|

CITY HIGHLIGHT, OCTOBER 2004

REAL ESTATE OUTLOOK POSITIVE ON CAPITOL

HILL

The Washington, D.C., commercial real estate market is healthy

in all sectors. New projects are being developed and, with

job creation on the rise, the outlook for the city and surrounding

areas is positive.

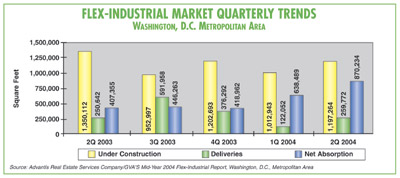

Industrial

The industrial real estate market in the Washington, D.C./suburban

Maryland and Baltimore region is seeing a renaissance of new

development with seven new projects under construction and/or

planned for 2005 and 2006 delivery. Previous years saw an

exodus of Class A industrial tenants from this region for

“greener pastures,” which offered large footprint

industrial buildings with lower rental rates. These new industrial

projects should finally bring Class A industrial tenants back

to the area.

There are several reasons for this spike in new development.

First, the “greener pastures” are much less available.

Land availability along Interstate 95 from Washington up through

Philadelphia is extremely limited and prices are now reaching

the same level as available land in the Washington area. Industrial

land prices range from $150,000 to $250,000 per acre or $13

to $17 per buildable square foot. Second, there is a growing

appetite for investment in industrial product in this area.

This capital has provided both the funding for new development

and an exit strategy (disposition) for speculative developers.

Partially fueling the investment appetite is the area’s

healthy market dynamics with a 9.4 percent vacancy rate. Net

absorption is steady and rental rates are climbing, with average

effective rental rates for Class A buildings at $5.95 per

square foot net and $4.85 per square foot net for Class B

buildings. Fully leased Class A and Class B buildings are

selling for sub-8 cap rates, and $80 per-square-foot prices.

The area’s retail sector and the federal government continue

to drive the market. Defense contractors have acquired industrial

space both for storage and redevelopment into inexpensive

office space. As the economy continues to improve, we are

seeing more and more corporate users expanding their operations.

The Home Depot, for example, continues to search for 400,000

square feet near Washington with literally no options that

size in existing buildings or build-to-suits.

— James Lighthizer, senior vice president, CB Richard

Ellis

Retail

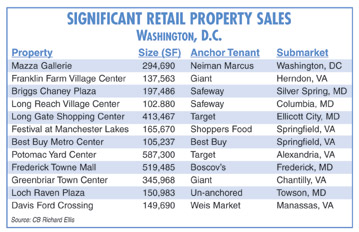

Current retail property capital market conditions are the

strongest they have been in the Washington-Baltimore metropolitan

area and in the U.S. in the past 20 years. The demand for

shopping center investments is extremely strong across all

retail property types and classes. Grocery-anchored neighborhood

and community centers, regional power centers, regional malls,

unanchored strip centers and mixed-use projects with retail

components are attracting strong investor interest and are

subject to a competitive bidding environment. This demand

is strong for both core and value-add retail opportunities.

Both are trading at a premium to their historic pricing levels.

Nationally, demand for retail investment properties is being

driven by low interest rates, the availability of debt and

equity capital, the lack of attractive alternative investments,

and the fact that retail properties as an asset class have

historically delivered one of the most stable and reliable

returns of all the real estate property types.

In the D.C. metropolitan area, demand for retail investment

properties is particularly strong for several reasons:

• Extremely low retail vacancy rates. Infill areas of

Fairfax and Montgomery counties have retail vacancy rates

of less than 2 percent.

• Zoning and land use controls that restrict future retail

development and prevent overbuilding.

• Strong regional economy that consistently outperforms

the US average.

• A long, consistent history of retail rental rate growth.

Capitalization rates for well-located, well-anchored, stabilized

shopping centers range from 6 to 8 percent. Pricing for the

very best neighborhood centers is now more than $275 per square

foot. The capitalization rate trade range is a much broader

and less meaningful benchmark for value-add retail properties.

This range has been as broad as 7 to 12 percent depending

on a number of factors, including occupancy, physical condition,

remaining lease terms, tenant credit, trade area competition,

and total cost for redevelopment plan execution and center

stabilization. As-is cap rate, stabilized cap rate, replacement

cost, interest carry cost during redevelopment and risk adjusted

development return hurdle rates are all factors that investors

evaluate in pricing value-add shopping center opportunities.

The combination of strong pricing and demand are resulting

in higher than normal shopping center sales volume. The active

investors include pension funds, real estate investment trusts,

high net worth individuals, offshore investors and opportunity

funds.

The pipeline of retail properties on the market, under contract

and coming to market in the third quarter continues at a high

level. The strong demand and increased investment sale activity

for shopping centers in the Washington-Baltimore metropolitan

area is expected to continue through the remainder of 2004.

