|

CITY HIGHLIGHTS, MARCH 2008

TAMPA CITY HIGHLIGHTS

Brian P. Rettig, Patrick Duffy, Cheri O’Neil, David Diaz and Alan Kaye

Tampa Industrial Market

The entire Tampa Bay trade area, consisting of Hillsborough (Tampa), Pasco, Manatee (Bradenton), Pinellas (St. Petersburg/Clearwater), Polk (Lakeland) and Sarasota counties had an industrial market vacancy rate of 4.88 percent. During the second quarter, 925,160 square feet of industrial space was absorbed. The statistics for the industrial submarkets of the counties relative to the Tampa Bay Area are as follows:

Continuing demand for industrial space to service the area’s growing population, coupled with the limited land available for development and relatively limited delivery of supply of new completed improved product, has and is expected to continue putting upward pressure on rental rates. The growth in rental rates is justifying the delivery of additional new product to the marketplace. Further, as traditional corporate industrial space users come up for renewal in third generation space with lower clear heights and substandard sprinkler systems, in lieu of paying an increased rental in such space, we believe these users will elect to pay slightly more per square foot for the new product which has (i) more cubic storage space due to increased clear heights, and (ii) ESFR fire sprinkler systems. So, the net cost to the user in new construction can actually come at a minimal increase due to a greater number of pallet positions and lower insurance cost for a similar footprint.

The growth in Tampa Bay’s industrial property market is also limited by natural barriers such as the Gulf of Mexico and Tampa Bay. More specifically, the lack of land in Pinellas and Western Hillsborough counties has pushed users east (along I-4) and southward (along I-75) in search of supply.

As of the end of 2007, the industrial property sector was the new “most wanted” investor demand — rental rates are on the rise, quarterly absorption is positive again (12 quarters in a row) and vacancy remains at a 20-year low. The overall average asking rental rate is $6.69 per square foot; however, the majority of the submarkets are above $7.05 NNN per square foot. This rate represents a 28.8 percent increase from 2005 and a 36.3 percent increase from 2004, which is attributable to a decreasing supply of industrial space combined with Tampa’s strong job and population growth.

The market has experienced a continuation of the demand that has occurred during the last few years. The Tampa MSA had 2.75 million square feet of positive absorption during 2007, which is remarkable given the vacancy rate is 5.6 percent. Further, the expansion in container business at the Port of Tampa has fueled the entire West Central Florida industrial market.

With such low vacancy rates across the Tampa Bay market, new construction had been long overdue. There is now 2.16 million square feet of new product being built in Hillsborough County, 619,000 square feet in Pinellas County, 881,180 square feet in Polk County and 451,701 square feet in Sarasota/Bradenton.

East Tampa’s I-75 Corridor is the Bay Area’s largest submarket (67.19 million), and it is greatly influenced by access to the area’s transportation network, which consists of I-75, US-301, US-41, the Selmon Expressway, SR-60 and extends westward along the I-4 Corridor to the Tampa Central Business District. The vibrant East Tampa/I-75 Corridor submarket saw 825,631 square feet of positive absorption in 2007.

Of the total 2.75 million square feet of positive industrial absorption that occurred in the entire Tampa Bay area, approximately 30 percent occurred in the East Tampa/I-75 Corridor submarket. The year-end vacancy rate stands at a stellar 3.6 percent, which is below the overall Tampa industrial market rate of 5.63 percent. Average asking rental rates are $6.75 NNN per square foot for East Tampa, and there is approximately 2.16 million square feet under construction in the I-75/US 301 submarket as of fourth quarter 2007.

Going forward, the trend of rising rental rates and low vacancy rates is expected to continue because of tenant demand and a limited supply of large blocks of space. Projects include IDI’s 700,000-square-foot Madison Industrial Park, Ryan Companies’ 492,000 square feet of speculative product at South Shore Corporate Park and Trammell Crow/ING’s 650,000-square-foot Madison project. Current rental rates for the new construction are between $5.75 per square foot and $6.65 NNN per square foot.

The primary attraction to the tenants of the East Tampa submarket is the inventory’s proximity to the major transportation routes that serve not only the MSA, but the entire state of Florida. Nearly half of all national freight destinations are within a day’s drive of the market; thus, proximity to the major roadways that serve the region is critical for tenant operations that rely heavily on transportation.

