|

CITY HIGHLIGHT, OCTOBER 2004

CRESCENT CITY REMAINS STEADY

New Orleans’ commercial real estate sectors have seen

varying degrees of success over the past year. Southeast Real

Estate Business asked three industry experts to comment on

current trends, new leases and developments, and their overall

impressions of the state of the market.

Office

The New Orleans office market has slowly recovered after being

hit with large amounts of oil company space dumped onto the

sublease market in recent years. However, two factors will

test the strength of that recovery over the next 12 to 24

months.

One factor is that much of the sublease space that has been

absorbed is approaching the end of the lease term. It remains

to be seen what percentage of those sublease tenants landlords

can hold onto, and at what rental rate. The other key factor

is the large amount of space currently occupied by oil companies

but with leases expiring between 2005 and 2006.

“The major unknown is what presence the major oil companies

intend to keep in New Orleans,” says Brian Rourke, an

office specialist with NAI/Latter & Blum Inc. “I

think everyone expects that a significant amount of space

will be coming back on the market over the next 2 years. Hopefully,

any pullouts of large users we might see will be offset by

the growth of smaller users entering the market.”

The market will need to hold onto a significant amount of

space to keep downtown Class A occupancy rates in the current

88 percent range. However, occupancy rates are expected to

remain above many markets, where the collapse of the telecom

and technology industries has decimated occupancy rate. Market

rents for downtown Class A space currently range from $13.50

to $15.50 per square foot.

The Class B market still has significant vacancy rates, with

more space likely to come on the market over the next 2 years.

Rates for Class B space currently range from $9.50 to $12.50

per square foot.

Class C space, once plentiful but undesirable, has all but

disappeared from the downtown picture. Strong demand for properties

for hotel and residential conversions has resulted in nearly

all downtown Class C properties undergoing redevelopment.

In Metairie, the only other significant office market in the

metro area, occupancy rates are slightly higher than downtown

at 89.1 percent occupied. Rental rates for Class A space are

much higher, however, and range from $19 to $21 per square

foot. For many users, the higher cost in Metairie is more

than offset by free or very inexpensive parking for employees.

For users needing more than a full floor of space, however,

downtown is the only option.

“Large blocks of space are unavailable in Metairie,”

says Rourke. “When an entire floor does become available

somewhere, it is quickly snapped up. For the big users, downtown

is the only choice.”

— Don Cooper, editor, NAI/Latter & Blum Market

News and Views

Retail

The New Orleans region is a hub for tourism, international

trade, university research, healthcare, maritime industries

and energy/petrochemicals. New Orleans also has developed

a niche in the film industry. Over the last 18 months, the

New Orleans metropolitan area has seen more than $200 million

in film and television production. The 10 parishes of southeast

Louisiana, centered on the city of New Orleans, account for

about one-third of Louisiana’s economy.

The riverfront area of New Orleans, which is comprised of

land abutting the Mississippi River, is heating up from a

development standpoint. Because New Orleans is surrounded

by water and is considered a mature market, major parcels

available in the city for development are limited. The riverfront

offers ample sites and has been discussed as the future location

of the expansion of the Ernest N. Morial Convention Center,

among other developments. Other areas experiencing significant

growth include the Westbank, Northshore and eastern St. Tammany

Parish.

Jefferson Parish is one of several proposed new sites in Louisiana

for the Isle of Capri Casino. Proposed plans include moving

the 289-foot Crown casino from Lake Charles to a site upriver

from the Huey P. Long Bridge. If the proposal is submitted,

a public referendum would likely be held. If the proposal

is successful, it would be the fifth casino in the New Orleans

area, but the only one on the river.

A new hotel at Harrah’s New Orleans Casino is expected

to open in early 2006. The $142 million, 26-story hotel will

provide an additional 450 hotel rooms to the New Orleans tourism

industry. As part of the project, two 19th Century-era buildings

will be returned to commercial use as part of the Fulton Street

retail development. Gordon Biersch Brewery Restaurant will

anchor Fulton Street when it opens its 11,000-square-foot

restaurant in the second half of 2004.

A water park is proposed to be located next to Zephyr Field.

Although there are five water parks within 90 minutes of New

Orleans, the development is part of the master plan for Six

Flags theme park. Jazzland Theme Park was recently acquired

by Six Flags, the largest theme park operator in the world.

