|

CITY HIGHLIGHT, MAY 2008

ATLANTA CITY HIGHLIGHTS

D. Michael Chambers, Aletta Barnard, Marc Weinberg & John A. DeCouto

Atlanta Industrial Market

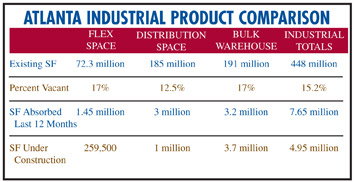

After a solid year, in which net absorption for Atlanta’s 450-million-square-foot industrial market was 10.2 million square feet, market velocity slowed in the first quarter of this year amid economic uncertainty. During the first quarter, 719,000 square feet was absorbed. New deliveries were more than 1.1 million square feet, and the vacancy rate crept up to 15.2 percent versus a year-end vacancy rate of 15.1 percent. New development activity has been strong for several years, although last year saw only half as much new space delivered as 2006. As of the end of first quarter, more than 4.9 million square feet are under construction. The majority of product being built is bulk warehouse speculative space.

Since the beginning of 2005, the metro Atlanta vacancy rate has hovered between 14.5 percent and 15.5 percent. Vacancy rates probably won’t move too much in either direction in the near future, as new development seems to be keeping pace with demand and most national developers continue to seek opportunities in the Atlanta marketplace. There is some speculation that sublease space could continue to rise as homebuilders and other residential related companies struggle amidst the downslide of new home sales.

Average rental rates increased during the last 12 months by $0.16. At $4.71 per rentable square foot, rents are now higher than at any period since mid-2002. Assuming that demand can continue to keep pace with new supply, and if construction pricing for new product continues to rise, there is a good possibility that rental rates will gradually escalate across the board. At more than 448 million square feet, the Metro Atlanta industrial market has grown by over 9 million square feet from this time last year. During the last 3 years, the market has undergone a transformation in its product mix, and bulk warehouse space has become the dominant sector for new speculative development. The metro industrial market is comprised of more than 191 million square feet of bulk warehouse product, which accounts for more than 42 percent of the total market inventory.

Significant first quarter deals include Newell Rubbermaid’s 784,900-square-foot lease and Harman Consumer Product’s 305,000-square-foot lease at Majestic Airport Center II. Petco has signed a lease for 506,200 square feet in a Braselton-area building that has been purchased by Prologis, and Carlisle Belting leased 676,000 square feet from Panattoni in Henry County. In addition, Walgreens is potentially searching for a 500,000-square-foot facility in the northeast or I-20 West submarkets. New project announcements include IDI’s 270-acre Meridian 75 Logistic Center located on Interstate 75 near Macon, Georgia. The park will eventually bring 3 million square feet to the market. Majestic Realty Company has announced plans to start construction on more than 1 million square feet in four buildings at Airport Center III, including a 600,000-square-foot bulk distribution building.

Retailers are driving the growth in the market, and as long as the population keeps growing, there will always be a need for retail distribution facilities. Logistically, Atlanta is one of the best markets in the country to build distribution centers because of its great access to large population centers, including Hartsfield-Jackson International Airport’s air cargo operations and the continued emergence of Savannah as a major shipping port. Because manufacturing is moving overseas, ports are seeing increased activity as more products are being shipped to the United States, and the Port of Savannah’s increased capacity will serve the Metro-Atlanta area well.

Looking forward, based on the overall performance of the Atlanta market during the past few years, the general health of the area remains good. New tenants are expected to take roughly 2 million square feet in the coming quarters, but developers already have 4.9 million square feet of new product in the pipeline expected to deliver this year. Although reported absorption was relatively slow in the last 3 months, leasing activity remained fairly buoyant, which should translate into healthy absorption levels throughout the year.

— D. Michael Chambers is senior vice president with Atlanta-based NAI Brannen Goddard.

Atlanta Multifamily Market

A barrage of national and local coverage has detailed the nation’s housing woes and economic uncertainty — which are clearly having an impact on Atlanta’s multifamily for-sale market. Average absorption rates slowed in all Atlanta submarkets during the first quarter to less than one sale per month, and many projects are struggling to make up for lost contracts as buyers cut their losses, get cold feet or discover they are unable to secure financing or sell their existing homes.