The I-75 Corridor has also been the most rapidly growing residential market in the Tampa Bay area. Easy access to I-75 and I-4 allows companies to attract employees to the I-75 Corridor from Pasco to Sarasota Counties and Polk County as well.

— Brian P. Rettig, SIOR is first vice president with the Tampa office of CB Richard Ellis.

Tampa Retail Market

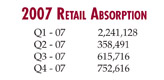

The Tampa Bay SMSA continued its strong run last year. At year end, the total retail inventory in the Tampa/St. Petersburg market area amounted to 165.5 million square feet, an increase of 3.59 million square feet more than year end 2006. Despite this robust delivery, last year saw a decrease in vacancy during the last 4 quarters from 5.4 percent in first quarter 2007 to 5.1 percent by the end of the year. Shopping center vacancy (excluding single tenant retail) ended the year at 6.6 percent. Absorption for the year was best in first quarter 2007, but ended the year on a positive note.

Sarasota and northwest Tampa had the highest net absorption with 1.17 million square feet and 852,039 square feet respectively, with Polk County (-6,765), Clearwater’s CBD (-10,118), Tampa’s CBD (-34,580), Gateway/mid Pinellas (-41,447) and South Tampa (-90,561) all posting negative absorption for 2007.

There is currently 4.28 million square feet of retail space under construction with another 11.6 million square feet of projects announced in the five county SMSA of Tampa Bay. This pipeline represents approximately a 5 to 6 year supply of retail space given the normal population growth rate of Tampa Bay. Many of the less mature projects will be postponed or cancelled in the near term as lenders tighten underwriting criteria and retailers reevaluate their expansion plans in the more “green” submarkets. Population growth slowed to 1.2 percent last year, resulting in the lowest percent increase since 1992. The average annual percentage increase for the previous 5 years was 2 percent. While the growth rate slowed, the region’s population and job growth remain among the top in the country. This growth will continue to support reasonable expansion of the retail sector in Tampa Bay.

New major projects under construction in Tampa Bay include:

• Cypress Creek Town Center — Wesley Chapel, I-75 & SR-56, 2 million-square-foot super regional mall (The Richard E. Jacobs Group).

• The Shops at Wiregrass — Wesley Chapel, I-75 & Bruce B Downs Boulevard, 835,000-square-foot mixed-use center (The Goodman Company).

• Orange Quarter of the Grove — Wesley Chapel, I-75 & SR-54, 690,366 square feet (Echo).

• Nature Coast Commons — Hernando County, US-19 & Algood Road, 350,000-square-foot retail powercenter (Opus).

• University Town Center — Sarasota, I-75 & University Parkway, 2 million-square-foot powercenter (Benderson Development).

• Ikea — Tampa International Center, 22nd Street & Adamo Drive, 353,000-square-foot freestanding retail store.

Most new, anchored centers are quoting in-line rents in the high $20s to mid $30s per square foot. Quoted rents peaked at the end of first quarter last eyar and retreated by approximately 10 percent from that high by year end, but still ended the year higher than year end 2006. Overall, average quoted rents were $16.23 per square foot by the end of fourth quarter and represented a 5.67 percent increase from fourth quarter 2006. Average shopping center rental rates increased to $16.04 at the end of 2007 from a year ago at $14.05.

We expect 2008 to slow marginally from last year as the overall U.S. economy has slowed and retailers have pulled back on their expansion plans.

— Patrick Duffy is president of Clearwater, Florida-based Colliers Arnold Commercial Real Estate Services.

Tampa Office Market

Most office markets around the country started to see a slowdown in leasing and rental rate growth as last year came to a close, and Tampa Bay was no exception.The oft-referenced sub-prime mortgage crisis and credit crunch have had the same effect on the region as they have on the country as a whole. Mortgage lenders, as well as borrowers, banked on the expectation that housing values would keep increasing. These same firms often signed leases with space to grow into based on assumptions of continued business expansion. The opposite has occurred and space givebacks have followed.

The overall availability rate, 14.6 percent, was up from 13.2 percent a year ago and is at its highest since the second quarter of 2005. The Class A rate rose year-on-year from 12.5 percent to 15 percent. In addition to the increase in Class A availability, Class B and C availability has ballooned by almost 5 percent from 9.5 percent to 14.3 percent. Tenant demand has been waning for several quarters. A market that appeared to be turning definitively into a landlord’s market at the close of 2006 has shifted and is now presenting greater opportunities for tenants.

