|

CITY HIGHLIGHT, MAY 2005

ATLANTA CONTINUES GROWING, AND GROWING, AND GROWING. . .

|

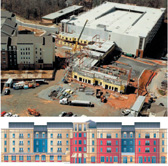

The Sembler Company is under construction on Perimeter Place, a 1 million-square-foot mixed-use center with 450,000 square feet of multi-anchored retail and 550,000 square feet of residential in the heart of the Central Perimeter submarket of Atlanta.

|

|

Throughout all of Atlanta’s submarkets, development is continuing on a positive upswing. Trends for urban revitalization are running rampant through the city of Atlanta, but the growth out in the suburban and exurban markets is continuing despite the increasing popularity of city living, working and shopping. The retail market is leaning toward mixed-use development trends, in which the demand for office, retail and multifamily space is met, and in both the retail and industrial markets, development continues to move further out from the city, creating exurban markets out in the distant suburbs. Furthermore, as Atlanta continues to grow exponentially due to job creation and businesses relocating to this vibrant market, the demand for high-quality multifamily developments and office spaces is on the rise. Overall, Atlanta continues to flourish across the board.

Retail

The Atlanta retail market has remained strong over the last two quarters of 2004 and continued to look robust in the first quarter of this year. All sectors, including urban, suburban and exurban, continue to see new project development.

After decades of suburban sprawl, the appeal of the urban lifestyle has generated an extraordinary revitalization of closer-in, high-density markets. Dramatic new developments such as Jacoby Development’s Atlantic Station and The Sembler Company’s Perimeter Place and Lindbergh Plaza projects are exciting examples of large-scale mixed-use developments taking place in Atlanta. It is a unique period in Atlanta real estate history when municipal governments, developers, tenants and consumers all see a similar vision for revitalization of obsolete properties in urban areas. The result is a renewal of retail activity and street life, tax benefits for local governments and improved quality of life for the community.

Part of the urban trend has led even the largest retailers to re-evaluate store concepts to allow for limited property and space. The result has been experimentation with multi-level stores, deck parking, rooftop parking and modified store designs to accommodate urban environments. Due to already densely populated trade areas, retailers have the advantage of opening an immediately profitable store.

Suburban expansion continues with buildings for traditional home improvement, super-discount and price-club tenant groups. While community resistance to the large, asphalt-dominated projects is increasing, developers and tenants still are finding space for new projects. Demand seems endless for outparcel spaces and quality small shop space, and there also is a rekindling of interest from movie theaters after a long dormant period in the market.

Atlanta’s exurban communities, such as Canton, Cumming and Gainesville, also are benefiting from the metro area’s relentless growth. As companies and jobs move farther out of the city, the resulting increase in housing and population will add fuel to the exurban retail market.

While Atlanta experiences its share of retail problems, such as aging malls and store closings, this seems to be counterbalanced by both the entrance of new retailers to Atlanta and the resourcefulness of the development community in recycling older properties. On balance, there is every reason to be optimistic that 2005 will be a strong year for retail real estate in Atlanta.

— Caldwell Zimmerman, executive vice president, Colliers Cauble & Company

Office

The fourth quarter of 2004 marked the third consecutive quarter of significant positive net absorption for the Atlanta office market, and has prompted new construction for 2005. While development levels have been generally in decline since early 2002, the announcement of several noteworthy projects has bumped the new construction total to 2.3 million square feet as of March. Additionally, Pope & Land Enterprises, Regent Partners, Grove Street Partners and Equity all have sites that may break ground in the coming months. This is the highest level of development in Atlanta since year-end 2002, and could well set the stage for future growth.

Core submarkets within Atlanta have shown improving leasing fundamentals, opening the door to new development activity. A prime example of this trend is in Buckhead, where vacancy decreased by nearly 5 percent in 2004, an elevated rate when compared to the metro Atlanta average of 2 percent during the same period. This led to the anouncement by Cousins Properties to build a 500,000-square-foot tower at the intersection of Peachtree and Piedmont roads, slated to deliver in 2007. Additionally, the former Art Institute of Atlanta site on Peachtree Road will be home to a new office building somewhere in the neighborhood of 300,000 square feet. For Buckhead, this will ensure a healthy supply of Class A office space going forward. The ability to land a significant lead tenant will be a key factor in the success of these new projects.

Another market experiencing significant activity is Midtown, where Hines is constructing Symphony Center Tower, a 665,000-square-foot, Class A office building on Peachtree Street. When it delivers in the spring of 2006, King & Spalding will occupy 416,000 square feet; the remaining 37 percent of office space is currently available for lease. The effect of Atlantic Station on the Midtown and Downtown submarkets cannot be understated. A model for modern growth, it has revolutionized the concept of mixed-use development. The addition of the 17th Street bridge, in conjunction with Atlantic Station, has expanded Midtown’s borders to the west across the connector and could lead to further redevelopment opportunities.

