is typically priced at $80,000 to $100,000 per acre, while industrial land in the outlying counties can still be secured at much lower prices.

— N. J. Godbold is president of Charlotte, N.C.–based Percival McGuire Commercial Real Estate Brokerage, LLC.

Charlotte Multifamily Market

Apartment development in the Charlotte area has reached an all-time high. Developers have grown more confident in the apartment market based on rising occupancy rates, rising rental rates, population growth and strong employment growth. Two years ago average occupancy rates were below 90 percent, but now the average is nearly 93 percent. Newer communities, excluding those in lease-up, have average occupancy rates approaching 95 percent. Same-store rents have increased more than 8 percent since February 2005. Moreover, the Charlotte MSA has gained more than 56,000 jobs during the same time period.

Developers in Charlotte are currently planning a record number of new apartments throughout the region at nearly 13,000 units. More than 2,000 of these units are planned along the South Corridor’s light rail line, which is scheduled to open this fall. The light rail line is projected to provide transportation to more than 18,000 riders daily by 2025. The largest of these projects along the light rail line is Crescent Resources’ C. C, which is located at South Boulevard and Bland Street, will include 361 apartments as well as shops and restaurants. Crescent plans to begin construction on this project in August. The Hanover Company is planning to begin work this summer on 310 ultra high-end units at 101 Tremont. The 11-story, $75 million residential tower will feature a rooftop pool, 10-foot ceilings and floor-to-ceiling glass. The units will average 1,165 square feet and rent for about $2 per square foot.

Meanwhile, there are more than 3,000 new units currently under construction throughout Charlotte. The majority of these units are located in southwest Charlotte along Highway 49. Colonial Properties Trust is building 368 units at Colonial Grand at Ayrsley. The community is located within walking distance of restaurants, entertainment, shopping and businesses. Biltmark Builders is wrapping up construction on Phase I of 216 units at Magnolia Station, which is located at Highway 49 and Steele Creek Road. Magnolia Station offers one- to four-bedroom floorplans with rents ranging from $619 to $1,249.

Average rental rates in Charlotte range from $627 for a one-bedroom unit to $875 for a three-bedroom unit with the total average being $712. Downtown is the most expensive with an overall average of $1,133 per month.

The forecast for the upcoming year is bright for the Charlotte apartment market. Occupancies should hold between 93 and 94 percent. Rental rates should continue to rise as the use of concessions decrease and as newer Class A units come online this spring and summer.

— Engle Addington is a multifamily analyst with Charlotte, N.C.-based Real Data.

Charlotte Office Market

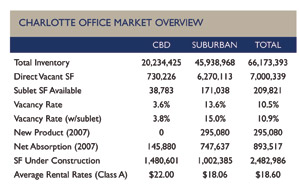

The suburbs aren’t just for residential development anymore. In Charlotte, the majority of office space absorption is taking place in its suburbs as Class A submarkets like Ballantyne, South Park, Airport and I-77 North are absorbed at a rapid pace due to the lack of space in downtown Charlotte. At the beginning of this year, with vacancy at 14 percent, the absorption trend of 747,637 square feet shows a healthy future, especially for Class A suburban office buildings like the recently leased 125,000-square-foot Crawford Building in the Ballantyne submarket.

The downtown Charlotte office market has responded through the upcoming development of the NASCAR Hall of Fame, the EpiCentre complex, the Ritz Carlton hotel and a new Trump hotel. The NASCAR Hall of Fame, which will hit the market in 2009, will add 2,200 residential units and 2.5 million square feet of office space. With downtown’s vacancy dropping for the eighth consecutive quarter and speculative Class A office space coming online in the future, downtown landlords will experience strong leasing activity for many years.

The largest downtown transaction in the first quarter came in January when the BB&T Center changed hands at 200 S. College St. for $117 million as CIM Group, with offices in San Francisco and Los Angeles, purchased the office property. Meanwhile, Childress Klein has begun construction on the 1.4 million-square-foot 1st St. Wachovia Cultural Campus in the first quarter.

With half of Charlotte’s 66 million-square-foot office market listed as Class A buildings, the city is always in the market for high-class tenants. Some of the new leases in the first quarter included New Dominion Bank signing on for 28,000 square feet at Metropolitan in the Midtown submarket; The Regus Group signing a 20,200-square-foot lease at 301 McCullough Dr. in the University submarket; Arcadis signing on for 19,835 square feet at First Citizens Bank Plaza in the Downtown submarket; and Wray Ward Laeseter taking 16,888 square feet of space at 900 Baxter St. in the Midtown submarket.

With so much action in Charlotte’s office market, the citywide average asking rental rate rose in the first quarter by 1.2 percent to $18.60 per square foot, with Class A rent at $20.63 per square foot and Class B rent at $16.80 per square foot.

A steady transaction pace and limited space options in downtown Charlotte are creating favorable market conditions for landlords in downtown and in suburban Charlotte.

“Downtown is a landlord’s market for the next 2 years,” says David Dorsch, vice president and principal with Colliers Pinkard in Charlotte. “So, the suburban Class A submarkets will see the action.” And those Class A suburban submarkets will be witness to tightening conditions for tenants as they will experience the majority of construction; the vacancy rates will drop; and the rents will rise.

— Daniel Beaird

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|