|

CITY HIGHLIGHT, MAY 2006

ATLANTA CITY HIGHLIGHTS

Charles King Jr., Maranda Walker, Fred Sheats, Marc Robinson

Industrial Market

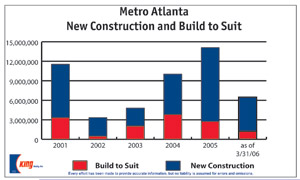

The momentum of new construction that broke ground in 2005, which marked the largest influx of new construction since 1998, continues this year for the Atlanta Industrial market. As manufacturing jobs move overseas, the demand for warehouse/distribution facilities to handle the logistics of moving consumer goods to their final destination increases.

The downtown submarket has seen minimal new construction and has the lowest percentage of first generation space among metro Atlanta submarkets. The lack of modern warehouse facilities contributes to the loss of tenants resulting in this submarket having the second highest availability rate in metro Atlanta. The existing available land is being rezoned and picked up by residential developers to meet the demand for in town living space.

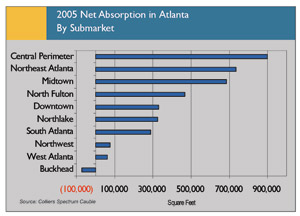

Maintaining the highest market share among its peers, I-85 North Corridor leads the pack in both activity and net absorption. Area developers have announced new speculative product to provide available big box warehouse/distribution facilities diminished by the lion share of net absorption being leases in excess of 100,000 square feet. On the heels of Progressive Lighting signing a 796,663-square-foot lease, Duke Realty Corp. is planning to add a 600,000-square-foot distribution space at the 318-acre Park 85 in Braselton. IDI also plans to break ground on two speculative buildings totaling 1.09 million square feet at Hamilton Mill Business Park following the 517,628-square-foot lease by Global Equipment Co. Cousins Properties Inc. will begin development of the initial phase of the 3.2 million square foot Jefferson Mill Business Park.

Another submarket of Atlanta experiencing strong speculative construction for 2006 is the South I-75 Henry County Corridor. A combination of available big box warehouse/distribution facilities and convenient access to I-75 played a large factor in bringing this submarket in third for net absorption in 2005. A number of warehouse/distribution facilities slated for this year include 416,000 square feet by Cousins Properties Inc. as the first phase of King Mill Distribution Park and 867,000 square feet from ProLogis in Park Greenwood. Panattoni Development Co. joins Cousins and ProLogis with a 676,000-square-foot building at Interstate South.

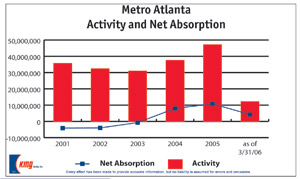

Atlanta recorded the best year in net absorption since 2000. The majority of activity can be credited to deals in excess of 100,000 square feet further demonstrating the growing influence of big box distribution facilities upon Atlanta’s industrial market. In response to this surge in demand, new construction in 2005 exceeded the 5-year high mark by more than 2.5 million square feet.

The question in everyone’s mind this year is will activity continue for big box warehouse/distribution facilities. Area developers are gambling that Atlanta’s position as the established regional distribution center for the South, as well as being a foreign trade zone, will keep the trend set in 2005 going for 2006.

— Charles King Jr. is a chairman of Atlanta-based King Realty Corporation/ CORFAC International.

Retail Market

Atlanta’s retail sector continues to reap the benefits of the city’s growth. From intown, mixed-use properties to suburban retail centers, retail developers are responding to the changing needs of Atlanta residents.

Mixed-use development has become a dominant trend and retail is one of its key components. Atlantic Station, for example, has attracted a wide variety of retailers to serve a submarket that has been vastly underserved. The center is home to IKEA’s first Southeastern location, which has proven to be one of the chain’s more successful operations, while Dillard’s has chosen it as the site of its flagship store.

In addition to Atlantic Station, residential towers such as Metropolis and Spire on Peachtree Street each feature street-level retail and restaurants — important components in creating a 24/7 environment. Downtown has attracted its share of development as well. Centennial Hill will be home to Centennial Park East, featuring residential, office, hotel and retail and TWELVE Centennial Station will offer a similar mix.

