|

CITY HIGHLIGHT, NOVEMBER 2004

RICHMOND WELCOMES ROUTE 288

The Richmond, Virginia, metropolitan statistical area has

finally topped the million mark in terms of population, continues

to be above the national average in terms of income, and continues

to attract new companies willing to relocate their headquarters

and facilities to take advantage of the quality of life and

minimal commute times. This positive outlook on Richmond is

reflected in the consistent growth in the retail market. The

biggest complaint is the lack of inventory in desirable markets.

|

|

TGM Development has opened

Westgate at Wellesley, which is

anchored by Panera Bread, Bertucci’s and

Starbucks Coffee.

|

|

Current retail vacancies in the market continue to hold steady

at less than 9 percent, with the Northwest and Southwest submarkets

encompassing more than 88 percent of the retail square footage

at 4.25 percent and 12.49 percent respectively. Rental rates

have continued to rise with rates for new construction exceeding

$20 per square foot in most areas; the highest rates are in

the Short Pump area, with some projects reaching into the

upper $30s.

New retail developments continue throughout all quadrants.

In Mechanicsville, Hanover Square South, anchored by Target

and PetsMart, is under development, and new retail projects

continue along the corridor including a proposed Lowe’s

Home Improvement Warehouse. In Colonial Heights, Circuit City

recently opened and Blackwood Development is expanding Dimmock

Square by adding Best Buy and Old Navy. The northwestern quadrant

continues to feed on the excitement of Forest City’s

Short Pump Town Center with Parc Place breaking ground, the

opening of TGM Development’s Westgate at Wellesley anchored

by Panera Bread, Bertucci’s and Starbucks Coffee, the

construction of Promenade Shops anchored by Hearth & Home,

as well as Short Pump Town Center’s own Lord & Taylor

replacement being lead by the opening of The Cheesecake Factory

and the signing of Orvis. The Chester market has Kohl’s

back-filling a vacant Lowe’s and the Stratford Hills

area of Richmond is home to a new Target and Ukrop’s,

both of which are under construction. Downtown and its immediate

surrounding markets continue to hold their own with the continued

interest in loft housing and urban living spurring new retail

developments and redevelopments. The northern quadrant isn’t

to be left out with the completion of the newly relocated

Atlee/Elmont interchange in the Virginia Center Commons submarket

spurring several new developments including the Northcross

Center to be anchored by The Home Depot.

The most significant new development to affect retail since

the arrival of two malls within one month isn’t a new

retail development — it’s a freeway. Route 288 is

due to be completed by the end of 2004 and will finally connect

I-95 south of Richmond with I-64 to the west, linking some

of the most affluent areas in the MSA. The completion of Route

288 is expected to shorten commuting times by up to 45 minutes

and generate additional growth along this corridor. The true

impact of Route 288 and its influence on the shopping community

as well as the reality of new developments along this corridor

will be told over the next few years.

— Connie Jordan Bradford, vice president, Thalhimer/Cushman

& Wakefield

Suburban Office

The Richmond suburban office market saw a significant office

building sale this summer with the transfer of two landmark

buildings to a partnership based in Northern Virginia. RER

Equities Inc. and its partner New Boston Fund paid $16 million

for the former headquarters complex of Capital One, one of

the nation’s largest credit card companies. (Please see

sidebar below for more details.)

Capital One, now the largest employer in the Richmond MSA,

began as the credit card division of Bank of Virginia, which

later changed its name to Signet Bank. Signet sold off the

division, which became Capital One. Capital One experienced

tremendous growth in Richmond, driving the office market during

the late 1990s. In 2000, Capital One acquired a large tract

of land west of Innsbrook in a project called West Creek.

Capital One has since constructed close to 1 million square

feet in the complex and located its corporate headquarters

in the Tysons Corner area of Northern Virginia. During the

last few years Capital One has vacated substantial speculative

office space in favor of its own campus. Capital One will

lease back the office buildings through the fall of 2005.

