|

SOUTHEAST SNAPSHOT, JUNE 2009

Tampa Office Market Q&A

Southeast Real Estate Business: What is the current state of the Tampa office market.

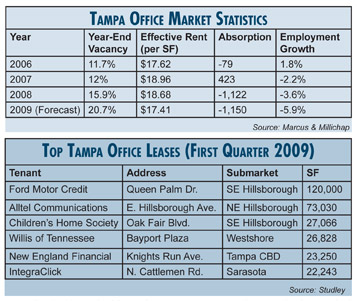

Randy Smith, GVA Advantis: Tampa’s office market had a strong run beginning in 2004 and lasting until the final quarter of 2007. During this period, the market recorded about 4 million square feet of net absorption; 1.3 million square feet of new office deliveries were added to the inventory. After this point, activity in the Tampa market slowed as recessionary forces kicked in.

Tampa’s significant exposure to the residential housing slide was a major factor in the market slowdown. Office demand began to wilt with the downsizing of an increasingly wide range of office users, starting with home builders and the finance companies.

During the past 12 months, a small surge in late-to-market new office construction added 1.2 million square feet of speculative office space in Tampa. This surplus inventory, in combination with declining demand, pushed Tampa’s direct vacancy rate to 17.2 percent by the end of the first quarter this year. For the same period last year, this vacancy metric registered 13.1 percent. Sublease space has also been on the rise over the past year, especially for Tampa’s Class A properties where it accounts for 2.7 percent of inventory.

In this economic environment, credit-worthy tenants are prized by landlords and have tremendous clout in lease negotiations. Many tenants in this category have seized the opportunity to upgrade into fresh office space. The migration from Class B to Class A buildings has been evident in the Tampa market.

SERB: What are some of the largest challenges facing developers and tenants in the current market?

Randy Smith: One major challenge for tenants now stems from the uncertain economy and the difficulty of projecting future needs. Despite the lucrative incentives available to tenants in the market, the current preference for many companies is to stay put. Renewals and shorter-term commitments have been prevalent among Tampa’s office tenants in 2009. Also, tenants have become more cognizant of the financial strength of their landlord or sublandlord — a default or bankruptcy by either could result in major headaches and additional costs for the tenant.

For developers, finding adequate funding at reasonable terms is probably the major hurdle right now. Lenders are significantly more risk averse when compared to a few years ago — equity requirements are much higher. In most cases, the developer faces the monumental task of trying to attract investor capital with suitable terms while adhering to the stringent underwriting standards imposed by the lender. Build-to-suits or pre-leased projects to credit tenants are the only office projects moving forward in the Tampa market.

SERB: What recent transactions have impacted the market?

Randy Smith: The $20.1 million sale of the Westshore 500 office building closed this past February and was notable, first for just getting to the finish line in a difficult investment sales environment. Secondly, it provided at least a fleeting benchmark for Class A properties in the Tampa market. It sold for $155 per square foot and at a reported cap rate of 7.5 percent.

SERB: Are there any major projects that have been recently completed or are in the pipeline?

Randy Smith: This past January, MetLife completed the first office building in its MetWest International mixed-use development in Westshore. This 250,000-square-foot LEED-certified building was part of the first phase of this 32-acre development.

The phosphate giant Mosaic broke ground in March on its new $20 million office headquarters. The 110,000-square-foot green building will open in the spring of 2010 with 400 employees. This March also marked the completion of the 100,000-square-foot office and laboratory facility for M2Gen, a collaboration between Moffitt Cancer Center & Research Institute and pharmaceutical giant Merck & Co.

In May, IKEA opened a new 353,000-square-foot store in Tampa. Initially it will employ about 400 workers. The project broke ground in June 2008 and its construction created 500 local jobs.

SERB: How will the office market change in the next year?

Randy Smith: In the recent past, Tampa has enjoyed a vigorous job market with annual growth averaging 4.3 percent in 2004 and 3.5 percent in 2005. While it will be difficult to achieve those levels in the near term, Tampa is well positioned for long-term growth.

SERB: What needs to be done to encourage activity in the Tampa office market?

Randy Smith: With its low tax burdens and reasonable office rents, the Tampa region remains a contender for corporate expansions and relocations. Tampa’s office market will benefit as its business community continues to diversify. One example is the evolving technology cluster that is growing around the University of South Florida and its research facilities. It is home to biotechnology and life sciences tenants and its program is pursuing developing areas as clean energy research.

Randy Smith is the regional director of research in GVA Advantis’ Tampa office.

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|