|

CITY HIGHLIGHT, MARCH 2007

TAMPA CITY HIGHLIGHTS

Randy Smith, Jon Slater and Steven Ekovich

Tampa Industrial Market

Tampa’s 83 million-square-foot industrial market remains in expansion mode and is primed for additional growth this year. Occupancy last year was boosted by steady tenant demand throughout the year. Net absorption of Tampa’s industrial space totaled 1.9 million square feet last year, a 13 percent increase from the previous year. The construction of new industrial product began to ramp up early and by year’s end new deliveries totaled 1.1 million square feet. Despite this surge in new supply, Tampa’s market fundamentals improved significantly during the year — the direct vacancy rate declined 100 basis points to 4.8 percent and the average asking rental rate climbed 21.3 percent to end the year at $6.89 per square foot.

Industrial space tightened significantly in Tampa’s Eastside submarket as leasing activity removed large blocks from the market. At Meadow Creek Distribution Center, Meadow Burke, West Logistics Group, Inc. and Star Stainless Screw Company combined to take down 189,890 square feet last year. By the close of 2006, the Eastside submarket, with more than 1.1 million square feet of new construction deliveries for the year, had dropped to a 5.2 percent vacancy rate. The 52 million-square-foot submarket, which runs generally north-south along Interstate 75, has historically been favored by industrial developers as they could assemble substantial tracts of land in close proximity to the major transportation corridors.

This year many of the long-established business parks in east Tampa are reaching the built-out stage and industrial developers are actively seeking sites for future growth. Land south of the “core” Eastside submarket is now exploding with new industrial development. At Madison Industrial Park, Trammell Crow Company is constructing two cross-dock distribution buildings totaling 680,000 square feet. The Parksite Group, a leading distributor of branded and specialty building products, has leased 210,000 square feet in the project which is scheduled for completion by this July. At Oak Creek Commerce Park, EastGroup Properties completed a 100,240-square foot distribution building last November. Reaching near the southern end of the I-75 Corridor, the Ryan Companies will close this May on 210 acres to start a new development — South Shore Corporate Park. Ryan, a Minnesota-based development firm, plans to start the first phase of the project with two speculative warehouse buildings totaling 490,000 square feet. Construction is scheduled to begin this summer. Entitlements for the site allow for a total of 2.7 million square feet of light industrial and office uses.

First Industrial Realty Trust, a long-time developer in the Tampa market, recently acquired two key development sites in east Tampa. In December, First Industrial purchased 28 acres at Interchange Center for $8.7 million. Part of this site will be developed for a 144,000-square-foot build-to-suit office/warehouse facility for Bright House Networks. Scheduled for completion in February 2008, the building will consolidate the company’s regional operations and house more than 900 employees. Last month, First Industrial announced another acquisition — a 49-acre site near Oak Creek Commerce Park, with development plans for 550,000 square feet of flex/service center facilities. The first phase, totaling 139,000 square feet, is scheduled to begin in the fourth quarter of this year.

Despite a significant pipeline of new industrial product underway, Tampa’s industrial market appears headed toward another year of appreciating rents with demand outpacing supply. Pent-up demand for new product, especially by users requiring 100,000 square feet and greater, will provide a healthy boost in absorption this year.

— Randy Smith is director of research with GVA Advantis office in Tampa, Florida.

Tampa Office Market

Despite well publicized insurance and real estate tax increases, Tampa Bay has remained a highly desirable area for office users throughout last year. Construction cost increases have slowed, and the relatively quiet hurricane season has dimmed memories of the previous two years’ events. Notable transactions included LifeLink Foundation, Inc. (125,000 square feet), MetLife, Inc. (115,000 square feet), and URS (114,045 square feet). Net absorption was strong, at more than 2.21 million square feet, primarily in the Westshore and East Tampa/I-75 Corridor submarkets, yet down significantly from 2005’s approximately 3.16 million square feet. Disappearing inventory may be one of the chief culprits for this slowdown.

Retrospectively, 2006 may become known as the “Year of the Landlord,” with unprecedented low vacancies abound. Available space declined from 9 to 7.6 percent last year. Among the tightest submarkets are Polk County (4.4 percent), Sarasota (5.4 percent), South Tampa (3.6 percent), St. Petersburg CBD (4.6 percent), and Westshore (6.9 percent). Class A vacancy fell from 9.81 to 8.48 percent, while Class B and C dropped from 11.61 to 9.16 percent and from 7.32 to 6.78 percent respectively. Sublease opportunities disappeared quickly, provided the space was functional and the asking terms were reasonable. Another striking aspect of this space shortage was how few large contiguous blocks of space were available. Less than 1 percent were 50,000 square feet or greater, while 3.6 percent ranged from 20,000 to 50,000 square feet.