Bruce Levy, CEO of RER Equities Inc., sees the acquisition

as an excellent opportunity to offer large blocks of office

space to Richmond’s corporate community. Although Richmond

is experiencing vacancy of about 11 percent overall, there

are few opportunities for those office users seeking blocks

of contiguous space in excess of 50,000 square feet. Both

buildings have floor plates of more than 40,000 square feet,

which is rare in the Richmond speculative market. Due to their

age, the buildings would be considered Class B in the suburban

market. The new owner plans to take advantage of their prime

location and upgrade the buildings to Class A status. RER

Equities Inc.’s partner New Boston Fund has acquired

numerous office building investments in Boston, Indianapolis

and the Washington, D.C., area. The former Capital One complex

represents its first venture in Richmond.

— Jeffrey Cooke, SIOR, senior vice president, Thalhimer/Cushman

& Wakefield

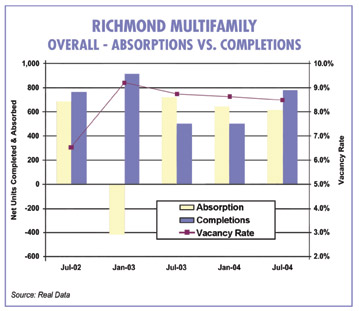

Multifamily

The apartment market in Richmond has held steady over the

last 18 months. Occupancy rates range from the mid to low

90s throughout most of the area’s submarkets. Henrico

County, with its high concentration of office parks, remains

one of the region’s top employment areas. The apartment

market in this area is capitalizing on its proximity to employment.

The area has the highest occupancy rates in Richmond according

to the latest report from Real Data, which tracks apartment

market statistics throughout the Southeast. Rental rates among

existing communities are up approximately 2.5 percent in the

last 12 months, according to Charles Dalton at Real Data.

Despite the announcement earlier this year by Capital One

that it would lay off 2,500 employees in the area, Richmond’s

employment base has expanded over the last year. The most

notable announcement was Infineon Technologies’ plan

to expand its Henrico facility by 1,200 employees.

With developers adding approximately 600 new units every 6

months and the number of renters expanding by slightly more

than 650 every 6 months, supply and demand have remained in

equilibrium over the last 18 months. As of August, there were

12 separate apartment communities under construction. Development

activity is concentrated along the James River in the center

of Richmond and in Chesterfield County along Route 288.

In central Richmond, Forest City Residential continues to

add units in its River Lofts of Tobacco Row development. The

former Luck Strike building is next up with 142 units. Daniel

Corporation is developing apartments as part of its mixed-use

project on Brown’s Island, which is on the James River.

Several other projects are either underway or planned along

the James River and downtown Richmond, including the redevelopment

of the John Marshall Hotel into 178 upscale apartments.

Route 288 is the catalyst for development in Chesterfield

County. The extended thoroughfare will enable commuters and

residents to quickly traverse Chesterfield County from I-95

in the south to the employment areas of Innsbrook in western

Henrico County. The Bogese Companies has 536 units under construction

or planned in Chesterfield County. The Belvidere is under

construction and the River Forest is expected to begin construction

this fall. Other developers in the area include Crowne Partners,

EWN Properties, NRP Group and Edward Rose Company.

With more than 1,600 units under construction, occupancy

rates for the overall market are expected to remain in the

low 90s through 2005, according to Dalton at Real Data.

Industrial

Absorption in the Richmond industrial market continues to

occur with a boost expected in the Southside metro area and

Virginia/Tri-Cities region. Currently, there are a minimum

of three companies needing approximately 100,000 square feet

each, which have collectively centered their search on sites

located in the city of Richmond, Chesterfield County and Prince

George County.

|

|

Colortree Inc. recently purchased

the 98,000-square-foot former

Ben Hogan manufacturing facility on Villa Park

Drive.

|

|

Examples include Ryder Logistics, which has just taken an

additional 87,769 square feet located on Bells Road; the former

100,000-square-foot GCX distribution facility located off

Route 10, which is proceeding toward settlement; and two other

large distributors (both local and out of state) that are

looking to expand their presence in the metro Richmond/Tri

Cities market. One party has shown interest in a 108,960-square-foot

shell facility in Southpoint Business Park located in Prince

George County and the other party is entertaining leasing

new shell space at The Enterchange off Ruffin Mill Road in

Chesterfield County.

