|

CITY HIGHLIGHT, OCTOBER 2008

WASHINGTON D.C. CITY HIGHLIGHTS

Wendy Feldman Block, Michael A. Royce, Edward Wolynec & Jon Eisen

Washington D.C. Office Market

As the economy slows, the Washington, D.C., region is feeling the impact. While the metro area continues to outperform most other metropolitan areas, the disparity between the health of submarkets inside and outside the Beltway has widened. Outside the Beltway, vacancy has risen and rents have dropped, while inside, vacancy has held steady as rents ticked higher. At the end of the summer, net absorption was slightly positive, indicating that supply and demand could approach equilibrium.

The District

In the District, a softening market in the third quarter created more options for mid-sized tenants in the 20,000- to 50,000-square-foot range. More and more mid-sized tenants opted for renewing their leases in an effort to sidestep the cost of relocating. Area landlords also became more aggressive in pursuing deals among the limited number of tenants seeking to relocate.

Vacancy in the District held steady at approximately 8 percent, and net absorption remained decidedly positive. As buildings delivered downtown, asking rents jumped higher as developers aimed to justify purchase costs. In the city’s downtown submarkets of the CBD and East End, rents continued to steadily climb. At the moment, developers remain bullish that large tenants will occupy any space they offer — and, for the most part, that has been true.

Emerging markets such as Capitol Riverfront and NoMa witnessed a slowdown in speculative construction. NoMa, which recently landed large deals with NPR and the Department of Justice, continued to compete with the Southwest in courting federal government tenants. Meanwhile, the Capitol Riverfront remains mired in a Catch 22: large corporate tenants await arrival of amenities, while retailers await more foot traffic.

Suburban Virginia

The Rosslyn-Ballston Corridor, Crystal City and Tysons Corner have seen the most tenant activity among Northern Virginia’s submarkets. The closer to Dulles International Airport one travels, the more new, largely empty buildings one sees. Due to depressed demand and the negative impact of the credit crunch, there is significantly less speculative construction in the outer suburbs than there was 18 months earlier. Vacancy in Northern Virginia (13 percent) has risen approximately 2 percentage points since the end of 2007. Absorption is negative, nearing 1 million square feet. Asking rents have resiliently held steady at an average of $32 per square foot for the last three quarters.

Suburban Maryland

Suburban Maryland’s vacancy rate crept into double digits at the end of the summer (10.5 percent), rising nearly a full percentage point from earlier in the year. The Bethesda/Chevy Chase submarket fared well in the third quarter, but softness in the Rockville submarket bogged down Suburban Maryland’s overall standing. To the dismay of area developers, very few large tenants were out in the market this year. Of the three 100,000-square-foot deals this year, two of them were renewals, and we have yet to see what the next few months will bring as the year comes to a close.

— Wendy Feldman Block is managing director with the Washington, D.C., office of Studley.

Washington D.C. Industrial Market

Vacancy levels and rental rates held steady in the Baltimore/Washington, D.C., industrial sector for the first half of 2008 despite a slowing economy. Leasing momentum continued due to the region’s proximity to major transportation systems and broad residential populations. Additionally, although financially-pressured consumers curtailed spending on retail goods, the weak dollar fueled exports and building demand for warehouse space near major international ports.

The year-to-date net absorption for the region was positive (+ 608,718 square feet). However, total occupancy gains registered 66.2 percent below 5-year averages, as industrial sectors adjusted to rising energy prices and leveling consumer spending and business investment.

While slowing business consumption and consumer spending are affecting some industrial markets upstream, most of the pressure is concentrated in suburban and rural locations that lack transportation access or have sparse residential populations. The densely populated Baltimore/Washington, D.C., market, with its key access to two international airports, regional highways and major port facilities, has maintained its velocity.

A project of note in the region is the Chesapeake Commerce Center at the Port of Baltimore. The development, an environmentally-friendly distribution project at the former General Motors site next to Seagirt Marine Terminal, will create direct access to the port of unequaled opportunity in the entire region. The eventual under roof construction will total greater than 1 million square feet. The expected increase in the container traffic at Seagirt will be satisfied and supported by the planned occupants of the buildings. With excellent transportation modes by rail and truck, the efficiency for distribution to the consumer will be greatly increased.

The majority of the new buildings under construction in the region can be found in Prince Georges County, and the space options for tenants in the flex market have increased significantly. This includes Steeple Chase 95, a 1.3 million-square-foot project; The Brick Yard, a 110-acre development with 1 million square feet of industrial space and a significant mixed-use component; and Konterra Town Center, which will eventually be a 4,000-acre business and residential development. Investors should keep their eye on this region for opportunities.