While new construction activity is rising as we enter 2005, it is unlikely Atlanta will see a construction boom similar to that of the late 1990s. A consistent rate of sustained growth is more likely, with levels remaining in the 2 to 4 million-square-foot range. As has been the trend in recent years, significant pre-leasing will be required by lenders before construction begins.

— Thad Ellis, managing director, Advantis Real Estate Services Company/GVA

Industrial

Currently, trends in Atlanta’s industrial market have yielded a limited supply of “close-in” land sites, which has caused developers to leapfrog to sites more than 50 miles out of the city. Cities like Braselton, Commerce, Pendergrass and Jefferson are now seeing a land boom as local and national developers compete for sites.

Overall, the Northeast Atlanta corridor is the largest and typically most active submarket, encompassing approximately 25 percent of Atlanta’s total industrial base. In this area especially, several significant developments are being constructed at the present time. The bulk warehouse sector leads the Atlanta market in projects under construction with almost 5 million square feet underway. Highlighting this sector is the newly announced 810,000-square-foot speculative project at Walnut Fork Business Center in Braselton. Also underway in the Northeast submarket is the 550,000-square-foot bulk warehouse facility at Braselton Distribution Center. Other projects include a third building at New Manchester totaling 540,000 square feet, and a 620,000-square-foot facility at SouthPark located off Interstate 675.

Current local developers in the Atlanta industrial market include a who’s who of national players such as Catellus, Duke Realty Corporation, First Industrial Realty Trust, Majestic Realty Company, Panattoni Development Company and ProLogis as well as a strong group of local and regional developers.

At the end of 2004, Atlanta’s industrial vacancy rate began to descend from the historic high it reached earlier in the year, with 16.2 percent of the market vacant at year’s end and 17.6 percent on market for lease. Even though vacancy had been leaning high, it is still on a positive swing, perpetuating the trends across the board in Atlanta. At year-end 2004, weighted average lease rates were quoted at $4.41 per rentable square foot, compared with $4.46 per square foot a year ago. Warehouse product saw a slight rise in asking rents during fourth quarter, but distribution buildings’ rates declined substantially, from $4.36 to $4.24 per square foot. Rates in flex space rose slightly during the quarter.

Looking toward the future, keep an eye on the South Atlanta industrial submarket, which has expanded rapidly in the past few years due to the growth centered on Atlanta’s Hartsfield-Jackson International Airport. Also, the ability to serve the Florida market more rapidly has led to significant growth in the big box industrial market in Henry County. The Interstate 20 West industrial area has been one of the most active industrial areas in Atlanta the past 5 years and has seen a significant increase in speculative development. Yet the once seemingly endless supply of undeveloped land in this submarket has rapidly diminished.

— Todd Barton, first vice president, CB Richard Ellis

Multifamily

|

The Highlands Companies is developing The Highlands on Cheshire Bridge on Cheshire Bridge Road between LaVista and Interstate 85. The $17 million project includes 164 luxury apartment units and delivers in the second quarter of 2005.

|

|

As with every other segment of Atlanta’s economy, the multifamily sector depends on the job creation that has fueled the metro area’s explosive growth over the past 30 years. And while condominium developers have a few advantages in terms of developing new product, Atlanta is still a renter’s market.

From 2003 to 2004, multifamily effective rents for garden properties grew from $618 per unit to $656 per unit, while concessions fell from $107 to $74, according to Dale Henson Associates. After the halcyon days of the late 1990s, Atlanta multifamily developers pulled back from delivering new product, with 6,424 new units delivered in 2004 versus approximately 12,000 in 2000. In turn, that has helped push vacancy from 89.9 percent at the end of 2003 to 90.4 percent at year-end 2004, also according to Dale Henson Associates. Over the next few years, an increase in interest rates combined with escalating home prices may leave more potential homebuyers on the fence and boost occupancy as well.

In Buckhead, Midtown and Downtown, condominium developers currently can pay more for land because condo-unit sales prices can support those higher land prices. Presently, apartment rents do not, but there are still plenty of opportunities for apartment development. Uncovering those opportunities just requires more patience, shoe leather and vision.

