|

CITY HIGHLIGHT, JUNE 2007

MIAMI CITY HIGHLIGHTS

Kenneth Krasnow, Ken Morris, Josh Rodstein and Brian Smith

Miami Multifamily Market

Nation leading employment growth coupled with diminished rental inventory due to condo conversion have resulted in a robust improvement of the fundamentals in Miami-Dade County during 2006. In 2006, Miami experienced strong sales, rent growth, population and employment growth and once again negative absorption. During 2005, Miami’s transaction volume of apartment communities with 150 units or more neared $1.05 billion. As of last December, transaction volume surpassed $1.24 billion, resulting in an average price per unit of $151,150, an increase of 20 percent from the previous year.

Due to continued interest from foreign investors, minimal apartment deliveries and high barrier to entry for new rental competition, Miami has managed to maintain the highest occupancy in South Florida and the fourth highest occupancy rate in the country of 97.6 percent. Furthermore, Miami increased rents 4.5 percent to the states highest per foot rents of $1.15.

Apartment deliveries in Miami-Dade totaled only 1,000 units in 2006, representing a 46 percent decline from 2005 and a 50 percent drop from the 2001-2005 average. Rental deliveries in 2007 are projected to only be 557 units in two projects, one a 431-unit mid-rise development while the other a 126-unit tax credit complex. The drop in new deliveries, combined with more than 30,000 units converted to condominiums since 2002, create a positive environment for existing multifamily properties.

Condominium conversions removed more than 30,000 units from the apartment supply since 2002. In 2006, 11 properties totaling 3,715 units were purchased for conversion. Thus showing a decrease in more than 50 percent fewer units converted than in 2005, converters and speculators have almost entirely left the market, leaving most buyers focusing on cash flow from rental operations.

The downtown areas of Miami as well as the Doral submarket have gained lots of attention from developers. Companies from around the world, especially from Latin America, have established corporate headquarters in the downtown Miami MSA especially the Brickell area, as well as Doral submarket.

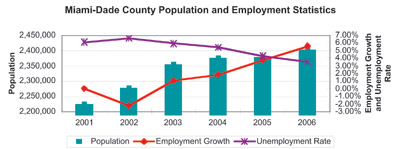

Population and employment growth in Miami is among the highest in the state. During 2006, Miami-Dade County added nearly 60,000 jobs, the highest in the state while maintaining an unemployment rate of 3.5 percent, just above the state average, and well below the national average of 4.5 percent.

— Kenneth M. Krasnow is chief operating officer in the Boca Raton, Florida, office of Apartment Realty Advisors.

Miami Office Market

At present, the Miami Office market is maintaining near historically low vacancy factors across most submarkets. At present the overall vacancy factor for Class A office space in Miami-Dade County is 9 percent with an additional 1 percent available for sublet space, average triple net rents are in the $21 per square foot range. Class B office space has a similar vacancy factor in the 11 percent range; average triple net rents are in the $16 per square foot range. A recent trend in the market is an increase of sublet space available in most every submarket.

The buzzword in development today is “green.” In the Miami area, several developers are working on new LEED (Leadership in Energy & Environmental Design), “green” office building projects including the new Brickell Financial Centre, in which construction began in April at 600 Brickell Avenue in the Downtown Miami, in the Brickell submarket. The building will consist of 40 stories and 600,000 square feet and the developer is the Foram Group. Liberty Property Trust is developing several buildings in South Florida that will be LEED certified including the Boca Colonnade in Boca Raton and the Monarch Corporate Center in Miramar, which is located in the southwest Broward office submarket. Also in Miami is the “Miami Green” building development by William Holly of Holly Development, which is slated for completion in the third quarter of 2008. It will be a 120,000-square-foot, 12-story building that is designed to take advantage of using natural light by its L shaped design. Developer Armando Codina is in the finishing stages of a new 251,000-square-foot office building in Coral Gables, of which Bacardi USA will be taking up 230,000 square feet for its new corporate headquarters in the building when it’s completed later this year.

The majority of new development in the Miami area continues to be residential condominiums but that market has cooled off significantly forcing developers to reconsider the type of project. Most office development is taking place in the Brickell/Downtown and Coral Gables submarkets due to demand from tenants seeking to be located in those specific areas. High land and construction costs continue to be prime factors in whether a project will be viable or not and both remain very high in Miami. Overall, new office development is not going to be an issue in office vacancy rates – a generally slowing economy and lower employment figures are driving the market at present. The high costs of real estate taxes and insurance will likely be a factor in dampening demand for office space.

Overall, office leasing velocity has slowed down considerably across the South Florida office market with the majority of leases signed in the previous quarter well under 10,000 square feet on average. Institutional money is the driving force behind most building acquisitions with average cap rates for multi-tenanted Class A buildings remaining well below 7 percent on average. The demand for product from institutional and foreign investors will likely keep cap rates low for the near term.

The office condominium market, which has been a prime factor during the past several years in the Miami/South Florida office development, has cooled off with several projects that were either slated for development cancelled, or conversion projects reverting back to a rental property.

The Miami area office market will continue to enjoy higher occupancy factors for some time to come due to the fact that land remains scarce (and expensive) and construction costs remain high which provide formidable barriers to new buildings to be developed. The trend of mixed use properties (i.e., those with a residential and/or hotel component) will be more of the norm in future office development in this area.