Moving into the third and fourth quarters of 2008, expect economic and employment growth within the Baltimore/Washington, D.C., region to be marginal compared to historical standards as businesses and consumers continue to act conservatively with spending and investment habits. Thus, while short term gains are unlikely during the next 6 months, longer-term projects remain solid. With the continued need by distribution firms to be in the region, there will be excellent opportunity for expansion. Currently, the pipeline of new development is in excess of 4 million square feet. While vacancy levels are expected to increase marginally during the short term, the historical absorption average figures of 2 to 3 million square feet per year will continue in the latter part of 2009 and into 2010. With new construction likely to be curtailed during the foreseeable future due to the difficulties of obtaining financing and construction loans, demand is likely to outpace supply in late 2009 and 2010.

— Michael A. Royce is a senior vice president with Jones Lang LaSalle.

Washington D.C. Multifamily Market

Washington, D.C., remains one of the top apartment markets in the nation. The federal government’s positive impact, a transient work force with a high percentage of renters and strong job growth numbers are the main reasons for this ranking. Not surprisingly, local, regional and national real estate players took note in a big way.

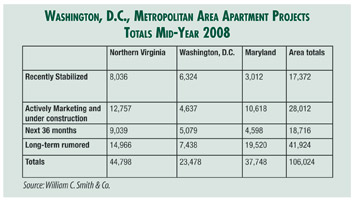

Residential is so hot that many commercial- and industrial-zoned parcels have been developed as residential. Transit-oriented projects are a developer favorite, and area planning authorities have pushed developers to create live, work and shop town-center environments. Numbers for current apartment development and projections for the next 48 months paint a realistic picture of the market. Some of the area’s most prolific apartment developers include Kettler, with 4,021 units in development or in the planning stages, and Archstone, who will develop 3,208 units. Camden’s projects have and will create 3,035 new units, and JPI and Fairfield are looking at 2,568 units and 1,875 units, respectively.

Even with all the new supply, the Washington market has done well. Annual absorption over the past 12 months was the best in the area’s history. The rental pipeline peaked in the fourth quarter of 2007, but now with the state of the financial markets, that pipeline will continue to decrease as it becomes more difficult to finance deals metro-wide. In 2007, there were 32 land sale transactions totaling $672 million for 10,949 planned units. Through the first half of 2008, there have been only three land deals totaling $33.6 million for 848 planned units. Rent growth has slowed slightly from the long-term average of 4.5 percent to 3.1 percent. Over the past 12 months, vacancy has edged up from 2.9 percent to 3.6 percent, but these are still dream figures for most markets in the United States. Developers are reprogramming their deals from high-rise condo projects to high-density wood rental projects. High-density wood projects are also being reprogrammed to surface parked, four-story walk-up products. The paradigm has shifted back to the rental model, causing revision of entitlements and sometimes significant adjustments to land prices.

There are, however, still opportunities. Industry experts are predicting that the members of Generation Y will have a dramatic impact on our market from 2010 to 2014. The twenty-somethings are said to prefer urban, emerging and green developments and are said to not be hung up with being home or condo owners. High gas prices will push even more renters to urban projects that are closer to work locations. Even the credit crisis will create opportunities for some. Some of the long term and rumored projects in the accompanying table will not get built, at least not by their current sponsor. Well- capitalized development teams will have opportunities to step in and get well planned but capital-stressed projects built.

Perhaps the most talked about suburban hot spots are along the D.C. metro’s silver line extension. Planned for delivery in 2012, experts say it will forever change development along the Dulles Corridor and that re-zoning around the new Reston stations will change their character from commercial and industrial to mixed-use. When completed, the line will stretch from Tyson’s to eastern Reston, down through Reston to Herndon and finally to Dulles Airport and Route 772 in Loudoun County.

The two new instant neighborhoods of NoMa and The Capitol Riverfront seem to present the most dynamic development opportunities. Currently 8,000 residential units are on the planning boards in NoMA. In the Capitol Riverfront neighborhood, more than 1,500 units are in construction or have been recently completed. 3,500 more are in the planning stages, and there is room for thousands more.

— Edward Wolynec is a broker with Washington, D.C.-based William C. Smith & Co.

Washington D.C. Retail Market

Retail activity in the Washington, D.C., marketplace might best be compared to a dog paddling in a pond; the dog moves slowly but steadily forward, but most of the action is happening underwater, where the paddling is fast and furious. There are many retail projects in pre-development that are being planned in anticipation of stronger economies in the years to come. Washington’s economy is buffered to a degree by the presence of the federal government and its legions of contractors, but retailers and landlords are feeling the pinch, just as they are elsewhere across the country.

