|

CITY HIGHLIGHT, SEPTEMBER 2004

ACTIVE YEAR FOR LOUISVILLE

Grubb & Ellis|Commercial Kentucky, Inc.

|

|

Marriott Hotel is developing

a convention hotel in Louisville’s

central business district.

|

|

Louisville, Kentucky’s central business district is

awash in major new developments from destination entertainment

venues to major convention hotels, luxury high-rise residential

developments and a seemingly ever-expanding Waterfront Park.

Leading the charge is 4th Street Live!, an upscale entertainment

venue in the heart of the city, developed and dedicated this

summer by The Cordish Company of Baltimore. The complex includes

Hard Rock Café, Red Star Tavern, T.G.I. Friday’s

and Borders Books & Music. Just blocks away, Marriott

Hotel is completing a 617-room convention hotel, to be connected

by pedestrian way to the recently expanded Kentucky International

Convention Center. Scheduled to open by 2005 Kentucky Derby

in May, the hotel is expected to boost Louisville’s rapidly

expanding tourist, visitor and convention industry.

The 22-story Waterfront Park Plaza, consisting of 76 luxury

residential condominiums and 20,000 square feet of retail,

is scheduled to open this fall with over 50 percent of the

units already committed. Additional market-rate housing initiatives

are underway, including a Hope VI federal housing grant to

redevelop a six-block area adjacent to the Louisville Medical

Center.

While the pace of development in the suburban market pales

somewhat in comparison to the CBD, several major projects

are currently underway. The Fenley Real Estate Group recently

broke ground on a 240,000-square-foot build-to-suit for Anthem

Insurance of Kentucky at the Eastpoint Business Center in

eastern Jefferson County. Koll Development Company of Dallas

will complete a 175,000-square-foot build-to-suit for Citigroup

at Blankenbaker Crossings later this year.

Overall vacancy rates in the CBD have stabilized, while suburban

vacancy rates are declining as net absorption exceeds new

construction completions. Both leasing activity and positive

net absorption are anticipated for the balance of 2004, perhaps

giving rise to renewed interest in new construction as tenants

continue to demand more sophisticated product, larger floor

plates and above-standard parking ratios.

— Phillip Scherer III, president, and Jamie Schaefer,

research services, Grubb & Ellis|Commercial Kentucky,

Inc.

Industrial

The Louisville industrial market continues to interest institutional

developers as well smaller regional and local developers.

ProLogis recently has begun construction on a 437,000-square-foot

speculative facility along Interstate 65, the hottest developing

corridor in the region. In the same corridor, Main Street

Realty, a local developer, has just completed Louisville Metro

Commerce Center, a 517,000-square-foot speculative facility.

Nationwide Insurance has broken ground on its 231,000-square-foot

speculative facility.

These developers realize Louisville’s potential and its

strategic location for large distribution centers. They acknowledge

the potential of the area’s largest employer, United

Parcel Service, UPS Worldport and Supply Chain Solutions.

They also recognize the state of Kentucky’s business

incentive programs, which have the ability to attract and

retain new business to the area.

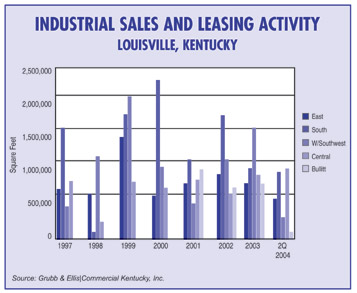

Louisville had an overall vacancy rate that stood at 10.9

percent at the end of second quarter 2004. This number has

fluctuated somewhat over the last 2 years but is only 0.9

percent higher than it was at the end of second quarter 2002.

Despite the growing vacancy rate, the market has experienced

a spike in sales and leasing activity and the aforementioned

speculative facilities occupy a niche with relatively low

vacancy, since Class A speculative facilities in excess of

200,000 square feet are rare finds in the Louisville market.