Mixed-use/lifestyle developments are catching on throughout the city. Though the Central Perimeter submarket is not underserved in terms of retail, a mixed-use development such as Perimeter Place is bringing an urban flavor to the shopping malls and power centers that currently dot the landscape. In Sandy Springs, CityWalk is offering a similar town square environment.

To compete with mixed-use developments, developers such as The Sembler Company are redeveloping obsolete properties such as Park Place in Dunwoody and Lindbergh Plaza in Buckhead.

Gwinnett County is also redefining itself as a retail market. New rooftops are going up every day and the market continues to expand into more than one trade area. While historically the Gwinnett Place Mall area has served the market, the addition of the Mall of Georgia and Discover Mills has changed the shopping patterns of this market. Initially experts were concerned that adding new retail centers would be a demise to Pleasant Hill Road and Venture Drive, but it appears that population density and income are strong enough in this market to sustain sales both in Buford and Duluth.

Occupancy across the metro area is very healthy, with more than 90 percent occupancy in the market overall. Rental rates intown are creeping up — Midtown rates rage from $35- to $40-per-square-foot, while downtown rates are a bit lower, ranging in the low $30s. Rates in Buckhead and Perimeter range from the mid- to high-$30s.

One downside of Atlanta’s intown retail growth is the effect rent and parking are having on smaller tenants. Because rental rates are so high intown, big national players are squeezing smaller tenants out. Those that can afford the high rental rates are determining whether shoppers will be comfortable shopping in an urban environment.

The upside is that Atlanta still has a lot of room to grow — from suburban areas to urban markets. As the intown areas turn into 24/7 environments, more retailers will be attracted to urban locations. It remains to be seen, however, if larger retailers can move into the market and capture sales without cannibalizing existing stores.

— Maranda Walker is director – retail services in the Atlanta office of CB Richard Ellis.

Office Market

The Atlanta office market remains the envy of most major cities around the world. Our diverse economy cushions Atlanta from the inevitable, local setbacks that occur in all major cities, such as Delta’s bankruptcy and BellSouth’s recent acquisition by AT&T.

Through the first three months of this year, Atlanta’s combined Class A, B, & C office markets encompassed 168 million square feet of space with a 17.5 percent vacancy rate. Net absorption for the first three months of this year totaled 715,000 square feet.

Net absorption for last year totaled 3.8 million square feet, just outpacing the 3.5 million square feet of space under construction. For this year, office space deliveries are expected to exceed 2 million square feet. Office absorption has exceeded the delivery of new office space for the last 2 years. However, from 1999 to 2003, Atlanta delivered more new office space than it could absorb, including 2001 and 2002, when Atlanta experienced back-to-back negative absorption totaling more than four million square feet.

During the fourth quarter of last year, leasing activity in Atlanta was less than expected, ending the streak of consecutive quarters where net absorption exceeded 1 million square feet. Nevertheless, activity in 2006 remains dynamic. Colliers forecasts that absorption levels this year will mirror 2004 and 2005 with annual totals near four million square feet.

Atlanta office rental rates peaked in 2000 and have experienced a steady decline during the last five years. Colliers forecasts higher rental rates for all office classifications this year. The average quoted rental rate for Class A office space is $21.45 per square foot.

More than two million square feet of new office space will deliver this year. The most notable deliveries are 1180 Peachtree in Midtown, Two Buckhead Plaza, Stonebridge 1 and 200 Milton Park. The delivery of 1180 Peachtree will create a sizable hole in the downtown submarket as King & Spalding LLP moves out of 191 Peachtree.

The threat of a possible terrorist attack represents a major factor impacting features offered by new office buildings in Atlanta. According to Harvey Rudy, SVP of Barry Real Estate Companies, five building security upgrades reflect the added importance of security to tenants.

• Optical turnstiles that permit only authorized tenants/visitors to travel up the building elevators. All others are physically blocked including a uniformed security guard.

• Strengthened security in the parking deck including cameras throughout the garage and main access areas in the building.

• Picture IDs for all visitors that includes digital images attached to the visitor badge with a driver’s license check.

• Dockmaster permanently overseeing security at the building’s loading dock.

