|

CITY HIGHLIGHT, MAY 2009

ATLANTA CITY HIGHLIGHTS

Craig Viergever, Mike Neal, Marc Robinson, Jim Stormont & Jeff Bellamy

Atlanta Industrial Market

The current dynamics of Atlanta’s industrial market are diverse and complex. The overall market remains relatively stable, but on a building-by-building basis, it is a different story. There are TIC-owned buildings in receivership. Vacant buildings are being foreclosed on by banks. Sizable assets are facing troublesome refinancing. Landlords are filling vacancies at bargain rates. User sales are off by 70 to 80 percent due to debt markets and waning demand, resulting in downward pressure on values.

Within the dark clouds is a silver lining. In 2008, developers were already on the sidelines due to inflated land values and historically high construction pricing coupled with relatively flat rental growth and escalating cap rates. The lack of new product will allow for a more timely recovery once this recession ends and will give the market some latitude when trying to soak up inflated vacancy rates. Factor in future inflation, and it seems certain that the value of industrial real estate will recover.

There are always a few pockets of any region that remain relatively active during a dark time. Despite the economy, some submarkets remain quite healthy. The Duluth/Suwanee/Buford submarket enjoys a 10.4 percent vacancy rate. Most important, several new industrial deals were recently inked in the area. Daimler Freightliner leased 376,380 square feet and Lund International leased 214,780 square feet from IDI at Hamilton Mill in Buford. Contemporary Marketing leased 125,000 square feet from Prologis at Best Friend in Norcross, and Trane leased 73,000 square feet from Duke at Pinemeadow Court in Norcross. Peachtree Logistics leased 277,000 square feet from AEW/MD Hodges at SouthPark in Fairburn.

Development-wise, First Industrial has purchased 148 acres in Fairburn adjacent to the new CSX Intermodal facility. The site is master planned for 1.9 million square feet with a single building of up to 1.2 million square feet. IDI is developing 275 acres in Macon, Georgia, at the Meridian 75 Logistic Center. The project is master planned for 3 million square feet. Site work is complete, including two pad -ready sites for 1 million square feet.

Atlanta’s 558 million-square-foot industrial market was 12.1 percent vacant at the end of 2008. The vacancy rate will most likely increase 2 to 3 percent this quarter due to sublease spaces expiring and further corporate downsizing. Unlike the vacancies in the 1990s that were due to over supply, the vacancy rates Metro Atlanta is currently experiencing are wholly attributable to the lack of demand due to the recession. Tenants are on the sidelines looking in and are perfectly comfortable not making any moves until the recession lifts.

Across Atlanta, a current trend is to make vacant space move-in ready, which eases the tenant’s burden and provides for a seamless transition from one tenant to the next. Owners are retrofitting vacancies with T5 lighting, painting the warehouse walls white and retrofitting the office. First Industrial made two 850,000-square-foot buildings partially move-in ready to gain an advantage in the market. Last-second transaction approvals from tenants and local permitting issues are the driving factors.

Loan maturity deadlines will dominate the discussion for the remainder of this year. Spec and land will remain four-letter words. Any new development during the next 12 to 18 months will be built to suit, as developers shy away from speculative projects based on population growth. The CMBS problems promise to provide some fireworks while vulture capital is stalking, ready to acquire discounted real estate. Those with the cash and foresight to buy in this market will have a basis significantly below replacement value and will ride the market up and profit handsomely.

— Craig Viergever is a founding partner of Atlanta-based Bryant Commercial Real Estate Parners.

Atlanta Retail Market

Consumer confidence seems to have hit the pause button during the first quarter of 2009 as most consumers wait to see if the new government policies will have an impact on their pockets. Although confidence is no longer in freefall, most consumers are reluctant to change their concerns about future income and employment. This is particularly the case for Atlanta; the unemployment rate rose from 7.5 percent in December to 9.3 percent in February. In other words, consumer expectations of personal income have to show some signs of improvement before any good news for the general economy can be translated into positive gains for the retail sector in Atlanta.

