|

CITY HIGHLIGHT, SEPTEMBER 2004

TIER-1 CITIES: MAKE ROOM FOR MIAMI

Sophisticated real estate investors are sending a message

to the famed Tier-1 cities around the country with their wallets:

start making room for Miami, your counterpart of the future.

This proud city is making bold moves on several fronts to

position itself for tremendous prosperity in less than 5 years.

First, strong leadership in local government has created an

improved image of Miami as a preferred location for business

and travel. This repositioning has been legitimized in numerous

tangible ways, including upgraded bond ratings and growing

post-9/11 hotel occupancy rates. Secondly, the city’s

sustained standing in trade circles ensures its viability

as a hub for companies seeking to do business in Latin America.

The state and major Florida cities have supported Miami's

designation as the permanent home to the Free Trade Area of

the Americas (FTAA) Secretariat; this support is but one sign

of the esteem in which the city is held in the region.

|

|

Downtown Miami skyline

|

|

No longer considered a “banana republic,” Miami

has enjoyed success in drawing sizable investments into local

operations from world-class companies including HSBC (60,000

square feet on Brickell Avenue), Citicorp North America (140,000

square feet in a single building in Downtown Miami) and Kraft

Foods Latin America (40,000 square feet in Coral Gables).

In fact, Miami’s central business district and its top

two suburban office submarkets have enjoyed 750,000 square

feet of combined Class A net absorption since mid-year 2002

— an indicator of the resiliency of this market in the

midst of a prolonged national recession.

Still, ask anyone familiar with Tier-1 cities why higher honors

evade this metropolitan area of more than 2.3 million residents

and a typical response might be, “Miami lacks a 24/7

vibrancy — the place is dead after 7 o’clock.”

In an effort to draw more business and leisure travelers into

the CBD and surrounding areas, major hoteliers such as Mandarin

Oriental, Marriott and Ritz-Carlton have made feet-first commitments

to the future of this city.

However, the hospitality industry alone cannot drive the required

change because the real difference-maker in a New York City,

Chicago or San Francisco is the presence of year-round residents

of the urban core. So now, national and local developers from

Millenium Partners to The Related Group are building thousands

of condominium units with supporting retail and amenities

in the CBD — and in the Downtown submarket in particular

— in a move that will positively transform the concrete

landscape that becomes barren and lifeless after the close

of business into an energetic, round-the-clock cityscape.

In a time when lifestyle priorities increasingly dictate the

type and location of a business’s office space, very

few CBDs in North America will rival the immediate proximity

among commercial and residential high-rise buildings and all

of the amenities supporting this mix of consumers. Riverwalks

will highlight the waterfront nature of the development, and

a brand-new performing arts center will open only a few blocks

to the north, examples of the bonafide commitment the city

is making to elevate the livability of its downtown.

The significance of this residential development in Miami’s

core will be the growth in commercial real estate values of

well-positioned office and retail properties. Skeptics will

say, “Miami is too small and it does not attract enough

credit tenants.” True, Fortune 1000 companies rarely

choose Miami for their corporate headquarters or corporate

campuses. And naysayers are correct in that one does not need

all of the fingers on two hands to tally the number of 100,000-square-foot

office tenants in the major submarkets. But these facts have

not dampened the interest of institutional investors in Miami

as nearly every trophy property in the CBD has changed hands,

many at record prices. With rent growth forecasted and substantiated

in the underwriting of these assets based on the market dynamics

already in place, it is pivotal to note that most of these

trades occurred prior to the onset of full-scale residential

development in Downtown, suggesting that the upside in these

investments has likely been underestimated and, quite possibly,

by a sizable margin.

On the subject of demand, we wrote nearly a year ago that

“law firms — an often undervalued tenant category

— are responsible for sustaining demand for Class A office

space in Miami’s CBD.” This trend will clearly continue

through 2005 as most of the major transactions that have been

finalized, or are now under negotiation, have been with law

firms. It seems clear most firms are expanding or planning

expansions. White & Case renewed its lease for 85,000

square feet in Downtown for 10 years. Shutts & Bowen also

elected a 10-year term for its 60,000-square-foot renewal

at Miami Center, also in Downtown. Existing law firms representing

another 300,000 square feet are currently considering their

options and it is fully anticipated that the majority of these

firms will follow the lead of White & Case and Shutts

& Bowen and elect to be a part of this transformation

of the CBD.

We also commented a year ago that “Miami retains its

luster in the eyes of many investors because of its strong

supply-demand fundamentals,” explaining that developable

land is always in short supply and Miami’s preeminence

as the “Gateway to the Americas” creates steady

demand, even if it presents itself mostly in requirements

under 5,000 square feet. These observations ring especially

true for the Miami CBD, considering the immeasurably uplifting

effect that a soon-to-be-unveiled residential component will

bring to an otherwise bland Downtown. The countdown to Miami’s

induction into Tier-1 status begins soon.