Pockets of Midtown and emerging corridors along Memorial Drive, Piedmont/Lindbergh and Cheshire Bridge Road offer some of the best inside-the-perimeter development prospects, especially for the growing demographic of young college graduates who are seeking an urban lifestyle but don’t necessarily want to own a home or condo. Zoning, entitlement and even environmental issues are some of the challenges developers will face in these areas, but that’s no different than other parts of metro Atlanta. While it’s difficult and enhances risk, identifying under-served submarkets and the ability to assemble land for multifamily development in these areas will lead to higher-yielding properties.

Regarding multifamily investment in Atlanta, real estate investment trusts (REITs) and institutional investors are resurgent and competing with the condo converters that have dominated the market for the past few years. For example, REIT Summit Properties acquired our Midtown Atlanta development, The Highlands on Ponce, for $44.8 million last year. Two years prior, it’s much more likely that a condo developer/converter would have presented the winning bid for this 296-unit, mixed-use Class-A property. Yet, as REITs and institutional investors waited on the sidelines and sold older assets over the past few years, they’re now redeploying capital to newer product in better locations.

— Chris Cassidy, president, The Highlands Companies

HARDIN CONSTRUCTION BUILDS ACROSS ATLANTA

Atlanta-based Hardin Construction Company is involved in several projects throughout the Atlanta area, including Atlanta Falcons Expansion, Cobb Energy Center for the Performing Arts, ECO Building, Glenridge Point, Kennesaw State University Village Center, One Brookhaven, South DeKalb YMCA, Southern Company Center and the WellStar Kennestone Hospital Bed Tower.

|

Kennesaw State University Village Centre Photo credit: Aerial Innovations and Niles Bolton Associates

|

|

Kennesaw State University Village Centre

A July completion date is set for Village Centre, a 65,500-square-foot student housing and activity center at Kennesaw State University (KSU). The development includes 24 four-bedroom apartment units, study/classrooms, computer terminals, recreational lounges, retail/restaurant space and property management offices. This project is a continuation of the KSU parking deck and was a result of Hardin’s successful completion of the parking deck for the KSU Foundation. Place Collegiate Development is the developer. The architect is Niles Bolton Architects.

|

Southern Company Center @ One Centennial Photo credit: Aerial Innovations and MSTSD, Inc.

|

|

Southern Company Center @ One Centennial

Barry Real Estate Companies has selected Hardin to build Southern Company Center @ One Centennial in downtown Atlanta. The 259,000-square-foot, eight-story headquarters office building is above a 249,000-square-foot, seven-level parking deck with retail space on the ground floor. Exterior skin is curtainwall and pre-cast with stone accents glazed into the curtainwall and pre-cast. The architect is MSTSD, Inc. Completion is scheduled for October 2005.

— Julie Fritz Hunt |

ATLANTIC STATION UPDATE

|

The grand opening of Midtown Atlanta’s Atlantic Station is scheduled for October 20-23, 2005.

|

|

With a grand opening celebration set for October 20-23 of this year, the 138-acre Atlantic Station redevelopment in Midtown Atlanta is entering its final stages of development. The project is divided into three areas — The District, The Commons and The Village — that combined will give Atlantic Station 6 million square feet of Class A office space, 3,000 to 5,000 residential units, 1.5 million square feet of retail and entertainment space, and 1,000 hotel rooms in at least three hotels.

The retail and restaurant tenant roster boasts national, regional and local stores. Recently signed leases include Ritz Camera, Strip Steaks & Sushi and GAP. Other tenants include Regal Cinemas, Dillard’s, Publix and Rosa Mexicano. IKEA, the world’s leading home furnishings retailer, will open a two-level, 360,000-square-foot store within The Village this summer. Jones Lang LaSalle recently was named the leasing and management agent for Atlantic Station’s retail district.

|

IKEA will open a 360,000-square-foot store at Atlantic Station this summer.

|

|

Residents are already living in the condominiums, apartments, townhomes and duplexes that were developed by Beazer Homes and Lane Company. Novare Group and Wood Partners have broken ground on the first hotel/condo, Twelve, which is being constructed by R.J. Griffin & Company.

The Atlantic Station community is located on the site of the former Atlantic Steel Mill at the nexus of interstates 75 and 85 in Midtown Atlanta. The project is being co-developed by Jacoby Development, Inc. and AIG Global Real Estate Investment Corporation.

— Julie Fritz Hunt |

THE NUMBERS ADD UP: IT’S DOWNTOWN ATLANTA.

Despite what some supposed experts may tell you, Downtown Atlanta remains one of the most viable commercial real estate options available to current and potential office and retail tenants, as well as residential developers, that are already well on their way to realizing Downtown’s potential. Believing otherwise could be costly for your company or your clients. Just look at the numbers. Despite what some supposed experts may tell you, Downtown Atlanta remains one of the most viable commercial real estate options available to current and potential office and retail tenants, as well as residential developers, that are already well on their way to realizing Downtown’s potential. Believing otherwise could be costly for your company or your clients. Just look at the numbers.

