|

SOUTHEAST SNAPSHOT, MAY 2004

Hampton Roads Office Market

|

|

Dawn Griggs, SIOR

Commercial Sales & Leasing

Thalhimer/Cushman & Wakefield

|

|

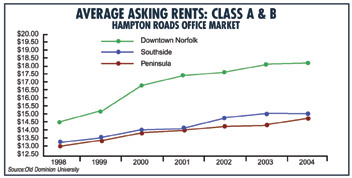

The Hampton Roads, Virginia, office market will experience

steady growth over the next year, according to Dawn Griggs

of Thalhimer/ Cushman & Wakefield. Average asking rental

rates will inch up to a projected overall market rate of $15.70

per square foot, a blended average for Class A and B space.

With job growth increasing, office space absorption will escalate

and new office developments will be announced.

“The Peninsula’s City Center at Oyster Point has

proved a very sound investment,” says Griggs. “With

three office buildings complete and several retail operations

(restaurants) open, we can expect additional announcements

within the hospitality sector that will round out the center

along with the residential, which is under construction.”

The impact of the City Center development has not yet been

truly experienced by the community. Once it evolves into a

full-blown residential, hospitality and office community,

it will become a destination for many. The space being occupied

by the new tenants of City Center are largely image enhancement

opportunities for existing Peninsula businesses. “We

are seeing some corporate headquarters relocation from outside

of the area as well,” Griggs adds.

Another noteworthy subsection of Hampton Roads is Williamsburg;

the New Town Development is creating synergy with the opening

of the SunTrust building along with several other mixed-use

buildings, which are in the final stages of approval by James

City County. The residential portion of the urban development

should be underway by second quarter and another major retail

announcement will be unleashed by this summer. This new “financial

district” for Williamsburg is welcomed by both new and

existing businesses; there has not been a center of town since

the Rockefellers came in the 1950s.

“The majority of development is taking place in the

‘center of town,’ such as Virginia Beach, Chesapeake,

Newport News and Williamsburg,” notes Griggs. “This

is largely due to the existing infrastructure and location,

location, location!”

Who is responsible for the new development? The local commercial

real estate community believes so strongly in the market,

they are leading the pack with new construction.

“One of our leading tenants has always been the government

and, therefore, government contractors. NASA Langley is further

enhancing its facilities on the Virginia Peninsula, thus causing

additional demand for office space within close proximity

to the NASA campus,” Griggs says.

On the Peninsula, the leading office leases have been within

The City Center at Oyster Point. The U.S. Attorney’s

office moved from downtown Newport News into 17,000 square

feet and Langley Federal Credit Union relocated its corporate

offices into a 35,000-square-foot space within Fountain Plaza

III. Specialty Foods Group relocated its corporate headquarters

to 10,000 square feet in The Newport News Plaza building located

at the corner of Pilot House Drive and Jefferson Avenue. Moreover,

The Mitre Corporation leased 19,000 square feet and Policy

Studies leased 8,960 square feet in Hampton Technology Center.

Equally as strong, the south side of Hampton Roads enjoyed

several new leases in downtown Norfolk at 150 W. Main: SunTrust

Bank leased 53,120 square feet and Kaufman & Canoles leased

68,071 square feet. In Virginia Beach, The Town Center of

Virginia Beach was successful in leasing 9,358 square feet

to Legg Mason Wood Walker, and, in One Columbus Center, HBA

Architects leased 16,624 square feet.

There were three major transactions in the suburban Southside

market, specifically Chesapeake: Sentara Health Care leased

40,211 square feet in The Crossings I building, AMSEC LLC

leased 57,429 square feet in the Battlefield Technology Center,

and Canon USA leased 65,374 square feet at Greenbrier Business

Center.

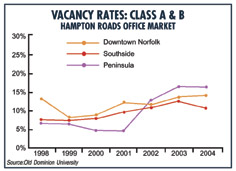

The range of Class A rental rates goes from $18.50 to $21

per square foot. Vacancy rates are up almost 31 percent from

1 year ago, standing at about 15 percent.

“Those looking for chance may want to keep an eye on

Suffolk, Chesapeake and Williamsburg,” Griggs says. “Major

opportunities will present themselves in the near future.”

Overall, the forecast for the Hampton Roads office sector

is optimistic. “We should have the best year economically

since 1984 if all of the indicators are correct,” says

Griggs.

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|