| TAMPA’S

JOB GROWTH WILL IMPROVE REAL ESTATE OUTLOOK

A bright economic forecast follows projected employment growth

in the Tampa, Florida, area. The MSA is expected to gain 30,000

jobs this year, an increase of 2.4 percent. By 2006, the area’s

job growth is expected to measure a 9.6 percent increase over

2003. These new jobs will help fill office vacancy, currently

at 20 percent, including sublease space; and they will improve

the industrial market, which is currently experiencing a direct

vacancy rate of less than 8 percent. The increase in jobs will

also help to fill local apartment communities and per-unit sales

prices will continue to increase. Retailers are also taking

note of the projected growth; they have more than 20 million

square feet of retail developments on the drawing boards.

Office

Crescent

Resources is nearing completion on the sole multi-tenant office

project under construction in Tampa. Corporate Center Three

at International Plaza, containing 287,000 square feet, will

be ready for occupancy this summer. This building currently

has 55 percent of its space committed. Crescent

Resources is nearing completion on the sole multi-tenant office

project under construction in Tampa. Corporate Center Three

at International Plaza, containing 287,000 square feet, will

be ready for occupancy this summer. This building currently

has 55 percent of its space committed.

Most office projects on the drawing board are planned for the

Westshore and Interstate 75 corridor submarkets; however, no

start-ups are expected in 2004 without significant pre-leasing.

2003 started with a spike in vacancy due primarily to the closing

of the 820,000-square-foot WorldCom/Intermedia campus as a result

of bankruptcy proceedings. Tampa’s overall vacancy rate,

including sublease space, remained stabilized at slightly more

than 20 percent over the course of the year.

Demand for office space was down in 2003 and many lease transactions

involved relocation or consolidation of existing tenants in

the market. One significant new deal was signed at a former

PricewaterhouseCoopers training facility in the Westshore submarket.

International Academy of Design & Technology consolidated

its local operations and leased the entire 130,000-square-foot

building. Net absorption will gradually improve during 2004

as business hirings gain momentum.

Over the past 3 years, the overall average asking rental rate

for Tampa office space has fluctuated in a narrow band around

$19 per square foot. Rates will bounce back as increased demand

reduces the space options for tenants. Rates in the Westshore

business district will rebound first, probably in the latter

half of 2004.

The Tampa area is well positioned for a resurgence of real estate

activity in 2004 and beyond. Economy.com projects employment

growth for the Tampa metro area from 2004 through 2006 to be

9.6 percent. This ranks the Tampa area as the 10th fastest growing

market in the nation. Job growth, especially in business services,

will positively impact Tampa’s office activity in 2004.

— Randy Smith, director of research, Advantis/GVA

Industrial

Speculative

development in 2003 was limited to smaller projects, generally

rear-load flex buildings, which were adaptable for office

use and higher parking densities. Trammell Crow Company, EastGroup

Properties and First Industrial Realty Trust each dipped their

toes back into the market with new spec deliveries during

the year. Speculative

development in 2003 was limited to smaller projects, generally

rear-load flex buildings, which were adaptable for office

use and higher parking densities. Trammell Crow Company, EastGroup

Properties and First Industrial Realty Trust each dipped their

toes back into the market with new spec deliveries during

the year.

In December, Trammell Crow Company broke ground on a unique

inter-modal industrial development, which offers wharf and rail

access at the Port of Tampa. The first phase of the Port Ybor

project will feature a 282,000-square-foot cross-dock facility

to be completed in August.

New construction start-ups are scheduled for this year, primarily

on the east side. Duke Realty Corporation is building its eighth

building at Fairfield Distribution Center. Construction began

in January with completion of the 94,000-square-foot rear-load

structure slated for July. Also on the east side, EastGroup

Properties is scheduled to begin Palm River South in March.

This will feature twin 80,000-square-foot rear-load distribution

buildings with 150-foot depth. Target completion date for the

first building is this August.

Vacancies in Tampa’s industrial market started rising in

2001, but peaked by mid-year 2003 with a direct vacancy level

of 9.1 percent. The second half of 2003 finished strong, dropping

the direct vacancy rate to 7.8 percent by the end of the year.

Industrial demand got off to a slow start in 2003, but finished

with a strong surge in the second half of the year with 773,000

square feet in positive net absorption. The Eastside submarket

captured a majority of the larger deals, typically in the 40,000-

to 50,000-square-foot range, and accounted for about 85 percent

of the total net absorption for the year.

The overall average asking rental rate for industrial space

in Tampa remained relatively stable throughout the year. For

flex space, which represents less than 20 percent of total vacancy,

the average rental rate showed a significant gain for the year.

It rose 8 percent over the past 12 months, to close the year

at $7.77 per square foot. The average for distribution space,

which makes up the bulk of the market, ended essentially unchanged

from the start of the year, at $4.22 per square foot.

