|

CITY HIGHLIGHT, MARCH 2007

MEMPHIS CITY HIGHLIGHTS

Charles Sevier and Joe Steffner

Memphis Industrial Market

Memphis’ industrial activity did not meet the tremendous growth in 2005 but most industrial brokers agreed that last year was a good year for business.

Memphis’ average industrial rents for the fourth quarter 2006 were slightly increased to $2.53 per square foot from $2.51 per square foot at the end of 2005.

New construction fell to 4 million square feet from 6 million square feet in 2005. Cap rates remain stable at 7 to 8.5 percent for Class A properties and the occupancy rate rose 1 percent to 84.5 percent in 2006.

The most significant developments all took place over the Tennessee state line into Mississippi. Panattoni and Industrial Development International (IDI) both had recent developments in DeSoto County, Mississippi. Panattoni expanded its distribution facility in the Southaven Distribution Center for GO/DAN Industries to 520,000 square feet from 390,000 square feet. IDI will complete two distribution facilities in Southaven in the Stateline Business Park. Building F will be 740,700 square feet and Building B will be 291,972 square feet. Both will be delivered on the market by the second quarter of this year.

Great planning and tax incentives were major contributors to smart growth in DeSoto County last year. There were 9 expansions in DeSoto County of existing companies that resulted in a capital investment of 65 million. For example, Imation Corp., formerly Memorex, expanded their occupancy in Building D of IDI’s Stateline Business Park to 562,440 square feet from 196,500 square feet.

This year, Prologis plans to build a 500,000 to 800,000-square-foot distribution center on its 140-acre site near the FedEx Ground Hub in Olive Branch, Mississippi.

Recent noteworthy lease transactions include Nissan Corp. lease of 413,000 square feet of their current 855,000-square-foot distribution facility in the Lauth Deltapoint Business Center at Holmes and Getwell last December. Across the street, Sharp Electronic’s leased 400,000 square feet at Panattoni’s Memphis Oaks Distribution Center in November. And in October, Panattoni was active at their Southaven Distribtuion Center when it leased 572,000 square feet to Boston-based IRON Mountain Storage Corporation.

The industrial investment market was active as well last year with three new major investors to note. San Antonio, Texas-based USAA just completed the $73 million sale of its portfolio in Memphis to London-based State Real. This transaction totaled more than 4.16 million square feet of space in Southeast Memphis. Also, Chicago-based SHA bought all of AMB’s portfolio at Willow Lake Business Park on Mendenhall and at Corporate Park on Winchester for $53.3 million. And in the first quarter 2006, Cabot II bought seven buildings from Eastgroup, totaling 533,000 square feet, for $15.2 million. Later in the year, Cabot II bought another two buildings from Eastgroup on Lamar, totaling 110,000 square feet, for $3.1 million. Also, in November 2006, Cabot II bought Boyle’s 107,500-square-foot building at 4105 Mendenhall for $3 million and the old J. C. Penney Warehouse, a 106,000-square-foot distribution facility located off Getwell, for $2.75 million.

— Charles H. Sevier is chief manager and principal broker with Memphis, Tennessee-based Crump Commercial, LLC/CORFAC International.

Memphis Office Market

The Memphis office market continued the recovery that began in 2005. Overall vacancy at year’s end was 18 percent, declining from 19.1 percent in the first quarter and a high of 19.4 percent at the beginning of 2005. This is the first time vacancy has dropped to 18 percent in more than 5 years and is evidence of the strength of the market.

For the second consecutive year, year-end absorption is positive and ends 2006 with 281,497 square feet.Most of the positive absorption was absorbed by Class A suburban properties, specifically the sale of the previously vacant and for lease Concord EFS Building (285,000 square feet) to Harrah’s Entertainment in the Northeast submarket. New construction has been scarce during the 2000s. For the first time this year, two buildings were completed totaling 103,000 square feet, and an additional 36,000 square feet is under construction. The majority of the new construction last year was the ThyssenKrupp Headquarters Building (78,000 square feet) in the 385 Corridor Submarket.

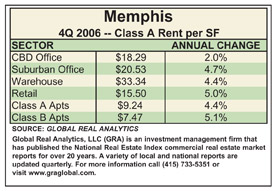

The vacancy rate Downtown dropped from 22.1 percent last quarter to 21.6 percent this quarter. Year-to-date absorption is negative 23,534 square feet, however, fourth quarter posted 58,742 square feet of positive absorption this quarter. Sublease space Downtown has dropped slightly and was approximately 100,000 square feet at year’s end. Rental rates are steadily climbing. Class A rental rates are currently $17.93 per square foot while Class B rental rates are $14.63 per square foot.

Vacancy in the suburban markets dropped to 17.1 percent last quarter down from 18.2 percent first quarter 2006. Year-to-date absorption was a positive 305,031 square feet and 245,339 square feet was absorbed in Class A space. Sublease space increased slightly to 279,582 square feet, which was up from first quarter’s 128,009 square feet. Class A rental rates remained stable last year at $20.44 per square foot as well as Class B rental rates at $15.71 per square foot.

Several submarkets are below 15 percent vacant: 385 Corridor, 9.9 percent; East, 13.2 percent; and the Northeast, 9.7 percent. All three posted positive fourth quarter absorption last year. The Northeast submarket posted the strongest year-to-date absorption with positive 358,099 square feet primarily due to the sale of the Concord EFS headquarters building which was previously available for sale or lease.

Tenants will find it challenging to receive incentives from landlords, specifically in the 385 Corridor and East submarkets. Free rent is virtually non-existent in these submarkets due to the small amount of available Class A space. Construction on new Class A space should commence this year. The challenge for landlords will be to lease the available Class B and C space in East Memphis versus moving to the suburbs. Tenants in the Midtown, North, Airport and Downtown submarkets will receive aggressive incentives as these submarkets continue to soften. The challenge will be to keep tenants in these northern and western areas of the city versus the ongoing trend of businesses to choose to relocate east.

— Joe Steffner is president of Nashville, Tennessee-based Grubb & Ellis/ Centennial.

©2007 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|