The revised lease agreement calls for the investment of $25

million in improvements to be completed before the end of

the 2005 season.

Winn-Dixie is the leading grocer in New Orleans, with 33 stores

and a 32 percent market share, followed by Wal-Mart Supercenter

(9 stores, 21 percent share), A&P (18 stores, 19 percent

share), Save-A-Lot (7 stores, 3 percent share) and all others

(71 stores, 25 percent share). The market total for grocers

in 2003 was $2 billion. Retailers active in the New Orleans

market have included Target, Academy Sports, PetsMart, Lowe’s,

Bed Bath & Beyond, Whole Foods and Wal-Mart.

Wal-Mart Supercenter has opened a new location on Tchoupitoulas

Street in an area that was once a public housing complex.

After overcoming lawsuits, critics and months of objections

by preservationists, the 200,000-square-foot store was built

in a designated historical district. The opening marked one

of the chain’s few urban stores. Riverwood Shopping Center,

located at Airline Highway and U.S. 51, has been revitalized

with new retail shops after the opening of a new Home Depot

store last year.

In April, CA New Plan Venture Fund acquired Marrero Shopping

Center, a 69,259-square-foot shopping center located in Marrero

for approximately $3.7 million. Plans include redevelopment

with the expansion of its Winn-Dixie anchor. Investors in

the $500,000 to $3 million range are most active in New Orleans,

which currently has limited supply.

— Lynn Leonard, NewBridge Retail Advisors

Industrial

The New Orleans industrial market is characterized by the

seemingly contradictory characteristics of a lack of supply

along with a lack of demand. Al Davis, an industrial broker

with NAI/Latter & Blum Inc., says, “The limited supply

has helped to keep vacancy rates steady, but it makes it difficult

for end users to find just the right space, with just the

right facilities, transportation options and amenities to

meet their particular needs.”

At the same time, says Davis, there is not sufficient demand

for warehouse space to justify the construction of new spec

space. Despite occasional ups and downs, these two factors

have served to keep the market from slipping into decline

but at the same time also have hindered growth.

Most of the activity that is taking place involves transactions

under 25,000 square feet. According to figures compiled by

the University of New Orleans (UNO) Real Estate Research Data

Center, 62 percent of last year’s industrial transactions

involved less than 10,000 square feet and 81 percent involved

less than 25,000 square feet.

Cocie Rathborne, president of Rathborne Properties, a major

industrial property owner, confirms UNO’s findings.

“Our company owns and manages over 1 million square feet

in Harvey and Elmwood,” said Rathborne. “Last year,

we had no transactions over 10,000 square feet.”

The most significant change in the warehouse market is the

lack of available land in Elmwood, the premier industrial

area in New Orleans for the past 20 years. Rathborne’s

company has long been the major owner of developable land

in Elmwood. Rathborne and his partners are now finalizing

the construction of 50 industrial lots in the 12,000-square-foot

range. Beyond that development, the only remaining vacant

land in Elmwood is either small-sized lots scattered throughout

the park or not for sale.

The forecast for 2005 remains much the same. Until some significant

outside factors change either the supply or the demand side

of the equation, local experts expect to see the industrial

market remain in a state of balance with continued slow pressure

on supply.

— Don Cooper, editor, NAI/Latter & Blum Market

News and Views

MAJOR INDUSTRIAL

DEVELOPMENTS

Folgers constructed a 692,000-square-foot coffee packaging

and storage facility in Lacombe, Louisiana, in St. Tammany

Parish. The company then expanded its New Orleans East

roasting facility into space vacated when storage was

moved to Hammond.

Glazer Companies — Glazer has started site work on

a 190,000-square-foot, state-of-the-art expansion to its

existing facility in Riverbend. This will essentially

double its space in Riverbend.

FedEx — FedEx has doubled its space by moving its

facility from Jefferson Highway to James Business Park

Distribution Park # 1. FedEx now occupies 90,000 square

feet. The move also brings James Distribution Center #1

to 100 percent occupancy. This building contains 250,000

square feet and was constructed as spec space in 2001.

Randa Corporation — This move came about as a result

of the efforts to keep Wembley Tie from moving to Mississippi.