For the most part, consumers have continued the spending patterns that were observed during the last part of 2008, focusing on bargain and necessity shopping. As mentioned in the fourth-quarter report, the continued focus on bargain and necessity shopping will maintain positive gains for low price leaders such as Wal-Mart and for fast food and fast casual restaurants. In one of the most telling stories of the current state of the retail sector, the well-known Streets of Buckhead project has delayed construction as economic woes have continued.

Many economists think signs of national economic recovery will start to show during the second half of this year. This will lead to additional business and leisure travel as well as increased personal consumption, all of which should be able to translate to an immediate and observable impact on the Atlanta retail sector.

The entire world’s economies entered a global recession during the past 6 months, reaching depths and an expanse unlike any in history. The crisis touched every economy and implored every governing body to take action to ease the stress of the impending financial difficulties. The United States’ employment level is at 8.1 percent. Stock exchanges have reached 1993 levels. Atlanta’s recession is expected to last anywhere from 6 to 18 more months. The nation as whole has a dimmer picture, and the recession might stick around for up to 24 months. The length and depth of this contraction depends heavily on current actions in Congress, but the total effects will last much longer.

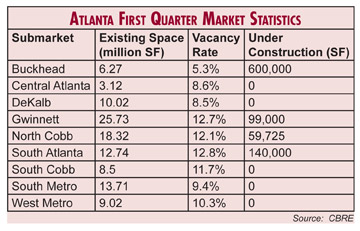

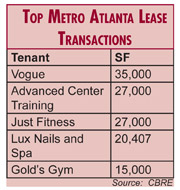

The first quarter of 2009 has seen a continuation of weakened demand and increased inventory. These factors have forced vacancy to rise above 10 percent for the quarter. As personal consumption remains low, many stores have gone out of business and many of the remaining retailers’ only moves have been to either restructure or downsize. Despite the current situation, many major projects, such as the previously mentioned Streets of Buckhead and the Midtown Mile, are set to deliver during the next couple years and look to provide a big boost to the retail sector.

After showing positive gains for 2008, absorption for the first quarter of 2009 reverted to negative, posting 378,629 square feet of losses. While seasonal demand pushed absorption up to end 2008, the first quarter of this year has been much more representative of the effect fundamental supply and demand factors have on absorption. Many factors, such as decreased demand, a reduction in discretionary spending and consumer uncertainty have led to retailers either staying put or going out of business. This further pulls absorption down. During the first quarter, the Northeast Atlanta submarket was the only submarket that experienced significant gains, with absorption recorded above 460,000 square feet.

The current economic conditions have forced many tenants to avoid higher-end space and remain in their current spaces or search for less expensive space. The result has been a leveling of lease rates. Lease rates increased just $0.02 per square foot from the fourth quarter to end the first quarter and now stand at $14.37 per square foot. With tenants searching for less expensive space, the two most expensive submarkets, Buckhead and Central Perimeter, and the largest submarket, Gwinnett, have felt the effects. Buckhead and Central Perimeter saw decreases of $0.53 per square foot and $0.82 per square foot, respectively, and Gwinnett experienced a $0.39 per square foot decline in rents.

— Mike Neal is a senior vice president in CB Richard Ellis’ Atlanta office.

Atlanta Multifamily Market

After many years of record-setting sales transaction volumes and plunging cap rates, the Atlanta multifamily market is now feeling the affect of three strong trends. The credit crisis, the softening job market and the oversupply of total housing units are all causing problems in the current market. This combination of factors has resulted in a dramatic reduction of sales transactions as well as upward pressure on cap rates. The fourth quarter of last year and the first quarter of this year were extremely slow. Compared to past years, there were very few sales transactions in the multifamily industry.

During the fourth quarter of last year and the first quarter of this year, investors were uncertain about the direction of the apartment market as well as the overall economy — were things going to level out, or were brokers in for another quarter of declining activity? The start of the second quarter shows evidence that the market may be loosening slightly, with the closing of several transactions at significantly reduced pricing relative to levels experienced in the first three quarters of 2008. These completed transactions foreshadow the direction of the market for the remainder of the year. Currently, from the high point in mid-2008, cap rates have risen 50 to 100 basis points for the highest quality assets and 200 to 250 basis points for the lower quality assets.

