|

SOUTHEAST SNAPSHOT, OCTOBER 2004

Jackson Multifamily Market

|

|

Blake Pera

Vice President

CB Richard Ellis

|

|

Jackson, Mississippi, like many other Southeast markets,

is seeing a rising trend in multifamily development in the

form of mid-sized tax credit properties. “A lack of available

land in upscale suburbs has tempered high-end construction,”

says Blake Pera, vice president of CB Richard Ellis’

Memphis, Tennessee, office.

Two significant tax credit properties have recently completed

construction and begun leasing in Jackson. Highland Park,

a 152-unit complex, is located in north central Jackson just

off Interstate 55. The 84-unit Park Springs is located in

the Clinton submarket of Jackson. Park Development of Jackson

developed both properties.

Recent market rate properties that have completed construction

include The Gables, with 168 Class A units in Ridgeland, and

Bridgewater, with 224 Class A units in Brandon. Heritage Properties

of Madison, Mississippi, developed these communities.

Two tax credit properties totaling 328 units, one in southwest

Jackson and one in the Pearl/Richland area, are under construction

should be completed later this year. Additionally, a market

rate property in northeast Jackson totaling 248 units also

will be completed by year’s end.

With the new Nissan manufacturing facility just north of Jackson,

it seems probable that the majority of development would be

in north central or northeast Jackson. “Although there

is development in these areas,” says Pera, “developers

seem to be banking on the solid growth of the entire market

for the future strength of the area, as they branch out into

nearly every submarket of Jackson.”

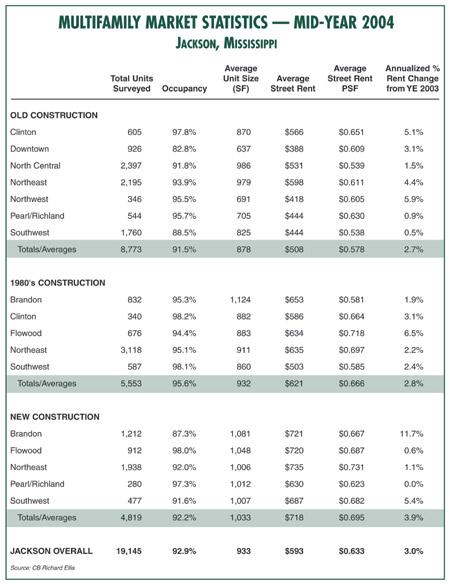

The overall average rental rate in Jackson is $593 per unit,

a 3 percent annualized increase over the year-end 2003 rents.

Rates range from an average low of $508 per unit for older

properties, to $621 per unit for properties constructed in

the 1980s, to an average high of $718 per unit for new construction

properties. The vacancy rate is holding steady at slightly

more than 7 percent.

Downtown areas in many second- and third-tier cities have

a common bond in the redevelopment of their inner city and

the development of new housing units in areas that, in the

past, have been predominately industrial. “Many cities,

such as Memphis, Nashville and Little Rock, cannot develop

fast enough to keep up with the in-migration trend, which

is resulting in some of the highest rents in these markets,”

says Pera.

Downtown Jackson’s residential revitalization is slowly

beginning to take shape. “Recent efforts to clean up

the area, including the condemnation of a number of dilapidated

buildings, a new downtown police substation and a designated

economic redevelopment area, may breathe life into an area

rich in heritage,” says Pera. “Downtown Jackson

has the potential to become a hotbed for commercial and residential

development.”

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|