The good news is that the necessary steps are underway to correct the supply-demand imbalance. Projects with standing inventory are increasingly employing new strategies to gain traction --— enticing buyers with reduced prices and increased incentives, more openness to negotiation on price and attracting the broker community by providing a portion of commission for properties under construction at the end of the recission period, rather than all at closing. More proposed developments in the pre-construction phase are going on hold until the market recovers, being converted to rentals or cancelled altogether. For example, The Related Group has placed its One Cityplace project on hold; John Weiland announced that plans for One Museum Place are on hold until at least next summer; and Novare Group recently sold its proposed condo site near The Roxy Theatre.

|

Julian LeCraw & Co. is developing Paramount at Buckhead.

|

|

In light of the economic challenges, many developers are getting creative and flexible to drive velocity. In Buckhead, properties with the strongest value propositions are making the strongest headway — the standouts so far this year have been Paces 325 and Paramount at Buckhead, both achieving double-digit sales. Paces 325’s prime location at the intersection of Peachtree and East Paces Ferry roads, adjacent to the upcoming Streets of Buckhead, move-in ready homes and attractive pricing relative to nearby projects under construction makes the project a compelling value. Similarly, Paramount represents luxurious 5-star service and amenities, but at a considerable value relative to new properties still under construction nearby — especially The Mansion, which is next door with a starting price of $2.5 million compared to $199,900 at Paramount.

In Midtown, successful pre-construction sales are bucking the overall market trend. Trump Towers, developed by Wood Partners, has over 90 firm and binding contracts before breaking ground. Construction is well underway at 1010 Midtown by Daniel Corp., and Luxe by Paces Properties and Trammell Crow Residential, both of which are having particular success with increasingly popular larger homes, such as three-bedrooms.

|

Barry Real Estate is building The W Atlanta Downtown.

|

|

A key story downtown is that deeply discounted pricing at Central City has driven double digit sales since the property was foreclosed on. This is creating an affordable component lower even than TAD financed homes, and it is creating a difficult benchmark for competitive projects. At Novare’s Twelve Centennial Park, a new, innovative buy-back guarantee is aimed at easing buyer financing and concerns about potential price depreciation and sell out the remaining homes in Phase I. The W Atlanta Downtown Hotel & Residences by Barry Real Estate is successfully selling at the highest price per square foot ever achieved in the downtown submarket.

In East Atlanta, the hip, artsy, urban neighborhoods with historic authenticity and comparatively affordable homes have been far exceeding the average sales, mostly in the double digits since the start of the year, including 870 Inman in the heart of Inman Park, StudioPlex Lofts in the Old Fourth Ward, and AZ2 Lofts in Edgewood.

Horizon at Wildwood, a Wood Partners development at Interstate 285 and Powers Ferry Road, near the Chattahoochee River, has achieved more than twenty sales and closings this year. The key to Horizon’s success is creating buyer urgency where there was none by offering compelling pricing, combined with incentives customized to a buyer’s needs, offered for a limited time only. The program is complemented by the fully amenitized luxury high-rise community, and a limited selection of fully-furnished homes, which helps buyers visualize themselves in their new home.

Atlanta’s long-term economic and multifamily housing outlook remains strong. With its growing employment, affordable housing and attractiveness to young professionals, the city continues to attract new residents, an increasing number of whom prefer to live in urban, walkable neighborhoods found among Atlanta’s intown condominiums.

—Aletta Barnard, Ph.D. and David Tufts, both with the Atlanta office of the The Marketing Directors, LLC.

Atlanta Retail Market

Recent financial events have accelerated the real estate world’s process, and developers, leasing agents and tenant representatives are all moving quickly to get their deals closed before tenants decide not to continue their expansion and lenders decide not to honor their commitments to developers. In the second quarter of this year, Atlanta’s retail news is dominated by the overall economy and tenants announcing expansion delays or cancellations; however, this is not the entire story for the Atlanta market.

For several months, many of the anchor tenants, including Wal-Mart, Target, JC Penney, Kohl’s and The Home Depot, have been canceling or delaying openings for 1 to 2 years. This news has allowed discount retailers such as Burlington Coat Factory, Cato, Academy Sports, Michaels and Rue 21 to have sites presented to them in markets that were previously too expensive. This extends to the grocery world with the resurgence from Winn-Dixie and the continued expansion of Food Lion.

Buckhead continues to lead Atlanta’s urban markets with new retail space and retail interest that goes against the current slowdown trend. Ben Carter’s Streets of Buckhead mixed-use project continues to draw national and international high-end retailers and restaurateurs. Also, a new mixed-use development is being marketed to mid-level retail on a 10-acre tract adjacent to the Streets of Buckhead. The Sembler Company’s Town Brookhaven is a large mixed-use project with 600,000 square feet of retail, including tenants Total Wine, Cobb Theaters, LA Fitness and additional local retailers and restaurants; 1,500 apartments; and 30,000 square feet of office.

