|

SOUTHEAST SNAPSHOT, OCTOBER 2004

Birmingham Office Market

|

|

Barbara Bushnell

Associate Broker

Eason Graham & Sandner

|

|

The current trend in the Birmingham, Alabama, office market

is small- to mid-size space users who desire to own their

office facility. A shortage of buildings in the 5,000- to

10,000-square-foot range, coupled with an interest in multi-use

live/work environments, is spurring rehabilitation projects

throughout the city of Birmingham. Older structures in the

central business district are candidates for office and loft

redevelopment, while new construction in the suburban markets

is combining office, retail and residential uses.

“Large-scale office development is presently arrested

as a result of several years of market softness and sluggishness

in the rate of absorption,” says Barbara Bushnell, associate

broker with Eason Graham & Sandner. “The past year

has seen a significant reduction in the amount of sublease

space available and moderate tightening of overall availability.”

As a result, no new large, multi-tenant office buildings are

slated for construction until 40 to 50 percent of pre-leasing

commitments are secured.

A significant development that is sure to impact the market

includes two buildings built in the late 1980s to house BellSouth

Corporation. Located in Colonnade at the highly desirable

intersection of U.S. 280 and Interstate 459, the buildings

are being vacated as employees are relocated to other facilities

in the Birmingham area. The larger of the two buildings, totaling

430,000 square feet with 45,000-square-foot floor plans, will

be available first. The smaller 265,000-square-foot building

will be made available as demand warrants.

“This is a tremendous opportunity for Birmingham to attract

large regional space users,” says Bushnell. “Economic

development efforts in our market have historically been hampered

by the lack of large blocks of space which will now be available

at the Colonnade.”

The recent merger of SouthTrust Bank with Wachovia also will

have a great effect on the office market. The merger will

mean a significant loss of jobs in the Birmingham market accompanying

the loss of a major bank headquartered in the CBD. At the

same time the SouthTrust presence is waning, the recent merger

of Regions Bank and Union Planters is a positive development

drawing new bank officials to Birmingham.

The majority of growth in the market is occurring along the

U.S. 280 corridor — south and east of the CBD —

and along the I-459 beltway. “Growth is being driven

by proximity to new suburban housing developments, increased

traffic congestion along major arteries into the city and

occupational tax issues within the municipal limits of the

city of Birmingham,” says Bushnell.

Another growth corridor gaining momentum and worth monitoring

in the future is the Interstate 20 area between Birmingham

and Atlanta, being fueled by the location of the Honda plant.

New housing, warehouse and retail construction is underway,

with medium-sized office facilities likely to follow suit.

Though presently there is not an influx of new office developers

in the Birmingham market, the CBD has attracted some small

developers from larger markets involved in the retrofitting

older office and warehouse structures for loft development.

Most of the work is being transacted exclusively by local

developers or by local developers teamed with outside partners.

“Birmingham is a city that has largely grown from within

as opposed to having office space users relocated to the city,”

says Bushnell. “We believe that will change, especially

with the availability of space at the Colonnade.”

The largest space users include the large bank headquarters

— SouthTrust, Regions, AmSouth and Compass — and

the law firms in the CBD. With Birmingham poised as the legal

and financial heart of the state, Bushnell feels that with

Mercedes, Honda and Hyundai locating plants nearby, the city

will see an increase in engineering firms locating in close

proximity.

Birmingham’s national reputation as a leading medical

center and home to the University of Alabama at Birmingham

(UAB) also creates demand for office space. Nine percent of

the area’s employment base and six of the city’s

top 25 largest employers are healthcare providers. Additionally,

UAB is the largest employer in the Birmingham metro area.

The largest lease to close recently was for space in the U.S.

280/Southern market, which is expected to be a corridor to

keep an eye on in the future. Eason Graham & Sandner represented

Blue Cross/Blue Shield of Alabama in the 100,000-square-foot

lease at Meadowbrook, a development located south of the I-459

interchange on U.S. 280.

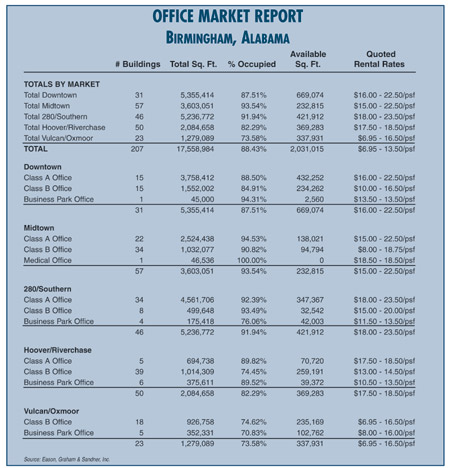

As of the end of the second quarter, Class A rental rates

in Birmingham range from $16 to $24 per rentable square foot.

The CBD rates fall in the $17 to $24 range, with the Class

A market experiencing 83 percent occupancy, having eight buildings

counted as Class A, multi-tenant facilities. The Midtown market

has offerings in the $16 to $22 range, with 19 Class A, multi-tenant

building at 96 percent occupancy. The U.S. 280/I-459 market

runs from $17.50 to $23.50, with 20 similarly described buildings

and a 93 percent occupancy as of June 30.

Though the SouthTrust/Wachovia merger will cause additional

vacancies downtown, the vacancy created by the availability

of the Colonnade space is viewed as a plus for the U.S. 280/Southern

market, with employers outside the Birmingham area showing

a strong interest.

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|