— Eric Siegrist, senior vice president – leasing

and management, Jones Lang LaSalle Americas, Inc.

Multifamily

Job growth and a concentrated effort toward urban redevelopment

bode well for multifamily investment in South Florida, as

the area is expected to be one of the leading local economies

in the country. Employers are expected to add 53,000 jobs

in 2004, with 25,000 in the Fort Lauderdale metropolitan statistical

area.

In addition to condominium conversions, multifamily development

remains very active in South Florida, with construction of

dense, mixed-use space in urban centers and larger complexes

in the suburbs likely resulting in a short-term surplus of

units. We project the completion of 7,200 units in 2004, a

3.5 percent increase from last year. West Palm Beach alone

should account for 2,650 units.

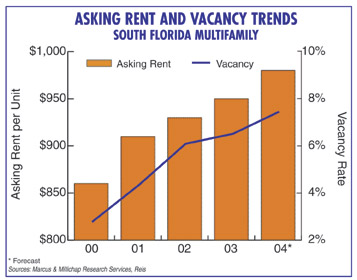

Despite rapid population growth, vacancy is moving steadily

higher in South Florida as a result of recent overbuilding

and a spike in demand for condo conversions. By year-end 2004,

vacancy should increase 70 basis points, to 7.5 percent. At

5.6 percent, Fort Lauderdale has relatively low vacancy due

to strong economic growth combined with an older, more stable

population.

South Florida’s asking rents have demonstrated a tendency

to rise steadily and should improve by 2 percent, to $981

per month, this year. The trendy South Beach submarket will

see the highest asking rent, which, at $1,439 per month, is

up 4.4 percent from 1 year ago.

Owing to robust employment gains, in-migration and tenant

demand, we envision another strong year for apartment property

sales in South Florida. The median sales price in South Florida

is forecast to exceed $68,000 per unit by year-end 2004, posting

an annual increase between 6 and 9 percent. A recent theme

across South Florida is the sale of assets in or near employment

centers as more tenants demand rental property in close proximity

to offices and away from tourist spots.

— Gene Berman, senior vice president and regional

manager, Marcus & Millichap’s Fort Lauderdale office

Industrial

After a few rough years, Broward County’s industrial

market shows signs of improvement, illustrated by positive

absorption in recent months. North Broward led the resurgence

with a net absorption of approximately 125,000 square feet,

primarily due to leasing activity at Atlantic Business Center

and Park Central Business Park. Significant announcements

include GA Telesis Turbine Technologies’ move from Opa-Locka

(Miami-Dade) to Fort Lauderdale; New Town Holdings’ purchase

of Newtown Commerce Park, a Davie flex park, for $20.25 million,

or approximately $137 per square foot; and the selection of

Butters Construction & Development to develop the 45-acre

Carver Homes site in Pompano Beach.

Average rentals in Broward increased slightly for both the

warehouse and flex sectors, by 1.4 percent and 5.1 percent,

respectively. At the midpoint of 2004, the direct vacancy

rate for flex buildings had dipped by 3.4 percent, while available

warehouse space declined by 5.3 percent. Currently, only 350,000

square feet are under construction in the county, so the supply

of both warehouse and industrial space is projected to remain

stable for the foreseeable future.

Meanwhile, Miami-Dade emerged as one of South Florida’s

most vibrant industrial markets, with more than 30 million

square feet of inventory and vacancy rates relatively consistent

at just under 12 percent. Institutional investors, in particular,

have been drawn to Miami-Dade’s Airport West market,

which serves as the gateway to Latin America. New investment

by institutions and public companies continues to be quite

impressive here, most significantly by Principal Real Estate

Investors, with its $45 million purchase of the Dolphin Commerce

Center, as well as Keystone Property Trust and AMB. Additional

advisory investment during the first half of 2004 occurred

when the Canyon-Johnson Urban Fund, backed by former NBA star

Magic Johnson, acquired the Miami Free Zone, a duty-free warehouse

complex that ships goods to Latin America from European and

Asian exporters.

Overall, the Miami-Dade industrial sector is a target market

for institutional investment, with some of the most prominent

investors focusing on this area. We expect that trend will

continue throughout the balance of 2004.

— John Bell, senior vice president – investment

sales, Trammell Crow Company\

Retail

The Miami/Dade/Broward/West Palm Beach area is one of the

largest and fastest growing demographic regions in the United

States. The U.S. Census Bureau recently released statistics

that show that Miramar, located 17 miles northwest of Miami,

is the third fastest-growing city in the nation for municipalities

with more than 50,000 residents. With a current population

of just over 96,000 residents, the city is expected to boom

to 145,000 residents by 2020.