— Ken Morris, SIOR, is president of Plantation, Florida-based Morris Southeast Group/CORFAC International.

Miami Retail Market

The Miami retail real estate market is hot. Land prices, rents and values are rising dramatically due to limited supply, few new projects and a land shortage.

The lack of developable land for traditional horizontal development has given rise to the need to go vertical with mixed-use projects in the central core. From Brickell Avenue to Little Havana, to downtown Miami, and up through Midtown Miami, most new retail space being developed will be vertical, mixed-use. The Midtown Miami project, developed by Developers Diversified, is a prime example of a multi-layered retail project in a planned residential and office environment. In the Brickell area, Mary Brickell Village is opening soon with a multi-level retail environment in a residential and office environment. Land values in these areas have risen dramatically because of the densities permitted on these high-rise parcels, with asking prices now above $150 per square foot. The demand for retail space by big and medium box retailers in these areas is strong, but their standard single story concept will not make economic sense.

The rents in these areas are rising and will average more than $40 per square foot on a triple net basis. In certain well located projects, the rents will be as much as $60 per square foot. In the other major retailing hubs, East Kendall/Dadeland, West Kendall, Doral, Aventura, and Miami Lakes, occupancies are all strong with rents for new projects now above $40 per square foot. In East Kendall/Dadeland, the Downtown Dadeland project has started delivering space to retailers with rents now quoted from $55 to $60 per square foot. In the South Dixie Highway corridor of Pinecrest, the rents are currently ranging from $30 to $50 per square foot. In West Kendall, joint venture partners Woolbright and Masters Development’s projects of London Square and Kendall at 137 Avenue are leasing space from $40 to $45 per square foot. In Aventura, Doral and Miami Lakes, the retail rental rates are the same as West Kendall for well located projects.

Well located out parcel prices are exceeding $50 per square foot in these same areas and in certain critical intersections or corridors, prices are approaching $150 per square foot. In all areas, demand for retail land is at an historic high.

The Campbell Drive/Turnpike market has been driven by the new single family housing built during the last 3 years and the opening of the new Baptist Hospital – Homestead campus. There are six major retail projects planned or under construction in the area. Oasis Plaza, anchored by Publix, is being completed and Crystal Lakes, anchored by Navarro’s Drug Store, is under construction. Developer’s Diversified’s proposed 300,000-square-foot retail anchored project at the northwest corner of Campbell Drive and the Turnpike should be approved and under construction in 2008. Prime Builders project on the southwest corner of this same intersection has been completed with a movie theatre and Chili’s anchoring the project. Rents for these projects are in excess of $35 per square foot.

— Josh Rodstein is a principal with NAI Miami.

Miami Industrial Market

If one word could be used to summarize the Miami Dade County industrial real estate market it would have to be tight. Tight for a few reasons. First, the availability of Class A industrial space is at an all time low. Rents are at an all time high. Sales prices continue to climb in all sub-markets and cap rates for investment properties are also very low and continue to compress. These factors all affect the market and the various players within each category.

First, tenants throughout Dade County have seen their rents spike. Their overall rates have increased due to the landlord’s increased operating cost as well as increased demand for their space. Further compounding this is the recent sales activity of warehouse space in South Florida. Increased prices owners pay for industrial assets translates to an eventual increase in rental rates, usually sooner than later. Miami is on the radar screen among major institutional investors. Their return criteria is typically far less aggressive than individual owners. This has pushed pricing up and increased competition for assets. What was undesirable to an institutional investor 5 years ago is gold today. There does not seem to be any end to the shortage of space anytime soon. Demand continues to be strong and inventories of available space are continuing to dwindle, even as rental rates hit new highs every quarter. There is very little land left so all indications are that we will continue to see increased rental rates and low vacancies throughout Miami Dade County.

Next, private owners are having trouble making sense of holding their industrial assets. Whether they are owner/users or private investors they all face the same question, sell now and take my profits or will the market continue to increase? Take the money and go lease or hold on for a bigger payday down the road? This is a question many owner/users are asking us. There is no perfect answer. It really depends on each individual’s needs. One thing to consider first and foremost is are there any suitable spaces on the market that you can rent? The market is extremely tight and finding a viable building to rent is no easy task. Those looking to purchase a property are faced with the challenge of first finding a building then getting over the sticker shock of what it costs to carry it. Insurance and property taxes as we all know have taken the fun out of owning property for many local investors.

Finally, the institutional owners, those large funds that purchase property throughout the country, have largely changed the landscape of the Miami industrial market. They have purchased large amounts of space during the past 3 years. Both multi-tenanted investment portfolios as well as free-standing bulk distribution centers are highly sought after. It seems most building types are in play among the large investors. Most of the largest industrial landlords throughout the U.S. have holdings in Miami-Dade County. They continue to purchase properties that in the past would have sold to owner/users. This consolidation has had a ripple effect. It has increased values, raised rents and depleted available property inventories for owner/users. This trend will continue for the foreseeable future. Larger owners will continue to grow their portfolios slowly but surely decreasing the market share of the private investor.

— Brian Smith is senior director, industrial brokerage services with Cushman & Wakefield of Florida in Miami.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|