Looking back, as 2006 ended, the rally was expanding beyond an ultra-tight Westshore, pushing development into surrounding submarkets where available land exists and population growth was happening. In early 2007, areas that were considered peripheral such as Pinellas and Southeast Hillsborough experienced the strongest expansion activity. In the wake of the sub-prime crisis, availability spiked in nearly all markets during the last 2 quarters, and the expansion phase appears to be retracting.

The two Eastside submarkets, Southeast Hillsborough and Northeast Hillsborough have significant large blocks of space available. Some of these large blocks exist in vacated spaces of large users such as Verizon and The Home Depot, but many spaces will come available this year as new product comes online. Plus, some tenants are shifting from older buildings into brand new product, such as Travelers’ move to a new Duke property. Approximately 1.3 million square feet is scheduled to deliver this year. With a current vacancy rate of 19 percent in the combined submarkets, an additional 1.3 million square feet has the potential to increase availability to 33 percent.

Tenants find themselves in a much more favorable position in this climate, and tenants restructuring existing leases may also have increased leverage in the face of greater availability in the market. Landlords are becoming more generous with incentives in an effort to attract new tenants and retain existing ones, particularly large tenants committing to long-term leases. While landlords may be holding face with rental rates, they are generally offering increased flexibility through attractive concessions such as free rental periods and greater tenant improvement allowances, not to mention their renewed willingness to sign shorter term leases. Improvement in the economy could take some time. Nevertheless, forecasters still expect that job creation in Florida will outstrip the national rate in this year — with a gain of 2.1 percent in Florida versus 1.2 percent for the country as a whole.

— Cheri O’Neil is senior vice president and branch manager of Studley’s Tampa office.

Tampa Multifamily Market

Like a handful of markets across the country, Tampa has seen heightened activity in their multifamily sector since 2003. And, again, like other markets across the country, uncertainty in the short-term market has caused many developers to delay groundbreaking on new projects, if not cancel them all together. Most would agree that the medium- to long-term strength of Tampa and surrounding submarkets looks very promising. However, developers looking to meet short-term yield requirements by delivering new product in a period of softened fundamental conditions have a right to be nervous. This uncertainty has presented challenges for developers, equity partners and banks to get comfortable with construction projects other than those that are well located and low-risk.

While to a lesser degree than other markets in Florida, Tampa’s shadow market does exist and is impacting short-term asset performance. The shadow market has grown significantly statewide due to an oversupply in investor-purchased units in both new construction condominiums and single-family home developments. The imbalances of fundamentals associated with speculative investors renting units well below the cost of debt service, taxes and fees will resolve itself in the short to medium term resulting in eventual market stabilization.

Condominium conversions removed much of the already-limited apartment stock in South Tampa. Land cost in this core market can be prohibitive, however, there may be opportunities arising from developers caught in outside projects needing cash. The major need in Tampa is for affordable workforce rental units within or close to central business districts. This remains a common theme in the state as county and municipal employees currently commute long distances to work. The barriers to entry are the high cost of land and construction.

There are approximately 3,500 rental units planned to be delivered in the next 24 months in the Tampa market, which coupled with the market’s desirable strength and strong demographics, should prove to have fairly minimal impact overall on vacancy upon delivery. The majority of development taking place consists of smaller, less than 100-unit infill projects in core markets, as well as larger typical Class A garden-style assets in suburban locations. It is always difficult to assemble density in core markets, such as South Tampa and St. Petersburg, at a price that justifies for-rent product. Smaller infill projects are typically more successful in these markets, particularly when they are geared to the renters seeking an ultra-luxury, location driven lifestyle.

Rental rates range from $0.80 per square foot to $1.40 per square foot, depending on asset class and location. Occupancy ranges widely depending on submarket and asset class. Core assets are experiencing minimal vacancy, while some submarkets are showing 10 percent-plus vacancy rates in addition to significant concessions. A submarket to keep watching is the Brandon-Riverview market, as the completion of the Crosstown Expressway’s reversible lanes makes this one of the most easily accessible suburbs for commuting downtown workers.

— David Diaz is chief operating officer with JBMRA – Sperry Van Ness Institutional in Tampa. Alan Kaye is managing director with Sperry Van Ness | Kaye Commercial Investment Group in Boca Raton, Florida.

©2008 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|