The aforementioned oversupply of housing began several years ago and was fueled by the robust development of for-sale housing throughout the Metro Atlanta area. This growth was enabled and might have even been encouraged by hyperactive residential mortgage lending. With a historic pattern of excessive construction and development, combined with an equally strong trend of population and job growth, the Atlanta market was a perfect storm for the housing bubble that finally burst in the middle of last year.

As we move toward the halfway point of 2009, the impact of the subprime meltdown and the excessive housing supply has contributed to an alarmingly high single-family foreclosure rate in excess of 7,500 single-family units per month. A significant percentage of those foreclosures are working their way back into the rental stock, thus putting pressure on an already weak apartment market.

Further compounding the multifamily problem is the softening Atlanta economy, which is contributing to job losses. After a decade of strong job growth, the Atlanta economy is currently retrenching slightly, with the expectation of approximately 50,000 jobs lost in the first quarter of this year.

The softening apartment market, combined with the collapse of the capital markets, has contributed to significant foreclosure activity of multifamily rental communities. To date, the majority of the distress in the apartment sector has been in lower-quality assets, primarily C and D properties. Recently, however, several B-quality assets have been foreclosed with numerous other scheduled or already in process.

In addition to the softening apartment fundamentals, the recalibration of values is being driven by a noticeable change in investor psychology and the lack of financing available. The list of reliable lenders in the market today has become very short, with Fannie Mae and Freddie Mac still providing debt, but at substantially constricted underwriting guidelines. There are only a few regional banks willing to lend, and these loans are typically at 50 percent to 70 percent LTV ratios and full borrower recourse. Investors demand strong cash-on-cash returns, based on historical, in-place performance, rather than future-looking proformas.

Opportunity is on the horizon, as many investors are gearing up to acquire re-priced assets that can be purchased with attractive yields.

— Marc Robinson is the managing director of the Atlanta office of Southeast Apartment Partners.

Atlanta Hospitality Market

In March 2008, tornadoes ripped through downtown Atlanta, tearing holes in the Georgia Dome and the Georgia World Congress Center, damaging signature hotels — such as the Westin and the Omni — and blazing a path of distruction through downtown and other parts of the city. The disaster interrupted the Southeastern Conference basketball tournament and several other events, throwing the city into a short-term hospitality tailspin. Months later, the nation’s economy tumbled, brought on by the collapse of major financial institutions. Combined with a new wave of hotels set to hit the Atlanta market in 2009, Atlanta’s hospitality industry was faced with a seemingly perfect economic storm.

PKF Hospitality Research reports that Atlanta’s decline in hotel revenue per available room was worse than other national markets in 2007 and 2008, but the research firm predicts that Atlanta will return to positive revenue trends by 2010. This and additional recent industry data indicates that Atlanta’s hospitality market may be quicker to recover than other major cities. Rubicon, a leading provider of forward-looking booking trends for the hospitality industry, reports in the March issue of the North American Hospitality Review that Atlanta’s occupancy on the books for the remainder of 2009 compared to the same time last year is down by 15.6 percent. This is nearly 7 percentage points better than the national average, which is down by 22.6 percent. Furthermore, average daily rate for the balance of 2009 is currently tracking at -3.2 percent in Atlanta, compared to -6.3 percent nationally, based on reservations currently on the books compared to the same time last year.

Atlanta’s strength in the convention and business markets may play a key role in its recovery. The most recent slowdown in the group segment is evidenced by very poor recent activity in Honolulu and San Diego; group bookings in those cities during the past 30 days are down 90 and 70 percent, respectively, over the last year, according to Rubicon. While also suffering, Atlanta is only down 30 percent. Therefore, certain resort markets are getting slammed, while the effect is muted in the more business-oriented markets.

Anxiously awaiting the turnaround is a host of new hotels in several submarkets of Atlanta. On the Southside, Grove Street Partners is currently developing two new hotels — Marriott and Springhill Suites — as a part of its new $250 million mixed-use Gateway Center development. Located adjacent to the world’s busiest airport, the hotels’ prime location next to the Georgia International Convention Center and its mixed-use setting will create an ideal location for conventions and business travelers. Starwood has opened three W Hotels in Atlanta in the past few months. In Buckhead, the St. Regis and The Mansion on Peachtree are introducing a new combination of luxury hotel space and high-end condominiums. In Midtown, a new Loews Hotel will be the focal point of a $500 million mixed-use development, set to capture a unique audience with its contemporary urban appeal. Loews, as well as Kimpton’s new Palomar hotel, will benefit from that sub-market’s strong business and entertainment district.