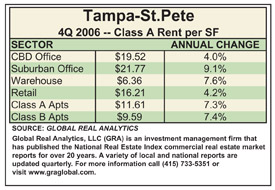

As a result of this tightening, rents have increased and concessions have declined. At year-end 2006, the average full-service quoted rate for the entire Tampa Bay area was $19.81 per square foot for direct space versus $18.39 per square foot 1 year before. The area’s largest office submarket, Westshore, experienced an overall $1.80 increase to $21.76 per square foot, while Class A average rent increased from $3.60 to $26.42 per square foot. The St. Petersburg CBD Class A office market witnessed a similar increase, from $20.80 to $26.58 per square foot. Most asking rents in existing premier office buildings are nearing the $30 per square foot threshold.

In response, approximately 1.44 million square feet is under construction, although nearly one third represents buildings under 25,000 square feet, which for the most part will be for sale only. Several projects, such as the 208,000-square-foot Phase I of Highwoods Bay Center and Highland Oaks’ III and V, will offer some much needed relief. Several build-to-suits started last year, among them MetLife’s 115,000-square-foot Class A building by Highwoods Properties and Lifelink Foundation’s 125,000 square feet at USF Research Park facility. Numerous projects are in development, such as Crescent Resources’ 247,000-square-foot Corporate Center IV at International Plaza, Highwoods’ 208,000-square-foot Phase II of Highwoods Bay Center and MetLife’s three-building, 750,000-square-foot office component of their Westshore area campus redevelopment. How many will be built will largely be determined by 2007’s market performance. If the net absorption slowdown continues, then 2007 will be a year of stabilization. Either way, the Tampa Bay office market will remain a dynamic arena which will continue to rise in prominence amongst its national peers.

— Jon Slater is managing director with Studley’s Tampa, Florida, office.

Tampa Multifamily Market

Driven by population growth and a steady pace of job creation, low vacancy and robust rent increases in the apartment market will persist in Tampa during 2007. Local employers are expected to add 18,000 jobs this year, a 1.4 percent increase, compared with 17,000 positions in 2006. Furthermore, supply additions will be minimal, as units slated for completion this year will raise rental stock by less than 1 percent. Apartment completions are expected to total 1,300 units this year, down from 2,300 units in 2006. Of the approximately 10,000 planned units in the metro, nearly 2,000 units are scheduled for delivery in Hernando County, located north of Pasco County.

Compared with recent years, though, supply additions in 2007 are not likely to be offset by conversion-related reductions due to softer for-sale housing demand. In fact, the emerging buyer’s market in the for-sale sector could affect the performance of Class A multi-family properties, where the gap between average monthly rent and monthly mortgage payments on the median-priced home is only $400. If home sellers increase buyer incentives in the months ahead, there may be some additional migration of Class A renters to homeownership. Even if this occurs, however, the result would likely be limited to a slight uptick in vacancy in areas such as the Central Tampa, Westshore and North Hillsborough submarkets, where Class A properties are a large percentage of rental stock.

Overall, vacancies rates for class A, B and C properties in the Tampa MSA will rise 30 basis points to 4.9 percent by year end. Shadow rental stock has not had an appreciable adverse affect on either vacancy or rents as of yet. In fact, property owners will enjoy strong rental growth as asking rents are forecast to increase 5.5 percent to $864 per month and effective rents are projected to add 6 percent to $827 per month. Rent gains in the Class B/C sector are expected to be in the mid-6 percent range, after posting a strong increase of approximately 7 percent last year.

Class B/C properties may still outperform this year, as changes in the for-sale market are less likely to influence rental demand. Among investors, converters will maintain a much lower profile this year compared with last year and before, when conversion-related buying accelerated, initiating a run up in prices. Forward-looking conversion buyers will continue to purchase assets to operate as rentals until conditions in the for-sale market become favorable for conversions again. Meanwhile, failed conversion schemes may place more properties on the market and open up greater opportunities for apartment operators. Areas of interest for apartment operators include sections of northeast Tampa south of the Pasco county line.

Median sales prices per unit in Tampa should continue to rise as they have in the past three years. In 2004, the per-unit sales price was $55,000 and it jumped to $65,300 by year-end 2005. At the end of 2006, the price per unit reached $71,700. While investors will continue to eye opportunities across the region this year, central Pinellas County may be a good target. So far in 2007 apartment properties in central Pinellas County were posting year-over-year effective rent growth from 6 to 8 percent at the beginning of this year.

Long-term investment prospects for the Tampa Bay apartment market are excellent, with steady demand and barriers to entry impeding development. Strong population growth and limited new supply will drive demand among renters, which will attract even more capital to Tampa Bay in 2007.

— Steven M. Ekovich is the first vice president and regional manager of the Tampa office of Marcus & Millichap.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|