|

SOUTHEAST SNAPSHOT, SEPTEMBER 2009

Tampa Multifamily Market

The future of the Tampa multifamily market, even in the middle of an ever-darkening economic storm, is bright. While currently the market is still dealing with the lingering effects of a high vacancy rate and other impacts of the recession, rents are beginning to stabilize and some of Tampa’s shadow market inventory is evaporating.

“The rate of [market] decline is slowing down,” says Patrick Dufour of Apartment Realty Advisors’ Tampa office. “During the next year, you’ll really see a stabilization of the market. We’re starting to see early signs of that now.”

Though the Tampa area continues to lose jobs, companies are no longer hemorrhaging employees, a sign that recovery may be around the corner. In the second quarter of 2009, Dufour says, the metro area lost half as many jobs as it did during the same quarter in 2008. New companies moving to Tampa are helping reverse the job-loss trend, and a few Tampa-based firms have started hiring.

“The worst of the job losses are behind us,” he says.

A decline in single-family homeownership will also contribute to Tampa’s turnaround. The economy has turned some buyers into renters, and Dufour is finding that more fresh college graduates are turning to the rental market. This trend, when combined with job growth, will help the market.

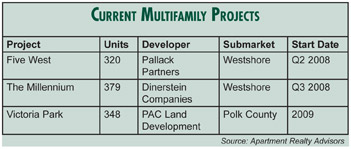

An additional boost comes in the form of infill developments. Historically, companies had constructed apartment complexes away from the city centers where more space could be acquired for less cost. With the onset of higher gas prices and a greater environmental consumer consciousness, demand has shifted. “One of the reasons [infill is] being supported is people are willing to pay more to be closer to employment,” Dufour says. Tampa’s Westshore district is one of the city’s main employment centers. There are currently a handful of projects finishing up in the area, including Lane Company’s 200-unit Watermark II complex and the 379-unit Millennium project, which is being developed by Dinerstein Companies.

Substantial projects that have been looking to get off the ground, however, are dead in the water. The financing market has so thoroughly destroyed development outlooks that it will be a while before firms start building new apartment complexes. “You’ll have a two or three year lag there where nothing will be delivered to the market as the economy is rebounding,” Dufour says. The overall market, however, should improve years before new construction starts back up. “When the economy does start to move back in the right direction, the multifamily market is going to rebound very strongly.”

— Jon Ross

©2009 France Publications, Inc. Duplication

or reproduction of this article not permitted without authorization

from France Publications, Inc. For information on reprints

of this article contact Barbara

Sherer at (630) 554-6054.

|