Louisville has seen its share of bulk industrial transactions

in recent years. Companies such as GUESS? Inc., Plastech,

Linens ’n Things, Union Tools, Alcoa, Tennant, PPG and

Dohmen Distribution all have found the state of Kentucky,

mainly the city of Louisville, as the right location. These

companies enjoy some of the most efficient, automated and

cost-effective facilities offered anywhere.

Louisville’s developer partners and its impressive tenant

base have continued their commitment to industrial development

and growth in the area. All have and will continue to benefit

from one another, ensuring the future success of the region.

— Stephan Gray, industrial sales associate, and

Jamie Schaefer, research services, Grubb & Ellis|Commercial

Kentucky, Inc.

Retail

The retail environment in Louisville continues to be active.

As previously mentioned, the retail dynamic creating the most

buzz is The Cordish Company’s 4th Street Live! development

in the CBD. The project is 50 percent open, with remaining

space scheduled to open throughout the year. This entertainment-style

retail development creates significant draw to the CBD now

with developers continuing to look further south on Fourth

Street for more retail space.

The biggest impact on the Louisville traditional retail market

will be the closing of the Winn-Dixie supermarkets in Louisville

and surrounding communities. The withdrawal of Winn-Dixie

in the Louisville marketplace creates a significant opening

for other retailers looking to expand in Louisville. The Winn-Dixie

stores should be closed by end of the year or early 2005.

The northeastern retail corridor, with Bayer Properties’

The Summit and CBL & Associates Properties’ Springhurst

Towne Center developments, continues to expand with the announcement

and beginning site work for Old Brownsboro Crossing. The Shoppes

at Springhurst will be the last retail development available

in the Springhurst Towne Center, which has been a stabilized

and extremely successful community draw for the northeastern

retail quadrant. The developer is currently talking to a department

store to anchor the Shoppes at Springhurst and has already

signed Panera Bread for the outparcel.

Class A retail vacancy rates continue to be stable in the

9 percent range throughout the city. Land prices in the new

development areas continue to set all-time highs, as do rental

rates in the suburban and the CBD marketplace. Small shop

space in the 4th Street Live! development gains rates in the

$40-per-square-foot range. The best available retail spaces

in the east end developments continue to push $25 per square

foot on a net basis.

— Craig Collins, retail sales associate, Grubb &

Ellis|Commercial Kentucky, Inc.

| ECONOMIC DEVELOPMENT

AUTHORITY GIVES LOUISVILLE A BOOST

Business has an ally in Louisville, Kentucky — the

Louisville Metro Development Authority (MDA). It’s

the place to come for one’s business needs, from

finding a good location or improving property to potential

tax breaks and financial assistance.

MDA’s mission is to enhance the quality of life for

metropolitan Louisville residents by encouraging high-caliber,

sustainable development projects, and by supporting new

and expanding businesses. MDA’s staff achieves this

by encouraging and promoting Louisville’s revitalization

and growth — including interaction with developers,

construction companies, real estate agents, businesses

and residents of the Louisville-Jefferson County metro

area to find out exactly what they want and what their

businesses need.

MDA is made up of four divisions that function together

to accomplish its mission — the Retail Development

Division (RDD), the Industrial and Commercial Development

Division, the Environmental Division, and the Business

Development and Financing Division. Specifically, RDD

encourages and facilitates the development of retail businesses

to enhance the quality of life in neighborhoods along

metro Louisville’s commercial corridors. Its goal

is to identify underutilized or vacant retail space and

convert those areas into vibrant neighborhood assets,

through the Corridors of Opportunity in Louisville (COOL)

program. It also assists business associations in Louisville

with startup and expansion issues, which can help bring

improvements and new businesses to commercial areas.

The retail staff uses its knowledge of the Louisville

market to work with residents, existing businesses, commercial

real estate agents and developers, lenders and government

agencies to facilitate redevelopment along these corridors

of opportunity. Services include site identification,

demographic analysis, industry expertise, advocacy in

the approvals process and retailer recruitment. |

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|