Because of the efforts of the state, St. Charles Parish

and numerous others, Randa Corporation decided to locate

its 165,000-square-foot corporate headquarters in the

James Business Park on 9.7 acres of land. |

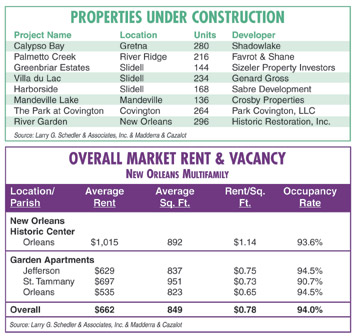

Multifamily

“Steady as she goes” is probably the best way to

describe the current status of the metro New Orleans apartment

market. The unique geography of the Crescent City has restrained

development and kept the inventory of 48,000 units in sync

with demand. As a result, the city enjoys a current occupancy

level of 94 percent with very few locations available for

future development.

The trend in multifamily development over the past year has

been focused on suburban developments, primarily north of

Lake Pontchartrain in St. Tammany Parish, a community that

boasts the highest income levels in the state and until recently

only a modest amount of professionally run apartment communities.

Currently there are eight properties that are in various phases

of development. These projects will add 1,738 units to the

market, five of which are being developed in St. Tammany Parish.

On the shore of Lake Pontchartrain in eastern St. Tammany,

Gros Development of Houston is developing 234 units at Villa

du Lac. Additionally, New Orleans-based Sabre Development

is developing 168 units at Harborside Apartments. Both of

these developments will offer residents waterfront locations

with boat slips, elevators, stainless steel appliances and

direct access garages. In the north quadrant of east St. Tammany,

Sizeler Property Investors, a publicly traded real estate

investment trust based in Kenner, Louisiana, has developed

Greenbriar Estates, a 144-unit community near Northshore Square

Mall.

Development is nearing completion in western St. Tammany Parish

in Covington, Louisiana, on The Park at Covington, a 264-unit

development by the Campbell Companies of Baton Rouge. In nearby

Mandeville, 136 units are ready for occupancy at Mandeville

Lakes, which is being developed by New Orleans-based Crosby

Development. Both of these communities will target upper-income

residents and offer high levels of unit amenities and features.

Also under construction is Calypso Bay Apartments, which is

being developed by New Orleans-based Shadowlake Management.

Calypso Bay will provide 280 super premium units to the Gretna

submarket, which has not seen a new multifamily development

in more than 20 years. The Favrot and Shane Companies of Metairie

has recently completed the Palmetto Creek Apartments in River

Ridge, which will add 216 units to a submarket that has virtually

no remaining prospects for additional units.

The “frontier” to watch is the downtown/uptown submarket.

Currently this infill location is the site of River Garden

Apartments, which will consist of 296 units on the former

site of the St. Thomas Public Housing Development. The property

is being developed in a mixed-use setting anchored by an urban

Wal-Mart. The project is the residential component of a tax

incentive financing and will require that 20 percent of the

units are set aside for low and moderate income residents.

In the next 12 to 18 months, infill locations in the downtown/uptown

sections of the city will be where developers set their sights.

The trend in the nearby warehouse district from rentals to

condominium regimes will create a continued demand for apartment

units in this historic corridor. We can expect some ground-up

developments but also redevelopments of older office buildings

in the central business district. This submarket is conveniently

located near the financial district, the medical corridor,

Loyola, Tulane and Xavier Universities, and the historic St.

Charles Avenue.

Just as the focus in the past has been on the higher-income

“lifestyle resident,” I would expect this trend

to continue. Average rental rates will not support the cost

of new construction. The moderate-income market is being adequately

serviced by the rehabilitation of the older, existing inventory.

The average rental rate in metro New Orleans is $662, which

calculates to $0.78 per square foot. Average rents range from

$443 for studio units to $1,031 for three-bedroom floor plans.

The average occupancy rate for metro New Orleans is 94.5 percent.

The restraints that the geography of metro New Orleans have

on new construction have created a franchise of sorts to developers

and investors. Although all markets are susceptible to peaks

and valleys, New Orleans has been, and should continue to

be, a stable market.

— Larry Schedler, CCIM, Larry G. Schedler &

Associates, Inc.

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|