Despite a sluggish national economy and consolidation in the

retail industry, the Broward County retail market is showing

signs of improvement. The overall vacancy rate dropped from

9.67 percent in 2000 to 7.93 percent as of May 2004. Average

asking rents grew to $18.78 per square foot as of May 2004,

up 26.6 percent from 2000. The strongest rent growth has been

in the Pompano Beach/ Deerfield Beach market.

Another sign of economic growth and activity is a 19 percent

increase in the number of passengers at the Fort Lauderdale-Hollywood

International Airport during the first 6 months of 2004. Domestic

travel was up 18 percent and international travel was up 26

percent, placing Fort Lauderdale among the fastest-growing

airports in the nation.

Land use patterns in South Florida are changing significantly.

Over the last 4 years, Broward County has lost 47 percent

of its agricultural land to residential and commercial development.

Rising land prices, savvy developers and growing demand for

housing have driven the changes. The Airport West submarket,

encompassing the area west of the Miami International Airport,

is seeing a conversion of industrial land to residential and

commercial, given its proximity to the airport and its ease

of importing and exporting to Latin America.

Magna Entertainment Corporation and Forest City Enterprises

have entered into a predevelopment management agreement concerning

the planned development of The Village at Gulfstream Park,

an 80-acre retail, entertainment and residential project in

Hallandale, Florida. The planned first phase of The Village

at Gulfstream Park will integrate a lifestyle shopping and

entertainment environment with Magna Entertainment Corporation’s

thoroughbred racetrack, Gulfstream Park. The first phase is

expected to incorporate approximately 600,000 square feet

of lifestyle retail shops, restaurants, a cinema and entertainment

facilities.

The mayor of Plantation is hoping to bring free concerts and

increased vitality to the midtown business district by building

an open-air amphitheater. A site on the eastern edge of Pine

Island Park, just west of Broward Mall, is proposed. Central

Park, west of midtown, is an alternate proposed site. A state

grant application to help fund the project has been approved

by City Council.

An ice rink for recreational skating and hockey is in the

negotiation and planning stages in Weston. City officials

have suggested a joint venture between the Florida Panthers

and a Cleveland-based company and hope an agreement will lead

to a proposal to the city.

Ram Realty Services wants to revitalize its Intracoastal Mall,

the once-booming waterfront mall in North Miami, by adding

residential towers. The 234,000-square-foot mall suffers from

high vacancy and is considered underutilized. A residential

component is proposed to bolster existing tenants T.J. Maxx,

Winn-Dixie, Old Navy and Sunrise Cinemas, as well as the surrounding

North Miami Beach community.

The Seminole Tribe of Florida now owns and operates two Hard

Rock Hotel & Casinos in Florida, one in Tampa and one

in Hollywood. The $279 million, 135,000-square-foot Hollywood

casino opened in May and is expected to attract jobs and boost

the economy of South Florida. The Seminole Tribe is said to

be interested in investing in water parks, theme parks and

shopping malls.

In an off-market deal in August, Colonial Properties Trust

bought three South Florida retail properties from Ross Matz

Investments for $81.7 million. The transaction included Deerfield

Mall, a 371,000-square-foot mall in Deerfield Beach anchored

by Publix, T.J. Maxx, Marshalls, Sports Authority, Sunrise

Cinemas and OfficeMax. Also included were College Parkway

Center, an 82,000-square-foot Office Depot-anchored center

in Fort Myers, and Office Depot Plaza, a 68,000-square-foot

center in Pembroke Pines.

In July, Sterling Centrecorp bought a 50 percent interest

in the 800,000-square-foot Mall of the Americas in Miami.

The $51 million deal was completed through a joint venture

with an affiliate of Kimco Realty Corporation and other private

investors. Mall of the Americas is anchored by The Home Depot,

AMC Theatres, Foot Locker and Old Navy.

Also in July, Equity One sold Plaza Del Rey, a 50,146-square-foot

Miami shopping center, for approximately $9 million. Batista

Investment Corporation bought the center, which was 100 percent

occupied at the time of the sale.

Early in the year, Weingarten Realty Investors acquired T.J.

Maxx Plaza, a 161,900-square-foot center located in Kendall

(Miami), Florida, for $23.7 million. Anchored by T.J. Maxx

and Winn-Dixie, the center was more than 95 percent leased

at the time of sale. T.J. Maxx Plaza was one of a portfolio

of four centers that Weingarten acquired from a partnership

comprised of Trammell Crow Company and Granite Properties

for more than $160 million.

— Lynn Leonard, vice president of marketing, NewBridge

Retail Advisors

©2004 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|