|

SOUTHEAST SNAPSHOT, OCTOBER 2004

Atlanta Industrial Market

|

|

Michael Demperio

Principal – Industrial Properties

Newmark & Company Real Estate

|

|

Due to the limited new construction during the past 4 years

in the Atlanta market, there has been no significant change

to the physical attributes of both the bulk industrial and

office warehouse structures, according to Michael Demperio,

principal – industrial properties with Newmark &

Company Real Estate’s Atlanta office.

Geographically, any future development will be occurring farther

from the center of Atlanta, as land availability is scarce.

“Thus, land values have increased substantially both

near the perimeter highway, Interstate 285 and in outlying

areas,” Demperio says. “Additionally, much of the

land that is geographically acceptable has been passed over

during the last expansion period and has engineering challenges.”

There are few new industrial developments that have been announced

in the past 12 months in Atlanta due to the recent real estate

recession. However, the large industrial parks that were developed

during the past 3 years still have land availability, and

these parks will attract a significant amount of build-to-suit

and speculative buildings within the next 3 years.

New tracts of bulk industrial land located within Atlanta

are priced at $70,000 to $125,000 per acre, which may make

industrial development cost-prohibitive.

“Therefore, Braselton, in northeast Atlanta near the

Mall of Georgia on Interstate 85, may experience future development,”

says Demperio.

Bulk warehouse rental rates are averaging between $2.35 and

$2.55 per square foot with 3 percent office, and office/warehouse

rates with a 20 percent finish are averaging $4.50 to $5 per

square foot.

The south side of Atlanta is still an attractive alternative

with numerous tracts of affordable developable land. “Nevertheless,

at this time, there are limited new proposed projects due

to the competitive leasing climate,” Demperio says. “New

construction will not be feasible until the vacancy rate drops

and the rental rate rises substantially.”

In the near future, the corridors of Interstate 20 west, Interstate

75 south and Interstate 85 south should continue to be areas

of interest due to the excellent labor source, a large availability

of land and excellent accessibility. At the current time,

however, the majority of the industrial real estate development

is taking place south of Interstate 20 and Hartsfield-Jackson

International Airport. “The main reason for the development

in this area is the lack of available land in northwest and

northeast Atlanta, coupled with lower land prices,” he

says. “Labor is cheaper and the area provides better

accessibility to the interstates and to the airport/airfreight.”

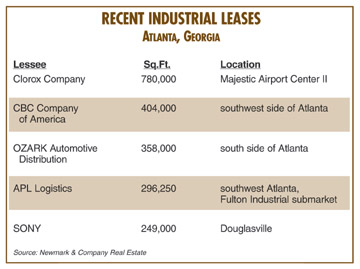

Catellus recently has made a major entry into the Atlanta

market by developing a 900,000-square-foot building for APL

Logistics. Cousins Properties also has announced its intention

to develop industrial properties, and it currently has at

least one property under contract and others in review. “These

developers are paying more for land to get entry into the

Atlanta industrial market and only time will tell if they

can hit their proforma numbers,” Demperio says.

“Most of the bulk developments are attracting large national

and international companies that have very simple distribution

needs, such as high clear ceilings, trailer storage and access

to the interstate,” he says.

Atlanta’s vacancy has recently decreased to 14.4 percent,

which includes all industrial space. Atlanta had a positive

net absorption in the first quarter of 2004, and the second

quarter resulted in almost 3 million square feet. Unfortunately,

the vacancy rate is still too high for rent appreciation.

The south side of town has numerous large bulk industrial

blocks available: Catellus has 450,000 square feet; Opus has

500,000 square feet; Duke has 500,000 square feet; Carter

has 500,000 square feet; and Panattoni has 450,000 square

feet.

“Atlanta is still a tenants’ market,” says

Demperio. “And if the next 2 years provide positive net

absorption as seen historically — 10 million to 12 million

square feet per year — we should see rent growth and

additional industrial developments.”

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|