Currently, Downtown’s average asking rate for Class A office space is $21.42 per square foot, compared with $26.17 in Midtown and Buckhead, our neighbors to the north. Today’s deal is Downtown Atlanta, but momentum dictates that these value rates will only last so long. Downtown offers even better rates across a variety of asset classes, no matter what your budget or space needs require.

Amenities? They abound. From some of the city’s — and the United States’ — best top-shelf restaurants to the casual atmosphere of the Fairlie Poplar District, Downtown matches or surpasses any area in dining options.

Regarding Atlanta’s Achilles heel, transportation, Downtown is more accessible than any submarket by roadway, rail, bus and air. Employees can reach the office with ease, and they can walk easily during the day to run errands or grab a bite for lunch.

With the expansion of Downtown’s residential base, the addition of The World of Coca-Cola and The Georgia Aquarium, and Georgia State University’s growth, Downtown’s potential for retail development is unbeatable as well.

Some still believe the misperception that Downtown is crime-ridden. We house the largest daily population base, 200,000 people, in the metro region and represent only 8 percent of the city’s overall crime based on a 6-month analysis by the Atlanta Police Department. Statistically, Downtown is safer than many of its neighbors to the north. If you’re looking for crime, Downtown Atlanta is not the place to find it.

Today, in just 15 projects, more than $650 million in investment for housing, commercial office space, restaurant and entertainment space is underway. From Sweet Auburn to Ivan Allen Plaza, Downtown’s resurgence is phenomenal. And that’s just the tip of the iceberg when it comes to who’s looking, who’s asking and who is getting ready to announce another project. Actually, there’s more than $3 billion on the drawing boards. The numbers speak for themselves.

— A.J. Robinson, president, Central Atlanta Progress and the Atlanta Downtown Improvement District |

OFFICE REIT CRT PROPERTIES’ ATLANTA PORTFOLIO TOPS 3 MILLION SQUARE FEET

With the acquisition of two Class A office buildings in 2004, CRT Properties strengthened its position in Atlanta and its platform for growth. Among its Atlanta holdings totaling more than 3 million square feet, CRT’s portfolio includes trophy properties Three Ravinia Drive and Atlantic Center Plaza. The company will continue to seek out well-located, Class A properties to establish or expand its presence in submarkets such as Buckhead, Central Perimeter and Midtown.

Atlanta, one of our five core markets, runs on a very diversified economic engine rather than a handful of companies. Corporate America comes to Atlanta when it is locating to or expanding in the Southeast and increasingly, it comes to the Central Perimeter market. Additionally, Midtown, where Atlantic Center Plaza is located, continues to be a hotbed of residential and cultural activity for metro Atlanta

CRT’s Atlanta holdings include:

• Atlantic Center Plaza, with 502,371 square feet in Midtown, adjacent to Interstate 75/85, acquired in January 2004 for $117 million from Pope & Land Enterprises. Alston & Bird, one of the country’s largest law firms, occupies more than half the building.

• In the emerging North Fulton submarket, CRT acquired the McGinnis Park office complex in January 2004 as 75 percent owner in a joint venture with Triangle W/Development. This complex consists of two Class A mid-rise office buildings totaling 208,280 square feet on 8.5 acres of land.

• Three Ravinia Drive, a 31-story tower with 804,528 square feet located in the Central Perimeter submarket, was acquired in January 2002. In one of the market’s largest relocations, GMAC consolidated offices from downtown and elsewhere to 55,000 square feet here in the first quarter. InterContinental Hotels occupies more than 300,000 square feet as its U.S. headquarters.

CRT’s Atlanta portfolio also includes 1.2 million square feet in its 21-building Chamblee Center property, located at I-85 and Chamblee-Tucker Road. Government tenants including the CDC, FEMA and IRS dominate the center, which maintained 95 percent occupancy during the recent economic downturn. In Northeast Atlanta’s Gwinnett Center, CRT owns three buildings totaling 275,000 square feet. That site, as well as the McGinnis Park property, includes land available for future development.

CRT will continue to utilize its leasing, property management and development expertise, as well as regional office presence in Atlanta, to pursue aggressively new opportunities. After renaming the company from Koger Equity in 2004, CRT Properties has significantly restructured its office property portfolio from the more mature Koger office parks toward upscale Class A buildings in established and growing submarkets.

— Chris Becker, senior vice president, CRT Properties, Inc. |

©2005 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|