|

SOUTHEAST SNAPSHOT, NOVEMBER 2004

Orlando Multifamily Market

|

|

Steven Ekovich

First Vice President

Marcus & Millichap

|

|

The Orlando, Florida, apartment market is gaining steam due

to strong renter demographics and a revived and bustling economy.

Improvements in fundamentals and a restrained construction

cycle have come together to raise investor interest in multifamily

acquisitions. Both local and national buyers are attracted

to multifamily properties that serve workers in Orlando’s

business services community in the Maitland area as well as

those located in submarkets to the south, which house the

theme parks’ expanding work force. This has resulted

in record-high prices for multifamily assets.

Metro-area apartment owners are benefiting from recent job

growth as many new employees are becoming first-time renters.

Local employers are on target to add 25,000 new positions

by the end of 2004, representing a 2.7 percent increase in

total area jobs. Leisure and hospitality sector payrolls are

on pace to grow by more than 20,000 employees by the end of

2004. Strong growth in business and professional services

and financial activities is concentrated in the office complexes

and corporate headquarters along the Interstate 4 corridor

north of Orlando, particularly in the Maitland area north

of downtown Orlando. Multifamily properties in the northern

suburb of Maitland continue to attract renters who wish to

live near their white-collar jobs.

Multifamily construction in the Orlando area has slowed

significantly when compared to recent years, and developers

will complete only 2,250 units this year. Together, the Southeast/Airport

and the Southwest/435 submarkets will account for half of

2004’s completion total. Developers are attracted to

these regions due to accessibility to theme parks to the south

of the Orlando central business district. There are more than

5,000 units filling the construction pipeline, the majority

of which are located in the southern portion of the metro

area. When delivered, the apartment inventory will have grown

by 4 percent, which is high by most metro standards, but will

be easily absorbed in Orlando where in-migration forecasts

are strong. More than half of the local construction volume

is made up of affordable apartment product rather than Class

A multifamily units.

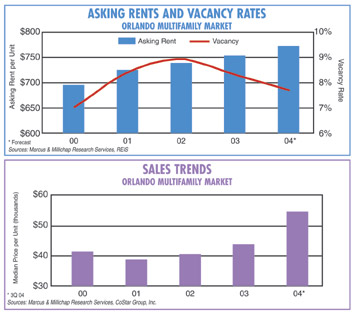

The average asking rent in the Orlando area is on target to

increase $23 in 2004 to $778 per month. Although local market

rents are low compared to other Eastern seaboard cities, rent

growth is occurring more rapidly. Submarkets with the highest

rents in Orlando are those in close proximity to the major

employment centers. Areas near theme parks support rents as

high $919 per month. Residents near the Maitland Office Park

attract residents willing to pay an average of $800 per month.

This year, the most significant rent growth — 4.4 percent

— is found in the Southwest/435 corridor, adjacent to

Disney’s property. Effective rents are beginning to gain

momentum as increases will be recorded in every Orlando submarket

by year-end.

Occupancy is rebounding strongly in Orlando and should improve

by another 60 basis points to end the year at a metro-wide

average of 92.3 percent. Gains in occupancy are the result

of stronger demand associated with an increase in local in-migration

and higher employment growth. Demand is outpacing new deliveries

and, as a result, absorption is on track to measure more than

2,900 units in 2004. The highest occupancy rates in the region

are found in the more mature submarkets to the north, such

as West Altamonte Springs and Northeast/ 436/551. Higher rates

of absorption, however, are found in the apartment communities

to the south where tourist-based employment is centered and

where the majority of available developable land is located.

After a slightly negative trend over the past 3 years, the

median sales price in Orlando is on track to increase by more

than 20 percent, to $52,000 per unit, by year-end. The $5

million-and-greater segment of the market is accounting for

a larger share of activity than usual, with sales of garden-style

properties containing more than 200 units being the rule rather

than the exception. This has prompted many sellers to put

together portfolios that are being greeted with strong interest

from out-of-state investors.

— Steven Ekovich, first vice president and regional

manager, Marcus & Millichap’s Orlando office

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|