Upcoming vacancies include the former 80,000-square-foot Lumber

Liquidators’ facility fronting I-95 in Colonial Heights,

which is now available as a result of its recently announced

relocation. In addition, Brown & Williamson’s former

332,000-square-foot cigarette manufacturing facility on 147

acres in Chesterfield County has decided to close as a result

of its recent merger with R.J. Reynolds.

Related to new construction, Devon USA continues to be one

of the few developers which has delivered new speculative,

multi-tenant warehouse space over the last 2 years. By late

fall Devon is expected to finish its new 215,068-square-foot

warehouse space at the Enterchange at Northlake in Hanover

County.

Projected areas of growth include the corridor surrounding

the opening of the new Route 288 extension to the west/southwest.

Users have already begun to see the benefits, as the drive

from the busy Route 60/Midlothian corridor to West Creek takes

only 12 minutes.

Recent sales include the Interflex facility, a 55,000-square-foot

fully air-conditioned property located in the Ashcake Industrial

Park that just sold to Woodworth Virginia LLC for use as a

metal heat treating operation. Also, Colortree Inc., a local

printer, recently purchased the 98,000-square-foot former

Ben Hogan manufacturing facility on Villa Park Drive.

The vacancy rate for non-owner/user industrial properties

50,000 square feet and up has inched up slightly to 31 percent,

but is expected to decline over the next few months.

— Richard Porter, CCIM, SIOR, Porter Realty

| RER EQUITIES, NEW

BOSTON FUND BUY CAPITAL ONE BUILDINGS

A joint venture of RER Equities Inc. of Herndon, Virginia,

and New Boston Fund recently acquired the former headquarters

complex of Capital One on West Broad Street from Capital

One Financial Corporation. The two-building property totals

453, 660 square feet and covers more than 35 acres. It

is located near the intersection of Interstates 295 and

64, across the street from Innsbrook Corporate Center.

|

|

RER Equities and New Boston

Fund purchased the two-building Capital

One property on West Broad Street in Richmond,

Virginia.

|

|

The new owners plan to lease the buildings to corporate

tenants after Capital One, which leased back the space,

vacates the property in late 2005. Jeffrey Cooke and

Evan Magrill of Thalhimer/Cushman & Wakefield are

representing the joint venture in leasing the office

space.

A 5-acre undeveloped land parcel was included in the acquisition.

Under existing zoning, and subject to local requirements,

additional buildings can be developed on the site for

use as office space, office condominiums, retail, lodging

or other uses. |

| Office Condominiums

The condominium office development in Richmond is a relatively

new phenomenon. Condominiums developed in 2001 represented

only a small percentage of the marketplace with a handful

of condominiums sold, totaling 30,000 square feet of area

in the $100 per-square-foot range. In 2002, with the cost

of construction and sharp developers realizing a niche

market, other condominiums were developed with approximately

56,000 square feet sold in 2003 with pricing jumping to

the low $120,000s. Thus far in 2004, approximately 56,000

have been sold with another 20,000 square feet under contract,

with pricing ranging from $116 to $135 per square foot,

cold dark shell.

Not wanting to miss an opportunity, several developers

are now in the marketplace with approximately 151,500

square feet of space under construction and another 258,000

square feet of planned construction in the west end of

Richmond alone.

This development and these sales are obviously driven

by low interest rates and the availability of ownership

opportunities. Professional companies that are investing

in office condominiums typically occupy space from 1,500

to 10,000 square feet in size. These investors are usually

small- to medium-size firms, medical practices in particular,

showing a keen eye to those developments located near

medical facilities.

The suburban office market absorbed 352,100 square feet

of lease area in 2003. This does not include the condominium

absorption of 56,000 square feet.

As of mid-year 2004, our suburban marketplace has shown

a negative absorption of 198,752 square feet of office

space. In that time period, the condominium market grew

by 56,000 square feet of sold absorption. The shock to

the whole system could be that, in both suburban submarkets,

west end of Richmond and south Richmond, the projected

total development of condominiums, in terms of phased

development, could total more than 1 million square feet

of future development. It remains to be seen if there

is sufficient demand on the part of small business to

absorb all of the projected condominium development in

a timely manner. If one assumes a continuation of the

favorable interest rates and mortgage climate currently

in place, condominium developers should continue to prosper.

— Mark Douglas, CCIM, SIOR, senior vice president,

Thalhimer/Cushman & Wakefield

|

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|