• Extra guards on duty during normal and after hours.

In-town Atlanta has experienced a well-publicized decline in its population during the last 30 years, even though the surrounding region enjoyed robust in-migration. Poor schools, crime and the relative cost of living are three primary reasons for people making the conscientious decision to move out of Atlanta. However, over the last five years many of these factors are swinging back in favor of Atlanta generating an in-town housing boom. No clearer symbols of this growth are the numerous cranes dotting the Atlanta skyline from Buckhead to Downtown. Atlanta’s current population of 435,000 is projected to grow to 585,000 by 2030. Change occurs not without controversy. Atlanta’s recent in-migration is putting pressure on various groups with a vested interest in its outcome. For example, the current political controversy between homebuilders and neighborhoods competing for scarce land and the appropriate size house for this land.

The office market is certainly impacted by this increased demand for land. Office developers will pay higher prices for land, and tenants will pay corresponding higher rental rates to recoup these costs making it more difficult to develop speculative office buildings.

— Fred Sheats is senior vice president/principal in the Office Services Group of Atlanta-based Colliers Spectrum Cauble.

Multifamily Market

As the calendar approaches mid-year, Atlanta is experiencing a very healthy multifamily development climate. The current trends are significantly different than the trends during the booming expansionary times of the mid to late 1990’s. During that period, development of suburban, garden style multifamily rental communities was occurring at a feverish pace. The three large North Atlanta counties — Gwinnett, North Fulton and Cobb — absorbed thousands of new units.

In the last couple of years, the pipeline of new rental communities in those areas has sharply declined, largely as a result of a softening rental market from the protracted period of historically low interest rates. This low interest rate environment has enabled many renters to pursue home ownership for the first time.

Multifamily developers have quickly shifted to meet the needs and trends of the current marketplace, fueled by these low interest rates. Infill condominium and townhome development is occurring at blistering pace, while development of infill rental communities has been more active than ever before.

The most notable new trend is the viability and appetite for intown condominium living. The long list of successful condo projects is proof that the lifestyle choices of many Atlantans has changed dramatically to now include condominium living. Atlanta-based Novare Group has been tremendously successful with numerous high-rise projects appealing to the entry level and upwardly mobile buyer. These projects are hi-rise, glass and steel structures that offer a lifestyle in the sky that has historically not been available in Atlanta. Additionally, two ultra-high end projects have been announced that will target the extremely well-heeled condominium buyer. The St. Regis, being developed by Eastland Capital, and The Mansion on Peachtree, being developed City Centre Properties, are both condominium/hotel towers. These projects will combine a five-star hotel with condominium residences in the same building, offering highly amenitized units at prices that compare to the homes in the most established Buckhead neighborhoods.

The availability of development land is an increasingly difficult challenge for multifamily developers. There are very few remaining pieces of raw land available for development. The intown areas present an even greater challenge, as land costs are extremely high and virtually all of the sites contain existing structures and uses. This has forced developers to look for underutilized real estate to redevelop. The vast majority of new multifamily development occurring is happening on land that is being re-used. Developers are acquiring well-located, older apartment communities to demolish and redevelop as for-sale multifamily properties, typically townhomes or condominiums. The driving force for this type of redevelopment is that existing multifamily zoning allow for new units without having to endure the lengthy rezoning process. The strong pricing of the newly built for sale units also makes this viable.

Similarly, most of the new multifamily rental communities are being developed in infill areas on sites that were previously other uses. Low density office buildings and aging hotels are examples of the types of property being demolished and rebuilt as apartment communities. The redevelopment of office and hotels to multifamily does often require the property to be re-zoned, which can be a very arduous process, but the demand for infill living continues to increase. To meet this demand, developers are becoming very creative to build in these areas.

For the second half this year and moving into 2007, expect to see a continuation of these trends. As long as interest rates remain relatively low, the demand for new for-sale housing in infill areas should remain strong. The apartment market should continue to strengthen, as relatively few new deliveries will allow concession to burn off in the existing stock, making slight rent increases likely. Infill property and land values should continue to rise.

— Marc Robinson is managing director with Atlanta-based Southeast Apartment Partners.

©2006 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|