In the metro area, vacancy rates are low — two to three percent — and available space is tight. Debt and equity thresholds have also changed dramatically. About two years ago, deals could be done with a certain amount of equity. Today, that equity might be 40 percent higher. As debt went higher, pre-leasing requirements went from approximately 20 to 30 percent to 50 to 70 percent over that same period. These new realities mean that the requirements are steeper to get into the build-it-and-they-will-shop game, so owners and landlords are working much harder to make the same deals in 2008 as they were 2 years ago. However, waterfront living is on the horizon in Washington. New mixed-use projects by major national and local companies are planned to revitalize waterways that have been largely ignored. Creative developers, land shortages and governmental support are among the factors driving this trend, which will take 25 years to fulfill.

The new retail projects cover the gamut. There are multiple infill developments, projects near close-in transit stations, adaptive re-use projects and major waterfront developments along the Potomac and Anacostia rivers. Suburban developments are also on the drawing boards, aimed at capitalizing on easy access to Dulles International Airport and up-zoned, 1970s surface parking lots. In most cases, redevelopments are popular town centers and mixed-use complexes, marrying apartments with shopping, entertainment, restaurants, libraries, skating rinks and civic centers. Mixed-use developments are not for the half-hearted or under-capitalized, however. Municipal officials clamor for lively town centers, but these officials are often slow to alter zoning laws to permit the projects or are reluctant to issue bonds to pay for expensive infrastructure. Faced with these hurdles, there is still an appetite for traditional strip centers and surface-parked office buildings.

There are many new retail projects sprouting inside the beltway. Close to Capitol Hill and the busy Union Station is NoMa, a large tract of downtown Washington. NoMa is a mix of large office buildings, shopping, retail and residential. A major federal agency is moving there, along National Public Radio, which is setting up new headquarters in the district. The Akridge Company is planning to bridge railroad and transit tracks with Burnham Place and build offices, homes, retail and a hotel.

City officials have just released a request for bids for Hill East at the edge of Capitol Hill. They have high hopes for a cool, emerging neighborhood that will build on the popular neighborhoods near the U.S. Capitol. The former McMillan Reservoir, a historic property replete with sand filtration silos, will be converted into a complex of shops, multifamily housing and offices. The reservoir and subterranean pumps still remain and will be incorporated into this new mid-city community. Washington’s Anacostia waterfront, home to its former NFL stadium, will get a major infusion of shopping, dining, residential and leisure activities. Developers such as Forest City are teaming with local experts to bring new life to this gateway location. The city’s former convention center is poised for redevelopment, with Hines and Archstone Smith joining together to populate the central-city location.

National Harbor is the show-stealer in the Maryland suburbs. This sparkling new complex along 1 mile of the Potomac River has booked its 2,000-unit Gaylord National Resort and Convention Center for the next 3 years. It boasts 250,000 square feet of retail and restaurant space, 400,000 square feet of conference and meeting space, three future hotels, 220 time share units, a marina and a waterfront promenade.

That’s tough to top, but some are trying. The University of Maryland is planning its East Campus with 420,000 square feet of retail and entertainment, a 200-room hotel, 2,000 apartments and 100,000 square feet of offices. Renowned developers Foulger-Pratt and Argo Investments Limited—retail revitalizers of downtown Silver Spring, Maryland—are crafting the plans. Park Potomac is emerging along Interstate 270 in affluent Potomac, Maryland, with a Harris Teeter, a Kimpton Hotel, fine dining and shopping, expensive condos and a new office building. Just north of that, the Crown Farm will take its place along Interstate 270 with 300,000 square feet of retail and restaurants, 2,000 homes and a new high school.

Virginia continues to be a strong retail market, and local officials are doing their part. Several retail and mixed-use developments are primed to go in Fairfax County. Officials there are considering offering TIF financing to jump-start three new complexes in the Dunn Loring area, recognizing the need to assist with creating necessary infrastructure.

Northern Virginia is expecting seven or eight new complexes to develop near rail stops around the proposed mass transit route between Tysons Corner and Dulles International Airport. These major planned developments will fuel strong growth and revenue in Virginia for decades to come. This is a submarket that could equal or surpass the massive redevelopment Washington, D.C., officials anticipate along its Anacostia waterfront.

— Jon Eisen is managing principal of Bethesda, Maryland-based StreetSense.

©2008 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|