— William Kent, executive vice president, investment

properties – institutional group, CB Richard Ellis

Office

The Washington, D.C., office market reached mid-year 2004

with strong leasing, investment and retail activity. With

108 million square feet of existing competitive inventory

and another 6 million square feet under construction, the

city has maintained an enviable vacancy level in the mid-single

digits. Market analysts are keeping a close watch on the northeastern

portion of the East End market, a notable, emerging micro-market.

A third of all new construction is concentrated within a few

blocks of the newly opened Convention Center. Currently at

9 percent vacant, speculative construction could force the

East End’s vacancy rate above 10 percent for the first

time since 1997. Once considered a fringe location, quality

sponsorship and first-class construction have attracted law

firms. The turning point for this micro-market came with Boston

Properties’ construction of 901 New York Ave. Additional

development by Louis Dreyfus Property Group at 1101 New York

Ave. and by JBG Companies at 1101 K St. will benefit from

being anchored on the east by 901 New York’s success.

Net absorption surpassed the 2003 total of 900,000 square

feet and reached 1.5 million square feet by July. As in 2003,

lease renewals remain the biggest competition to new construction

and five of the largest deals completed thus far this year

were renewals. At the same time, large law firms that inked

their last deals in the late 1980s and early 1990s and are

now facing expansion constraints are fueling the demand after

6 years of single-digit vacancy rates and 13.4 million square

feet of net growth downtown. These law firms, wishing to deliver

from both a national and international platform, are finding

a presence in the nation’s capital imperative. Short

of a major terrorism event, Washington will maintain its stable

occupancy.

Class A asking rents continue to climb, rising from $43 to

$44 per square foot in the first 6 months of 2004 — yet

fierce competition has enabled savvy tenants to secure large

concession packages from some landlords that have included

free rent — not seen with any frequency since the early

1990s — and assumptions of lease liability.

The vibrant investment market is continuing the blistering

pace set in 2003. More than $1.3 billion worth of property

has changed hands during the first half of 2004 with five

transactions in excess of $100 million. At present there are

relatively few properties formally being offered for sale

downtown, fueling an increase in speculative off-market activity.

Only the staunchest of long-term investors are turning a deaf

ear to the sound of investors clamoring for product. Several

properties that changed hands only a year ago are back on

the market and poised to provide their short-term owners significant

profits.

— Jay Olshonsky, managing director, CB Richard Ellis’

Washington, D.C., office

Multifamily

With the overall health of the market still being at very

desirable levels, the pipeline of new product in Washington,

D.C.’s multifamily market is substantial. Luckily, demand

for rental housing is keeping with this supply mainly due

to two reasons: jobs and conversions. The D.C. metropolitan

region is still leading the nation in new job creation, a

trend that is not temporary as it has lasted for several years

and is expected to continue, according to Stephen Fuller of

George Mason University.

Furthermore, as an alternative to rising single-family home

prices, the condo conversion craze continues to strengthen

the health of the market by depleting the inventory of new

units. Additionally, many former apartment sites are being

converted to condominiums before construction begins, thus

further lessening the number of units coming on line. One

apartment developer has been quoted to say, “I have been

as successful selling my property at the entitlement stage

as I have after stabilization.”

There have been several major mixed-use projects that have

either taken steps to become a reality or achieved recent

recognition. The formation of the Anacostia Waterfront Development

Corporation shows D.C.’s desire to move ahead on the

redevelopment of the Southwest Waterfront area after years

of being on the drawing board. In Virginia, a vibrant downtown

area will be created with the massive Potomac Yards mixed-use

development. The first stage of the project will include a

479-unit condo project developed by Comstock and 386-unit

luxury high-rise developed by Camden as well as a Harris Teeter

and more than 600,000 square feet of office space. The area’s

most recent development of significance is putting Prince

Georges County, Maryland, on the national map for mixed-use

developments with the announcement of the $3 billion project

called Rosewood. Just 120 miles east of Washington, the project

will be situated on 480 acres and is reported to eventually

contain 6,000 residential units.

Two different trends are taking place around the Metro region.

The first is based on demand for housing and the second is

based on supply of land. As noted by the recent, huge surge

in housing growth in more infill or urban population centers,

potential residents are drawn toward the live/work/play areas

with easy access to retail and public transportation. Areas

that demonstrate this trend in Maryland are Bethesda, Rockville

and Silver Spring; Alexandria and Arlington in Virginia; and

lastly the District itself. The demand is high for predominantly

high-rise living where residents can walk to restaurants,

shopping and the Metro.

The second trend is evidenced by the availability of land

for development in submarkets with pent-up demand located

in an environment that is receptive to development. In Virginia,

this has been demonstrated near the Fairfax Towne Center and

throughout Eastern Loudoun County, while in Maryland, this

is evidenced by several developments in Anne Arundel County.

— Drew White, Cushman & Wakefield’s capital

markets group, apartment brokerage services, Washington, D.C.

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|