The outlook is positive for the industrial sector. According

to a new report prepared for the National Association of Wholesale-Distributors

titled “NAW Economic Forecast 2004,” Florida will

be among the leading states in the nation for employment growth

among wholesale distributors; the report forecasts 3.5 percent

growth in hiring.

— Randy Smith, director of research, Advantis/GVA

Retail

Florida has always had huge growth from in-migration following

periods of national crises, severe winters and economic downturns

such as the events that were ushered in with the tech bust in

mid- to late-1999. As residents move north and south of the

city of Tampa, retailers are not far behind. Most of the proposed

retail development in Tampa is to take place in high residential

growth areas, with southeastern Pasco County, New Tampa and

north/northeast Hillsborough County leading the way. These areas

exploded in the mid-1990s with single-family and multifamily

residential but had few retail options. Now retailers are scrambling

to serve; qualified developers have more than 2 million square

feet of retail space on the drawing boards with plans to be

significantly engaged in predevelopment activity this year.

Oakley Plaza at the intersection of SR 54 and I-75 will be the

largest undertaking. Echo Development will build a planned 1

million-square-foot regional center, which should open fall

2006. Just a few minutes’ drive from Oakley Plaza, The

Goodman Company will develop the new 400,000-square-foot Wiregrass

Ranch Power Center. Wiregrass Ranch is also breaking ground

on a 14,000-unit subdivision. The Wesley Chapel/New Tampa neighborhood

has a Wal-Mart Supercenter and SuperTarget, but Wal-Mart continues

to grow, adding another Supercenter near the busy intersection

of SR 54 and Bruce B. Downs Boulevard on Porter’s Wiregrass

Ranch. Wal-Mart is planning a Sam’s Club less than 4 miles

away, at the intersection of the new SR 56 and SR 581. Jacobs

also has plans to build a 1.2 million-square-foot conventional

enclosed mall at the intersection of SR 54 and SR 56.

Another area of substantial residential growth is south Hillsborough

County where young couples have created demand for housing.

Retailers want to be there to take advantage of the new demand

for goods and services. Morin Development and The Sembler Company

plan a major power center at the intersection of I-75 and Big

Bend Road. At Big Bend and U.S. 301, RMC Property Group is developing

a center for The Home Depot and Publix. Kash n’ Karry also

plans a new store on the southeast corner of the project.

In the Tampa Bay area, the story continues to be urban infill,

with such developments as Clearwater Mall, the Morin redevelopment

of the Jim Walter building at I-75 and Dale Mabry, and the explosive

growth of north/ northeast Tampa-southeast Pasco.

— Jeremy Kral, director of market analytics &

GIS, Colliers Arnold

Multifamily

With

projections for strong employment growth and reduced construction,

Tampa’s multifamily market is poised for solid growth.

The Tampa MSA is set to record 2.4 percent employment growth

in 2004, a gain of 30,000 jobs, following a 1.5 percent payroll

expansion in 2003. Half of the new positions will be in the

professional and business services sector, which will fuel

demand for apartments as the market for first-time homeowners

begins to lose steam. With

projections for strong employment growth and reduced construction,

Tampa’s multifamily market is poised for solid growth.

The Tampa MSA is set to record 2.4 percent employment growth

in 2004, a gain of 30,000 jobs, following a 1.5 percent payroll

expansion in 2003. Half of the new positions will be in the

professional and business services sector, which will fuel

demand for apartments as the market for first-time homeowners

begins to lose steam.

Investors have taken notice, pushing up the median price per

unit among Tampa multifamily investment sales from $46,000 in

2002 to $48,000 in 2003. Sales activity has been stronger in

Hillsborough County than Pinellas County with the former accounting

for 60 percent of the metro area’s sales. A limited availability

of land helped the South Pinellas submarket post a median price

gain of 6.6 percent in 2003, to $52,500 per unit. Hillsborough

County’s median price per unit rose from $37,500 in 2002

to $44,000 in 2003. Areas closer to employment centers, such

as the Tampa CBD and Westshore, will record price gains over

the next 2 years as employment grows.

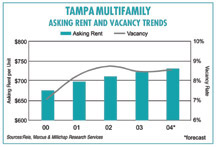

Apartment operators can expect vacancy to rise to 8.4 percent

in 2004, just 10 basis points above the 2003 level of 8.3 percent.

Vacancy climbed from 8.6 percent in 2002 to 9.6 percent in the

first quarter of 2003 but retreated rapidly later in the year

as employment escalated. Asking rents are expected to continue

climbing in 2004, from $722 per month to $731 per month, an

increase of 1.2 percent. Effective rents were flat in 2003,

at $660 per month, but are expected to rise this year.

Construction declined in 2003, and 2004 will see only 3,500

new apartment units. Heavy construction in the large North Hillsborough

submarket, however, resulted in a 5 percent increase in local

inventory and a jump in vacancy of 240 basis points. Selected

properties may be affected by new deliveries, presenting opportunities

for acquisition and repositioning.

— Steven Ekovich, first vice president and regional

manager, Marcus & Millichap’s Central Florida offices

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|