“Everyone is affected by the downturn, and hotels are no different,” says Beau King, president of Kim King Associates, developer of Midtown’s Palomar. “But the original premise for why we built the hotel is still valid: the Midtown market is still underserved compared to other submarkets in Atlanta and should be one of the first to recover. In the long run, we are all happy to be doing business in Atlanta.”

— Jim Stormont is a principal at Atlanta-based Grove Street Partners.

Atlanta Office Market

These haven’t been the easiest times to maintain optimism or even a somewhat sunny outlook, which is a crucial characteristic for those of us who lease office properties in Atlanta or anywhere else in the United States. Everywhere we turn, we’re constantly pounded with negative economic news as the pillars of American industry teeter and equity markets gyrate. But unlike the frozen credit markets, at least the reeling equity markets aren’t completely stagnant.

We’re starting to see signs of life, and the main question on everybody’s mind is have we hit bottom? Let’s hope so. There are a few early indicators pointing up, and long-term prospects suggest that metro Atlanta can maintain the growth that transformed the city during the past 30 years. First, Jones Lang LaSalle research has found that metro Atlanta’s office markets, including sublease space, absorbed 182,432 square feet in the first quarter of this year. That would’ve been a bad quarter in 2006, but coming off a year where the office market had negative net absorption of more than 850,000 square feet, we’ll take it. Unfortunately, the urban markets — Buckhead, Midtown and Downtown — posted negative net absorption of 47,640 square feet in the first quarter. Atlanta’s suburbs absorbed 230,000 square feet, with direct vacancies hovering at 17.6 percent.

As an added bonus, and unlike other downturns metro Atlanta has experienced, current construction in suburban Atlanta is negligible: 108,700 square feet in a 76.7 million-square-foot market. Downtown, too, has no new construction. On the other hand, Midtown and Buckhead have the preponderance of metro Atlanta’s new office construction. Midtown’s Atlantic Station and 12th & Midtown mixed-use developments have more than 1.2 million square feet under construction, but each property has significant preleasing. The same is not true for Buckhead, which has more than 2 million square feet under construction and lacks preleasing. This is a headache not only for the leasing agents of the new developments but for the existing properties as well. Buckhead developers — Duke Realty, Cousins Properties, Tishman Speyer and Crescent Resources — are among the most stable in the country, but a lack of preleasing has to leave them anxious, especially in a submarket where the average tenant size is approximately 7,000 square feet.

Still, there are plenty of large office-space users evaluating the market. Alston & Bird’s lease expires in 2013, and the law firm submitted RFPs in March for approximately 400,000 square feet in a new building. Fisher & Phillips’ lease expires in 2010, and the firm is on the hunt for 50,000 to 60,000 square feet in Midtown and Buckhead. KPMG, too, seeks about 150,000 square feet in Midtown or Buckhead, while Marsh is in the market in Buckhead for approximately 140,000 square feet. Another law firm, Hawkins & Parnell, seeks approximately 70,000 square feet in Midtown or Downtown, while SunTrust is reportedly evaluating downtown office properties in its search for more than 200,000 square feet.

As we fight through the current market, we’re finding more tenants signing short-term leases, which are perfectly fine, especially for second-generation space. While tenant-rep brokers would like to lock in longer-term deals because of unprecedented opportunities, their clients’ survival instincts push toward shorter terms. For owners and landlords, this means less capital outlay, less free rent, lower commission payments and the opportunity to reset rates in 3 years when, hopefully, we’re on the other side of this moribund economy.

Tenants aren’t disappearing, as they did in the aftermath of the dot-com bubble. They may be struggling, but they’re coming to brokers early to restructure and extend their terms or work out options for subleasing space and, most important, they are still paying rent.

— Jeff Bellamy is regional director of Jones Lang LaSalle’s Atlanta office.

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|