Midtown is competing with Buckhead for the same tenants with Selig Enterprises’ 12th and Midtown project, which is leading the efforts for Midtown Mile retail development with the first phase, 1010 Peachtree. Sembler’s Westside Marketplace, located at the intersection of 14th Street and Northside Drive, is a proposed 300,000-square-foot project that would add the typical suburban big box component to the midtown market.

The current economic climate and anchor tenants delaying their openings have affected suburban and ex-urban markets the most. If the project is not already in its construction and development stages, then the tenant slowdown is impacting the viability of the project. An example for continuing development is The Sembler Company’s Canton Marketplace, a 900,000-square-foot development that features Kohl’s, Target, Lowe’s Home Improvement Warehouse, Best Buy, Dick’s Sporting Goods, Linens ‘n Things and T.J. Maxx, which will open March 2009. However, there are exceptions to the slowdown. Both Dawsonville and Gainesville have 1 million-square-foot proposed projects on the boards. Jim Jacoby’s announcement for the former Ford plant in Hapeville will add 1.6 million square feet of retail and 2 million square feet of office. They propose starting construction mid-2009 with final build-out being completed in 2020.

The current economic climate’s impact will vary depending upon the strength of the supporting submarket. Overall, the Atlanta MSA’s retail development will continue, though at a different pace than it has been for the previous 3 to 5 years.

— Marc Weinberg is with the Atlanta office of The Shopping Center Group.

Atlanta Office Market

What a difference a year makes. The problems in the capital markets and liquidity crisis of the home mortgage market have found their way into the commercial markets, slowing leveraged office buys and refinancing. Tenant activity is strong, but not at last year’s levels. Add these to a shaky economy, and it’s hard to keep the optimism of 2007. However, metro Atlanta continues to be a leader in population growth, second in the country only to Dallas/ Ft. Worth, with an average of 150,000 new residents per year. Job growth, conversely, is expected to grow at half the rate of last year with technology and healthcare leading the way.

The metro Atlanta office market hit its 15th consecutive quarter of positive net absorption at year-end, and Atlanta’s overall office vacancy rate reached its lowest level in 6 years at 16.2 percent. Class A space led the way and accounted for most of the 3.2 million square feet of absorption, which is down from 4.2 million square feet in 2006. Fourth quarter of last year showed signs of slowing with approximately 500,000 square feet of positive net absorption, the second lowest quarterly net absorption since fourth quarter 2005.

Last year saw the delivery of a new wave of trophy office buildings including Terminus 100 in Buckhead, 55 Allen Plaza in downtown and the LEED Gold-certified 201 Seventeenth Street building in Atlantic Station. LEED certification and sustainable development are the buzzwords in today’s office market. Both landlords and corporate tenants are paying attention to this trend to “Go Green,” while the darling of the last few years, mixed-use developments, are losing steam. The “live” part of the “live, work and play.” developments is dead, with a number of high density condo projects in the midtown, downtown and suburban markets on hold as inventory continues to build without the corresponding demand.

At the beginning of the year, nearly 5.5 million square feet of office space was under construction with 3.6 million square feet scheduled to deliver this year without any significant pre-leasing. Even though it appears that supply may outstrip demand, landlords continue to push rates to the highest average rental rate for Class A space since 2000 at $22.82 per square foot full service. Concessions have been tightening, but expect this trend to reverse as owners try to push rental rates.

Buckhead seems to be the market to watch, with nearly 2.5 million square feet under construction in five competing projects within a mile of each other on Peachtree Street. Local developers Cousins Properties, Pope & Land and Regent Partners appear ready to duke it out with Tishman Speyer and Crescent Partners to fill these new projects. Regent Partners is in the lead with a spring delivery of Sovereign located at 3344 Peachtree, which is approximately 45 percent pre-leased to Jones Lange LaSalle, The Staubach Company, First Horizon Bank and the Buckhead Club, to name a few. Buckhead was the hottest submarket with a year-end vacancy rate at 13.4 percent.

This year could be the start of a cooling off period for these markets. With oil prices hitting a new high each day, the cost of construction going up, political uncertainty and economic woes, tenants are formulating a bunker strategy to weather the forecasted economic storm. In addition, the amount of sublease space on the market is increasing, which historically supports an increase in vacancy rates. Cash is king, and those landlords who see cash flow problems on the horizon are going to be the most vulnerable. The forecast for the region is cautiously optimistic growth, but the realities of the economy indicate that the office market may give back some ground gained over the last few years.

— John A. DeCouto, CCIM, MCR.h, is a founding partner of Atlanta-based Bryant Commercial Real Estate.

©2008 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|